U.S. and Canada data

USA:

- Core price index of personal consumption expenditures (y/y) (July), fact 1.6%, forecast 1.6%.

- Core price index of expenditures on personal consumption (m/m) (July), fact 0.2%, forecast 0.3%.

- Personal spending (m/m) (July), fact 0.6%, forecast 0.5%.

Canada:

- GDP (m/m) (June), fact 0.2%, forecast 0.1%.

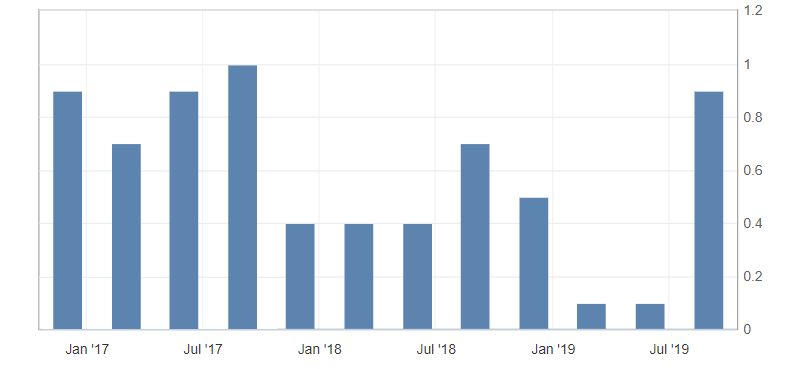

- GDP (q/q) (Q2), fact 0.9%, previous value 0.1%.

- Change in GDP for the year (q/q) (Q2), fact of 3.7%, forecast 3.0%.

- Raw Material Price Index (RMPI) (m/m) (July), fact 1.2%, forecast 1.6%.

The US spending data more closely matched market expectations. This provided a restrained support to the American dollar, thanks to an increase in the expenses of individuals, which may indicate prospects for growth in consumer inflation.

Significant impact on the market had data on GDP of Canada. Thus, the Canadian economy accelerated significantly on a quarterly basis, indicating the strength of the economy and increasing demand for the Canadian dollar.

Fig. 1. Canadian GDP chart (q/q)

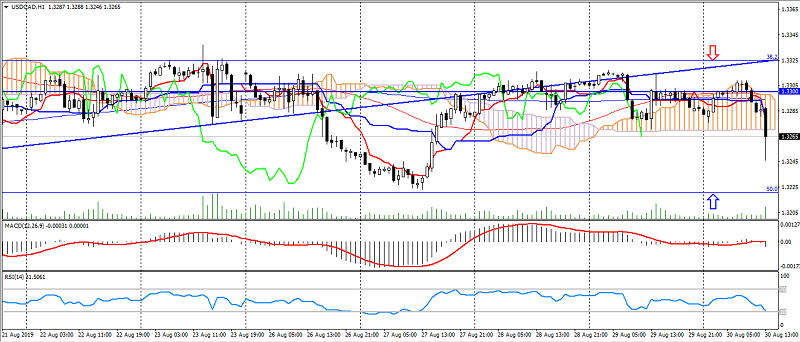

As a result, the USD/CAD pair accelerated its decline to weekly lows, but remained limited by the flat of the last two weeks (support levels: 1.3240 and 1.3220).

Fig. 2. USD/CAD chart. Current price – 1.3260

Reas also: “Stock indices and their influence on the Forex Market”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- How far the prospects for USD/JPY may be downward

- What does the US Fed Chairman Powell statement mean for the US dollar

- ECB is preparing a stimulus package

Current Investment ideas: