Analysis of the past week

The multidirectional dynamics was traced in the US dollar and in the market in general during the outgoing week, which was mainly caused by the dynamics of the US dollar, and that, in turn, depended to a large extent on the news published. So, the main pressure on the American dollar came from the comments of the US Federal Reserve representatives and directly of the Chairman Powell, who in a number of his speeches put pressure on the dollar due to soft rhetoric and hints at lowering key interest rates. The American dollar were supported by risks and positive US inflation data.

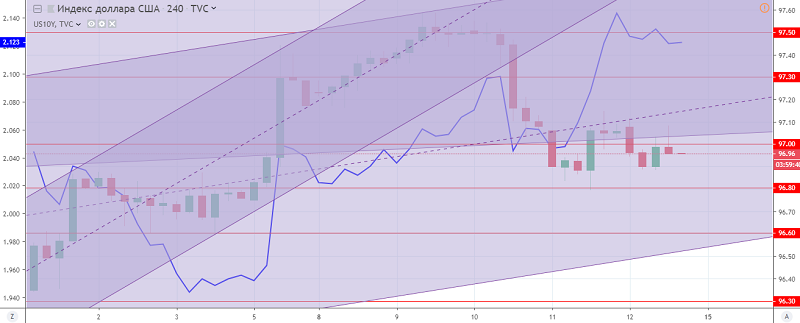

At the end of the week, the volatility of the US dollar index was about 0.8%. At the same time, the dollar index closes with a decline, having updated a low at the level of 96.80. This he slowed the upward trend, maintaining the uptrend, which is traced from the end of June. Significant support levels are located at the levels: 96.80 and 96.60, resistances: 97.30 and 97.50.

Fig. The US dollar index H4 chart. The current price is 96.90 (10-year government bonds yield is the blue line)

Hanzenko Anton