U.S. data

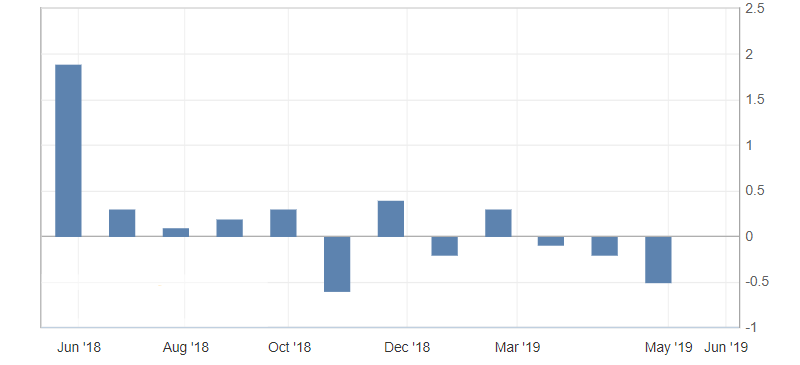

- Core durable goods orders (m/m) (Apr), fact 0.0%, forecast 0.2%.

- Durable goods orders (m/m) (Apr), fact -2.1%, the forecast -2.0%.

Durable goods orders in the US declined for the fourth consecutive month, indicating a significant reduction in consumption, which could slow down inflation in the country. It is worth highlighting the return of core durable goods orders to the zero mark, which may serve as a reason for recovery.

Fig. 1. U.S. core durable goods orders chart

Against the background of predominantly weak the US data, the US currency accelerated its decline against a basket of competitors, remaining under pressure from the downward trend in the US government bonds and risks. The limiting factor in reducing the dollar is its oversold and the upcoming weekend, which may force investors to cut short positions on the American dollar. Support levels: 97.70 and 97.60, resistance: 97.80 and 98.00.

Fig. 2. The US dollar index chart. The current price is 97.70 (10-year government bonds yield is the blue line)

Read also: “Candlestick Analysis – Continuation patterns”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Cryptocurrencies as new safe haven assets

- The impact of the trade war on the US stock market

- Expectations from the AUD/USD pair for May

Current Investment ideas: