Inflation data in the US

The base consumer price index (CPI) in the USA (m/m) increased by 0.3%, against the forecast of 0.2%, which provided significant support to the American. But the base index of retail sales in the US (m/m) fell to the level of 0,0%, while the volume of retail sales in the US (m/m) dropped to an annual minimum of -0.3%. As a result, it partially absorbed the positive effect of rising inflationary pressures in the United States.

Despite the mixed statistics on the US, the dollar index managed to update Tuesday’s high at around 90.00 against the basket of world currencies. At the same time, due to a significant increase in the profitability of the US state bonds, further strengthening of the US currency is limited, as indicated by the overbought bonds.

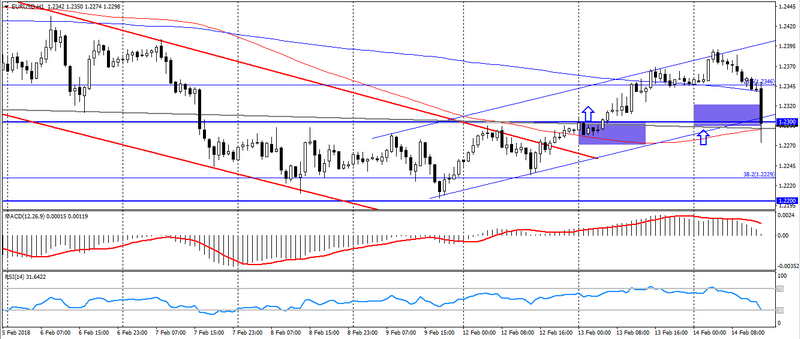

In the conditions of further correction of state bonds it is necessary to expect a restrained correction of the US currency, which will also confirm the expectations for the EUR/USD pair at a break from the support level of 1.2300.

Fig. EUR/USD. The current price is 1.2300.

Hanzenko Anton