Beyond the Dollar Everything’s ‘Just Noise’ for Emerging Markets

Bloomberg.com — As if emerging-market investors didn’t have enough to worry about — with political flare-ups and central-bank surprises galore — the dollar’s strength is poised to pile further pressure on currencies from the real to the rand.

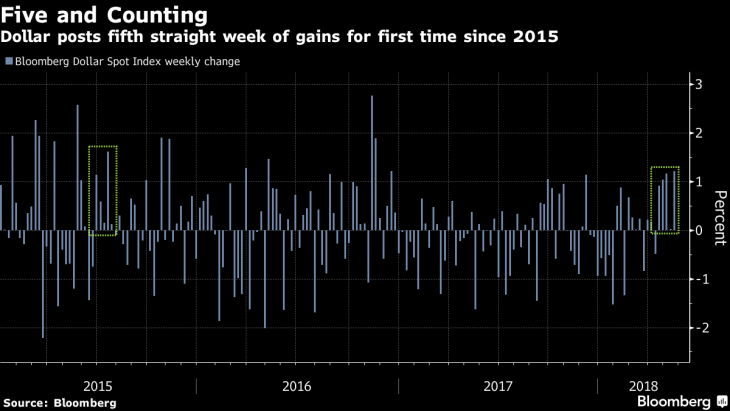

As the dollar clocked up its longest rally since 2015, the MSCI Emerging Markets Currency Index closed on Friday below its 200-day moving average for the first time in more than a year, heralding more losses. The gauge slid 1.3 percent in the week, its worst performance since 2016. Not one developing-nation currency rose last week as the dollar advanced, with U.S. 10-year yields closing above 3 percent the last five days.

For GAM UK Ltd.’s Paul McNamara, nothing worries him more than the strength of the dollar. “The rest is noise,” the London-based fund manager said.

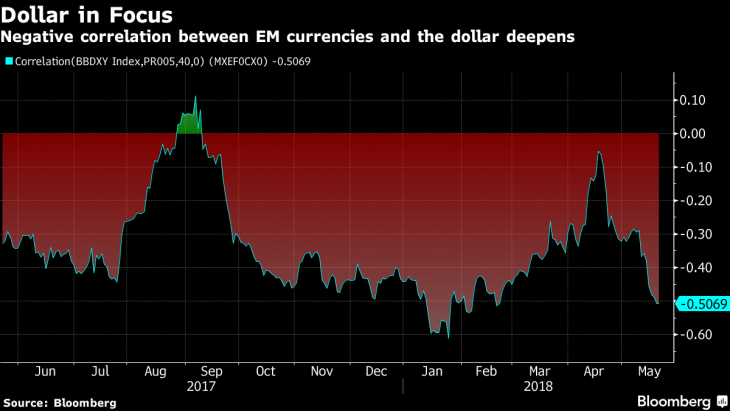

What’s more, the negative correlation between the dollar and developing-nation currencies is deepening.

To minimize the potential damage from the U.S. currency’s revival, McNamara is using Canada’s dollar and the euro to invest in emerging-market assets. A Bloomberg currency index that measures carry-trade returns from eight emerging markets, funded by short positions in the dollar, has declined to the lowest in a year.

“Unless the fresh set of U.S. data scheduled next week is seriously disappointing, EM currencies will struggle to trim their recent losses against the dollar, which is supported by rising yields on U.S. Treasuries,” said Piotr Matys, a strategist at Rabobank in London, said last week. Markets expect the Federal Reserve to raise rates at least twice more this year, he added.

The combination of higher debt levels and share of debt denominated in foreign currency means many emerging markets are now more exposed to dollar appreciation than in 2009, amid signs the robust growth in developing economies may be slowing, the Institute of International Finance said in a May 17 note.

While the U.S. Treasury will sell some of its largest offerings since 2010 this week, a slew of Fed speakers may reiterate plans for gradual rate increases.

The selloff in developing nation currencies is hurting other assets.

Emerging-market local-currency government bonds declined for a sixth week, the worst run since 2016. Developing-nation stocks retreated 2.3 percent last week.

What will central banks do?

Argentina’s central bank will probably hold its benchmark rate steady this week after raising it to 40 percent earlier this month to defend the peso. The Argentine currency has plunged almost 20 percent in the past month, forcing the government to spend a 10th of its foreign-exchange reserves to defend it and seek help from the International Monetary Fund.

The Bank of Korea is expected to keep its key interest rate on hold at 1.5 percent on May 24. Odds are increasing against further policy normalization after BOK Governor Lee Ju-yeol sounded caution on the economy, Prakash Sakpal, a Singapore-based economist at ING Groep NV, wrote in a May 17 note. Governor Lee said Thursday it’s difficult to remain optimistic even though the economy has grown steadily, given uncertainties over the U.S.-China trade dispute and the impact of monetary policy normalization in major countries.

His remarks followed the latest rhetoric from North Korea, which has threatened to pull out of a proposed summit between its leader Kim Jong Un and U.S. President Donald Trump in June if it’s pressured to surrender its nuclear weapons. South Korean President Moon Jae-in plans to visit Washington and meet with Trump in advance of the talks.

Hungary’s central bank will hold a rate meeting on Tuesday, where investors will be focusing on any reaction to the recent market volatility. Policy makers have used a variety of unconventional tools to lower borrowing costs since August, but the selloff had reversed most of the impact and there’s growing skepticism over how long the bank can stick to the measures.

Central banks in South Africa, Ghana, Nigeria, and Ukraine will also decide on policy this week.

Let’s Meet

The roster of big-name investors and chief executive officers attending Russia’s annual St. Petersburg International Economic Forum has withered since the annexation of Crimea, and this year’s event takes place in the shadow of the toughest U.S. sanctions to date. The run-up has already been marked by the U.S. ambassador to Moscow axing his planned welcome speech at a U.S.-Russia business panel.

Still, with a raft of top local officials speaking at the event, traders will be keeping a close eye on the event. The forum runs May 24-26. On Friday, Bloomberg News Editor-in-Chief John Micklethwait will moderate a panel with President Vladimir Putin, French President Emmanuel Macron and Japanese Prime Minister Shinzo Abe.

Meanwhile, foreign ministers from the Group of 20 countries gather in Argentina for their annual meeting. Officials from the U.K., Canada, Mexico, Japan, China, Australia and Germany are due to attend.

Trade

Global trade tensions are showing some signs of improvements after the Trump administration and China called an economic truce as both parties agreed to put tariffs on hold while they execute a framework to rebalance trade.

China and the U.S. agreed to “substantially” reduce the U.S. trade deficit in goods with China, which reached $376 billion last year. Beijing promised to “significantly” increase purchases of U.S. goods and services. But there was no dollar figure attached, despite assurances by the White House that Beijing would cave to its demand for a $200-billion annual reduction in the goods shortfall.

Politics

Venezuelan bonds may come under pressure when markets reopen Monday after Sunday’s presidential vote in which incumbent Nicolas Maduro won a second six-year term amid dubious electoral conditions. The result continues two decades of strongman rule by the late socialist president Hugo Chavez and Maduro, 55, his hand-picked successor. The Latin American economy has deteriorated to the point that electricity and running water are luxuries and malnutrition is rampant.

The nation’s benchmark sovereign bonds, which are leading emerging-market returns this year, fell to their lowest in a week ahead of the election.

Meantime in Ecuador, the focus will be on newly appointed Finance Minister Richard Martinez and his proposal to get the nation’s ballooning debt under control.

Economic Data

Poland presents another batch of April data, including industrial output, PPI, retail sales, M3 money supply and unemployment. The Finance Ministry will also hold its sole regular bond auction this month, planned for Thursday and initially flagged at 3 billion ($822 million) to 6 billion zloty.

In Brazil, the Finance Ministry is expected to revise down its yearly growth estimate, currently at 3 percent, following a series of disappointing economic indicators in the first quarter. Investor anxiety, as measured by the real’s one-month implied volatility, rose to the highest in about a year.

Finally, Taiwan is due to report gross domestic product growth data for the first quarter on May 25 after data Monday showed Thailand’s economy grew faster than economists estimated last quarter as exports and tourism rose.

— With assistance by Alec McCabe