Analysis of the American Trading Session

The US Wednesday session was the most volatile and positive trading session of the last days. The reason for the positive opening of the stock indices of America was the unexpected rise in the price of oil and the correction of stock exchanges. This reason was intensified by the persistence of low activity in the market. It is also worth noting that in addition to a noticeable correction in oil other macroeconomic indicators and geopolitical risks point to the persistence of negative sentiment.

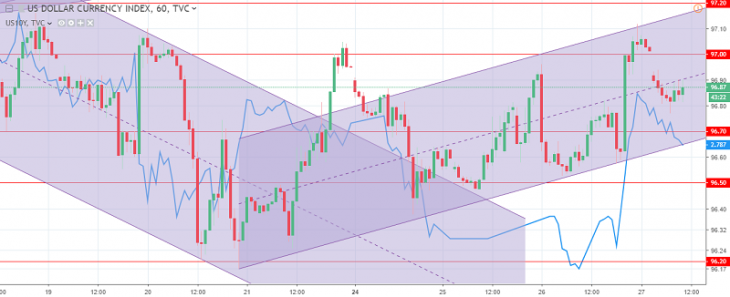

The dollar index, following the results of the American session, updated the weekly high, which indicated the formation of an upward trend, which at the trading on Thursday is limited to a downward correction and the resumption of negative sentiment on the stock markets.

The US dollar index chart. The current price is 96.80 (10-year government bonds yield is the blue line)

Read also: “Donald Trump is the president of the United States. Hopes and Expectations

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The S&P 500 index as a market sentiment index!

- Expectations from the USD/CAD pair at the end of the year!

- Safe assets and how to trade them in the Forex market.

Current Investment ideas: