Fundamental analysis: the interest rate and its impact on the exchange rate. 2/2

After we’ve got acquainted with the main role of interest rates, let’s consider the direct impact of this data on the exchange rate and on the market as a whole.

As was mentioned earlier, the change in key interest rates is the main tool for managing the country’s economy by the central bank. Therefore, decisions about changing interest rates or even hints or expectations are regarded by the market as a significant factor for a strong movement on the market.

Examples of interest rates changes and its impact on the exchange rate

One of the recent increases in US rates, March 21, 2018, has become quite disappointing, despite the fact that the refinancing interest rate was increased by 25 basis points from 1.50% to 1.75%.

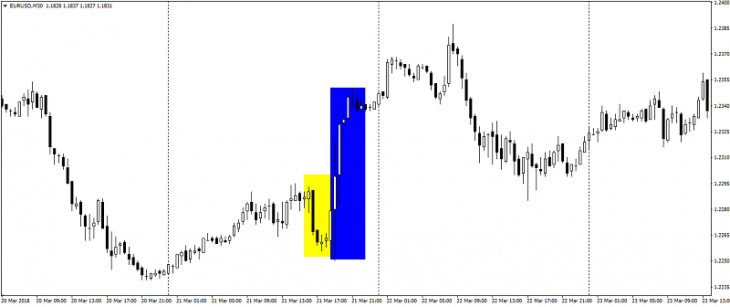

Fig. 1. Market reaction to the rate increase in the US in March

On the graph above the yellow zone shows the immediate reaction of the market to raise rates (about 40 points). Restraint in this case is conditioned by the expectation of this increase and the market has included this increase in the cost of the dollar in advance.

The decline in the dollar against the euro (the blue zone, about 100 points) was caused by the lack of a forecast in the Fed’s protocol for 4 rate rises this year, which ultimately completely ignored the data on the rate rise and changed the general trend of the American dollar.

Fig. 2. Market reaction to the rate increase in Canada in September last year

Another example of market reaction to rate rise was the September rate increase in Canada in 2017. When the Bank of Canada unexpectedly announced an increase in rates to 1.00% (volatility: about 270 points). Such a stormy reaction was caused by an unexpected decision, which the market didn’t actually expect. In the future, the increase in rates in Canada was regarded less violently because of the readiness of the market for these actions.

As can be seen from the examples, the reaction to the rate increase itself largely depends on the circumstances that precede it (forecasts, expectations, statements). Also, the accompanying statements of representatives of the Central Bank are taken into account, which can completely erase the positive effect of raising rates.

The publication of this news, one way or another, has a very high volatility, which is excellent for the strategy of “Trading on news.” In this case, there is a strategy Carrytrade, which is based on the difference in interest rates.

Data on interest rates, like many other news, is an opportunity to earn. Follow the Trader’s Blog, there are many interesting things!

Anton Hanzenko

You can also find many other topics on the site in the Trader’s Blog!

And if you have an offer – what to write about in the next article – write to us at info@esterholdings.com!