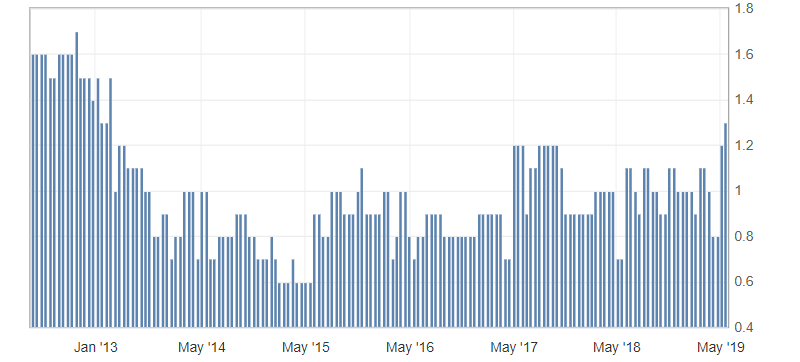

Eurozone Inflation Data

- Core Consumer Price Index (CPI) (y/y) (Apr), fact 1.3%, forecast 1.2%..

- Consumer Price Index (CPI) (y/y) (Apr), fact 1.7%, forecast 1.7%.

- Consumer Price Index (CPI) (m/m) (Apr), fact 0.7%, forecast 0.7%.

An inflation data in the eurozone for April coincided with market expectations to a greater extent, and the index of the coreconsumer price index (CPI) (y/y) even accelerated to five-month highs. But, despite the positive statistics, the pressure on the euro by the American dollar remains significant due to political risks in the eurozone.

Fig. 1. Core consumer price index (CPI) (y/y) in the eurozone

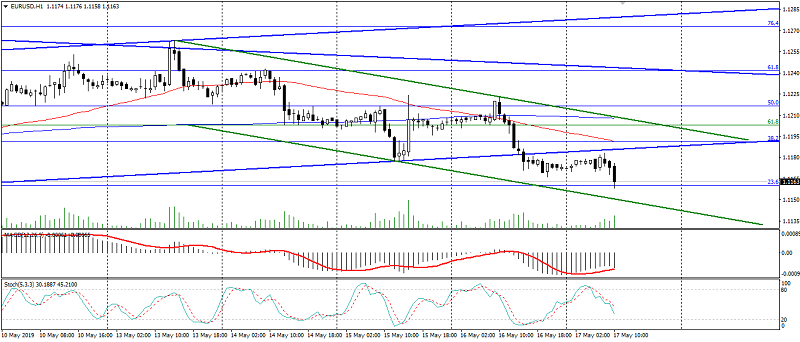

In addition to negative sentiment against the background of the closing of the trading week and flight from risk due to fears of aggravated the US – China trade confrontation, investors focused on political risks in the eurozone, which were exacerbated by the elections to the European Parliament. As a result, the EUR/USD pair accelerated the decline, despite the restrained positive data for the eurozone. Significant support: 1.1150 and 1.1130, resistance: 1.1180 and 1.1200.

Fig. 2. EUR/USD chart. Current price – 1.1160

Read also: “Financial issues at the beginning of 2018”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Expectations from the AUD/USD pair for May

- Escalation of the US-China trade war and what it means for the market

- Skills each investor must develop

Current Investment ideas: