Bonds Stabilize After Italy Rout; Asia Stocks Fall: Markets Wrap

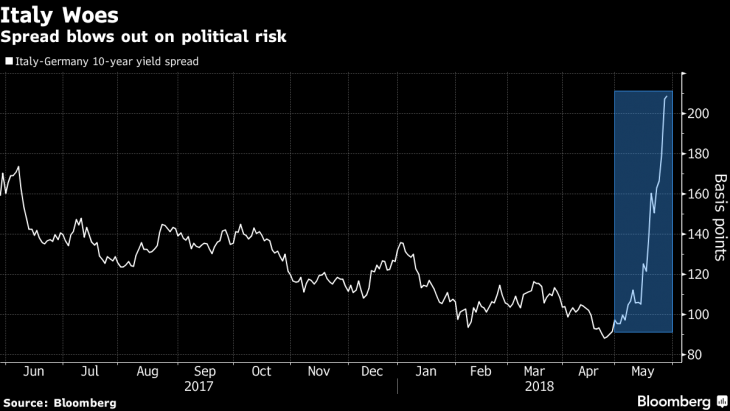

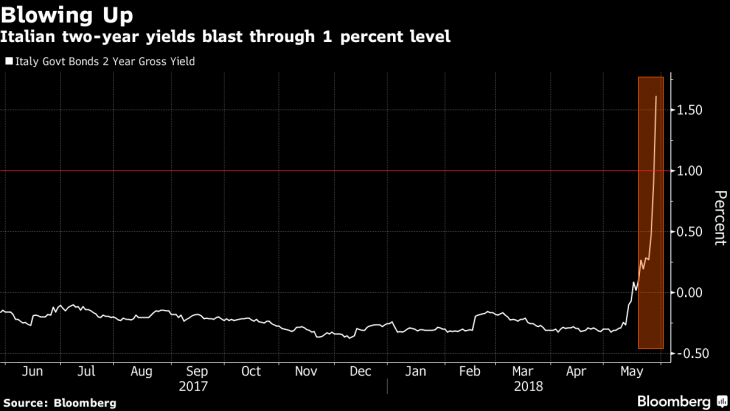

Bloomberg.com — Government bond markets showed signs of stabilization Wednesday after an epic rout in Italian debt triggered haven flows that saw U.S. Treasury yields tumbling. U.S. stock futures edged higher, while Asian equities tumbled in their catch-up with the previous day’s turmoil.

Ten-year Treasury yields climbed back above 2.80 percent after sliding 15 basis points Tuesday. Financial shares led the MSCI Asia Pacific Index lower as the Italian political impasse reminded investors of the European debt crisis and its knock-on effects across global banking. The regional gauge is heading for its lowest close since February. The euro remains less than half a cent from its weakest since last July.

While the prospect of snap Italian elections that effectively become a referendum on the nation’s inclusion in the euro zone has roiled markets, at least some are seeing an easing in the rout. One fund closing out positions has been Western Asset Management Co., which had made short bets on the debt of the euro region’s No. 3 economy last week.

“Ultimately we think Italy stays in the club,” said Gordon Brown, London-based co-head of global portfolios at Western Asset, which manages $431 billion in assets. “Yields will settle down at a more reasonable level, but one that reflects ongoing political risk premium.”

Here’s a Roundup of Italian Political Turmoil and its Impact on Markets

Investors are also keeping an eye on the White House, with the Trump administration giving conflicting signals on talks with North Korea and plowing ahead with plans for tariffs on Chinese goods.

Elsewhere, oil also seemed to be settling after a string of declines in the wake of major oil producers’ plans to step up output. Saudi Arabia, Kuwait and the U.A.E. plan to meet in Kuwait City on Saturday to discuss supply plans.