Bank of Japan keeps soft policy

Today at the beginning of the day, the minutes of the meeting of the Bank of Japan were published. According to the protocol, the Central Bank of Japan kept the interest rate at the previous level -0.10%, while the yield of the state bonds will remain at zero level.

The main pressure on the Japanese yen was made by the head of the Central Bank of Japan, Kuroda, who said that despite the growth of the economy, the Central Bank will adhere to a soft monetary policy until the target inflation rate reaches 2%. In addition, it was added that the discrepancies between the monetary policies of the Fed and the Bank of Japan will not affect the decision of the Central Bank of Japan.

Thus, such statements completely dispelled the market’s hopes for a possible tightening of Japan’s monetary policy and increased pressure on the Japanese currency. As a result, the Japanese yen was under pressure across the entire spectrum of the market.

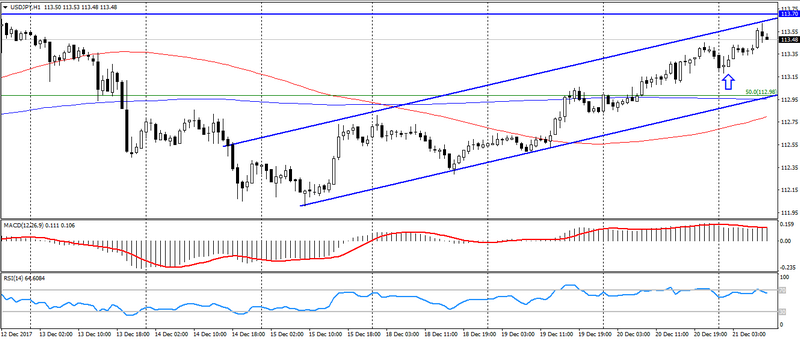

The pair USD/JPY accelerated the uptrend, but is limited to the level of 113.70, the maximum of last week.

Fig. USD/JPY. The current price is 113.50.

Hanzenko Anton