Analysis of the past week

At the end of the week, the US dollar weakened significantly across the market. The reason for this was the US Federal Reserve meeting results, which confirmed the market expectations for rates cut in the future, despite maintaining monetary policy unchanged. Thereby actually convincing the market to lower rates in July.

This caused a prolonged sale of the US dollar. An additional factor in the reduction of the American dollar was the exacerbation of tension in the Middle East, which was caused by the conflict between the US and Iran. The aggravation of the armed conflict increased the pressure on the dollar from safe currencies, in particular, gold.

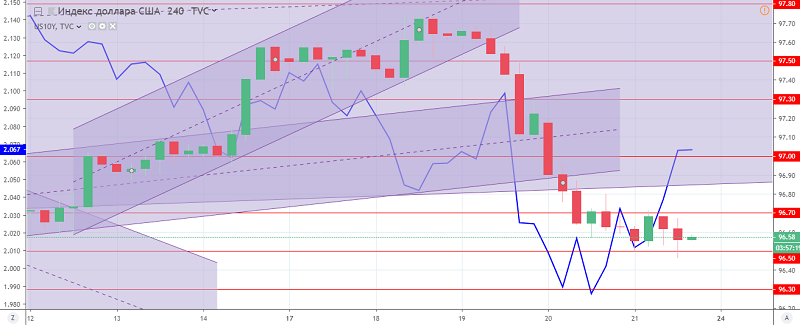

Thus, weekly dollar index volatility was over 1.3%. As a result, the dollar index updated the low of June at the level of 96.40, and was oversold significantly and slowing down the overall annual uptrend for the American dollar.

The US dollar index H4 chart. The current price is 97.30 (10-year government bonds yield is the blue line)

Hanzenko Anton