Analysis of the past week

The US dollar index is closing with a significant decline, which was caused by a general increase in optimism in the market against the background of the weakening tension in the US and China trade relations and the advancement of Brexit negotiations, which continue to raise questions. Thus, the preliminary text of the Brexit deal was approved by the UK government, but exacerbated political risks by the possibility of May’s resignation, that allowed to strengthen the single currency .

An additional factor in the dollar decline at the end of the week was the speech of the US Fed representative, who was very pessimistic in his forecasts, that markedly increased the pressure on the American dollar.

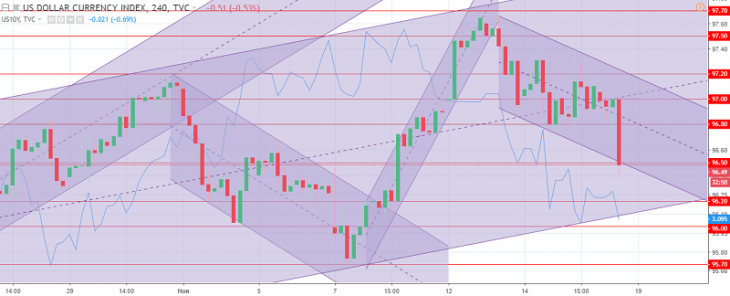

So, by the end of the week, the dollar index closes in a significant minus, indicating the formation of a downward corrective trend, which is also limited by oversold. Significant support is the marks: 96.50 and 96.20. Resistance is located at levels: 96.80 and 97.00.

The US dollar index H4 chart. The current price is 96.50 (10-year government bonds yield is the blue line)

Hanzenko Anton