British Pound (GBP) – Features of trading in crosses. Anton Hanzenko.

Earlier, the peculiarities of trading on cross-rates containing the Japanese yen were discussed. Continuing this topic, it is also worth paying attention to the British pound (GBP), which has a very volatile trading nature and some features.

Data on the UK economy

The UK’s GDP ranks sixth in the world. After the start of the exit procedure from the EU, the policy of the Central Bank (Bank of England) focused on tightening monetary policy and raising interest rates, which was caused by a sharp increase in inflation. The last rate increase by the Bank of England took place in November 2017 and amounted to 0.50%. Despite Brexit, the dynamics of the British pound maintains an upward trend against most competitors, which is caused by positive indicators of the UK economy. The exception is the euro, which is caused by difficult negotiations regarding Brexit.

The British pound positions itself as a commodity currency, but unlike the Canadian, Australian and New Zealand dollars is less tied to the dynamics of raw materials. The pound has a very volatile trading style, which on crosses can be expressed by especially high volatility. Therefore, cross-rates containing the British pound are classified as high-volatility currency pairs.

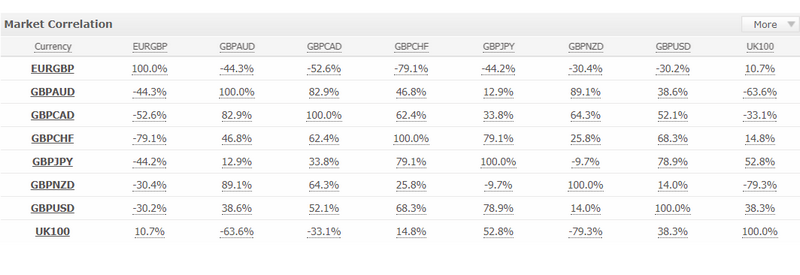

The British pound has an inverse correlation with the FTSE 100 index.

Like the yen, cross-rates with the pound have a very high level of correlation between adjacent (unidirectional) currencies, such as AUD and NZD; EUR and CHF.

A significant feature of trading on cross-rates containing the British pound is their resistance to channel trading. In this case, if the cross leaves the established channel, this will often indicate the formation of a new trading channel. This feature also allows the excellent implementation of trend strategies on these pairs.

Another feature is candle formations related to triangles and flags, which on crosses with pound have a high degree of development. And this rule is applicable to both small timeframes and large ones.

The main drawback of the pound trade is its unpredictability and a strong dependence on fundamental factors. And given the fact that the dynamics of the pound after Brexit remains dependent on the euro, adds complications. Especially considering the fact that the British currency remains in a less favorable position than the euro.

More details about the features of trading on cross-rates containing the British pound and not only can be learned from training courses.

Anton Hanzenko