Analysis of the past week

The first working week of April was very rich in business statistics (PMI), inflation data and the Central Bank meeting results, but the main event of the week was the publication of the jobs report in the United States. With all this, the fundamental driver of the market continued to be fundamental factors and general sentiment, which in fact caused the multidirectional dynamics in the market.

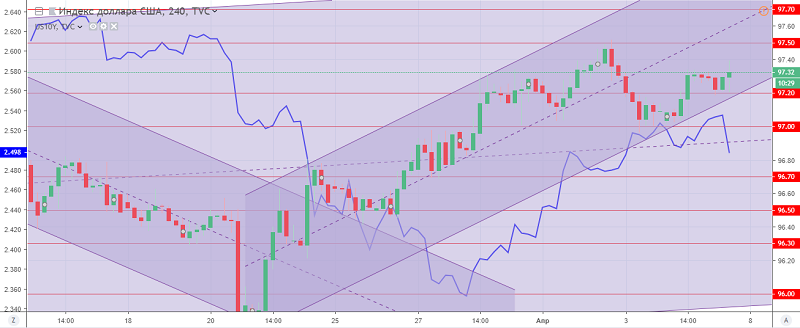

The US dollar index for the week was trading in different directions in the trading range from 97.50 to 97.00, going into the correction phase after the growth a week earlier. Intraweek dollar index volatility was about 0.50%. But, despite the multidirectional dynamics, the upward trend on the American dollar has been preserved. Support levels: 97.20 and 97.00, resistances: 97.50 and 97.70.

The US dollar index H4 chart. The current price is 97.30 (the yield on 10-year government bonds is the blue line)

Hanzenko Anton