Analysis of the past day

The new trading week opened with the growth of the American currency across the market on Monday. It was caused by the increase in risks on stock indices and the continued optimism of the American dollar. The main growth of the dollar fell on the Asian session, since trading on European markets was limited due to the day-off in the US and Canada. An additional factor to the restraint of the market was an empty economic calendar.

Stock indices close the day in a noticeable minus amid rising pessimism and strengthening of the US currency (Nikkei 225 +0.09; DAX -1,60; FTSE 100 -0.50; Dow 30 -1,20).

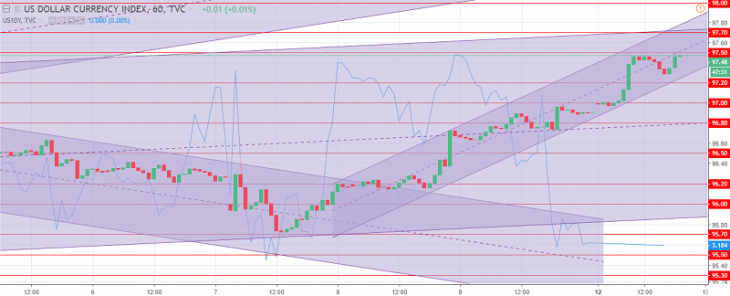

The dollar index closes the day with the update of the month highs at the level of 97.60-50, confirming the preservation of the uptrend, which, in turn, is limited by resistance levels: 97.50-70 and 98.00, support: 97.20-30 and 97.00.

The US dollar index chart. The current price is 97.50 (10-year government bonds yield is the blue line)

Hanzenko Anton