Данные по инфляции в США и занятости в Канаде

США:

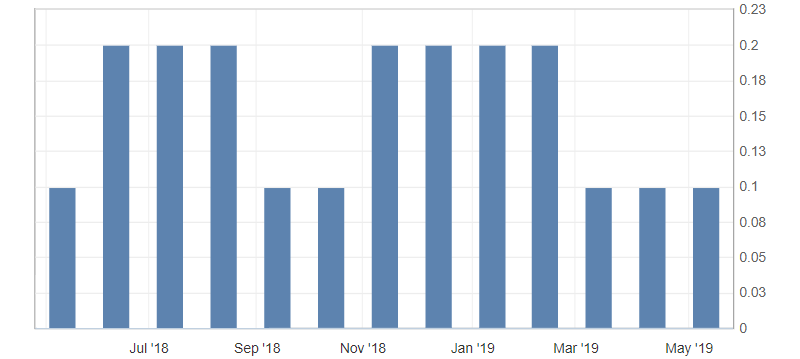

- Базовый индекс потребительских цен (ИПЦ) (м/м) (апр), факт 0,1%, прогноз 0,2%.

- Базовый индекс потребительских цен (ИПЦ) (г/г) (апр), факт 2,1%, прогноз 2,1%.

- Индекс потребительских цен (ИПЦ) (м/м) (апр), факт 0,3%, прогноз 0,4%.

Канада:

- Разрешения на строительство (м/м) (мар), факт 2,1%, прогноз 2,8%.

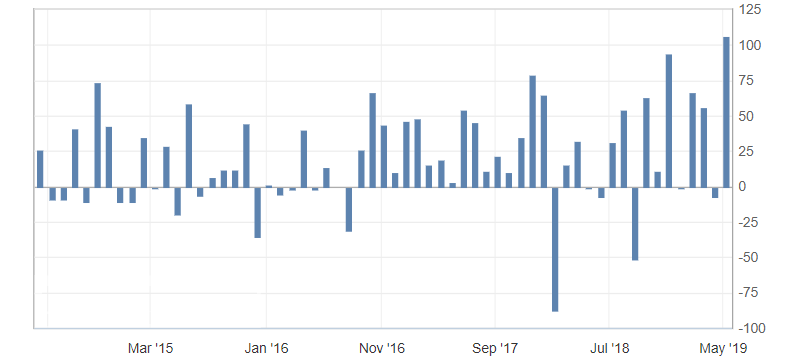

- Изменение занятости (апр), факт 106,5K, прогноз 10,0K.

- Уровень безработицы (апр), факт 5,7%, прогноз 5,8% .

Данные по инфляции в США не оправдали ожиданий рынка и показали замедление в апреле. Это усилило опасения рынка относительно замедления инфляции в США, и как результат увеличит вероятность снижения ставок ФРС в будущем. Базовый индекс потребительских цен (ИПЦ) США в месячном исчислении третий месяц подряд остаётся возле минимальных значений, сохраняя опасения по замедлению инфляции.

Рис. 1. График базового индекса потребительских цен (ИПЦ) США

Данные по занятости в Канаде показали неожиданный рост занятости к девятилетним максимумам и снижение безработицы к многолетним минимумам. Это указывает на значительный рост рынка труда в Канаде.

Рис. 2. График изменения занятости в Канаде

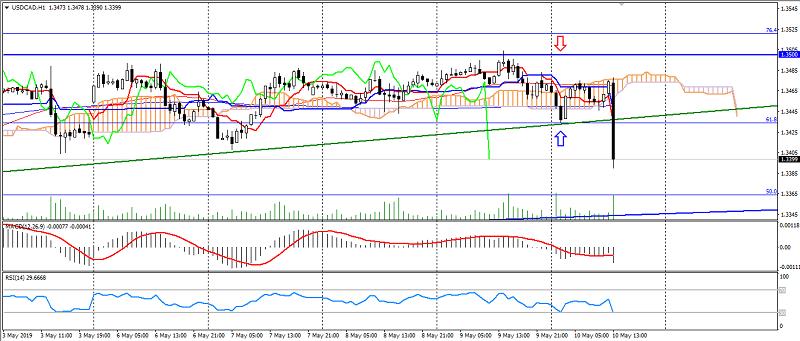

На фоне слабых данных по инфляции в США и роста занятости в Канаде пара USD/CAD оказалась под значительным давлением, обновив минимум на уровне 1.3400. Это переломило формирование восходящего треугольника, который прослеживался с начала мая. Столь стремительный обвал данной пары ограничивает её дальнейшее снижение перепроданностью и уровнями поддержки: 1.3380 и 1.3360. Уровни сопротивления расположились на отметках: 1.3440 и 1.3460.

Рис. 3. График USD/CAD. Текущая цена – 1.3400.

Читайте также: «Стратегия торговли на новостях Erste News VS Другие технологии»

Ганзенко Антон

Зарабатывайте с помощью сервиса торговли на новостях Erste News!

Актуальные статьи Блога трейдера:

- Навыки, которые должен развить каждый инвестор

- Чем интересно апрельское заседание ФРС США, и как оно может повлиять на политику мировых банков

- Фондовые индексы: штурм исторических максимумов

Актуальные Инвестиционные идеи: