Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

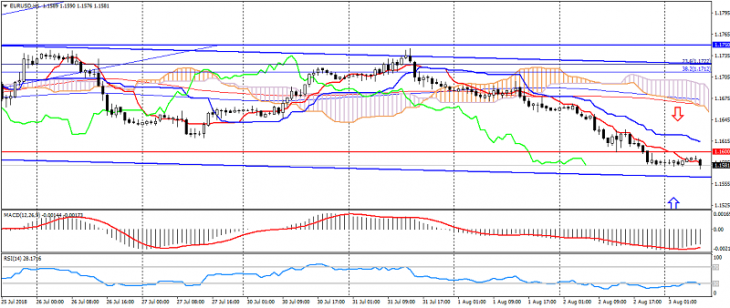

EUR USD (current price: 1.1580)

- Support levels: 1.1600 (significant psychology), 1.1500 (local minimum), 1.1450.

- Resistance levels: 1.1750, 1.1850 (June maximum), 1.2000 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1600, 1.1630, 1.1650.

- Alternative recommendation: buy entry is from 1.1550, 1.1520, 1.1500.

The euro-dollar pair keeps a downward trend, limited to oversold and waiting for employment data in the US.

GBP USD (current price: 1.3000)

- Support levels: 1.3050, 1.3000 (strong psychology), 1.2780 (the minimum of August 2017).

- Resistance levels: 1.3150, 1.3350 (June high), 1.3460.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3050, 1.3080, 1.3100.

- Alternative recommendation: buy entry is from 1.3000, 1.2980, 1.2960.

The British pound remains under pressure of pessimism, thereby resuming a downtrend.

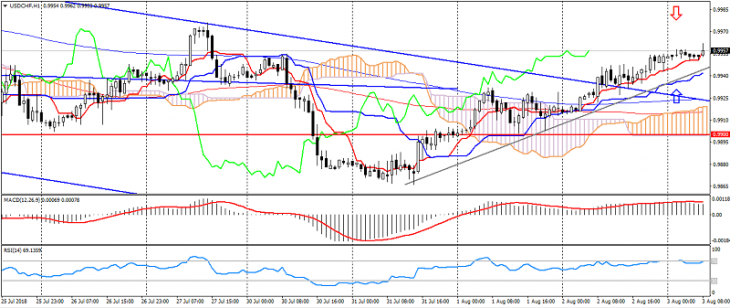

USD CHF (current price: 0.9960)

- Support levels: 0.9900, 0.9850 (local minimum), 0.9700 (minimum of June).

- Resistance levels: 1.000 (significant psychology), 1.0050 (May maximum), 1.0100.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.9970, 0.9990, 1.0020.

- Alternative recommendation: buy entry is from 0.9940, 0.9920, 0.9900.

The Swiss franc maintains an upward dynamics, limited to a maximum of the week and overbought.

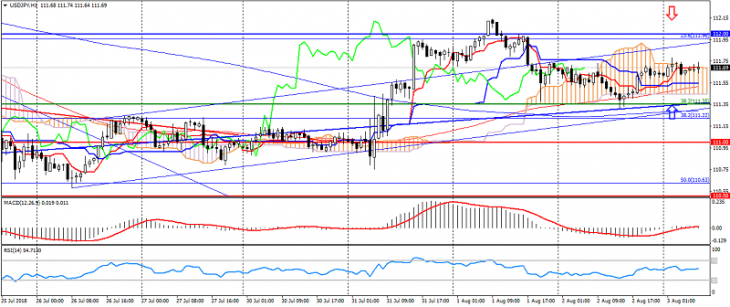

USD JPY (current price: 111.70)

- Support levels: 111.00, 110.50, 109.80.

- Resistance levels: 112.00, 113.30 (maximum of January), 114.00.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 112.00, 112.20 112.40.

- Alternative recommendation: buy entry is from 111.50, 111.30, 111.00.

The US dollar the Japanese yen maintains an upward trend, despite a slowdown in traffic on the waiting for employment data in the US.

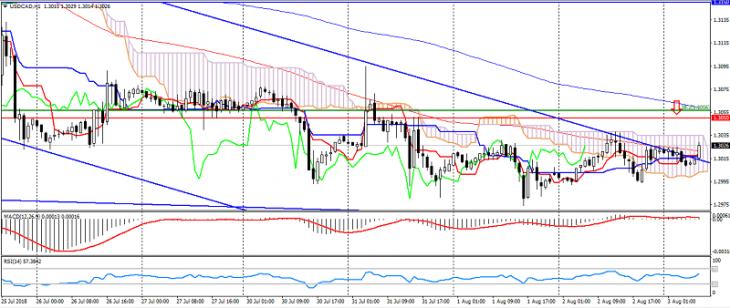

USD CAD (current price: 1.3020)

- Support levels: 1.3050 (May high), 1.2950, 1.2850.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.3050, 1.3080, 1.3100.

- Alternative recommendation: buy entry is from 1.2990, 1.2950, 1.2920.

The US dollar pair the Canadian dollar maintains a downtrend, confining itself to a flat on the correction of positions.

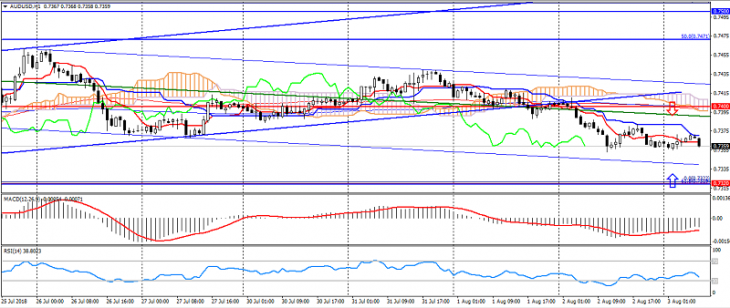

AUD USD (current price: 0.7360)

- Support levels: 0.7400, 0.7320, 0.7250.

- Resistance levels: 0.7500, 0.7550, 0.7600.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.7400, 0.7430, 0.7450.

- Alternative recommendation: buy entry is from 0.7350, 0.7320, 0.7300.

The Australian dollar remains under pressure from the risks of trade confrontation between the US and China.

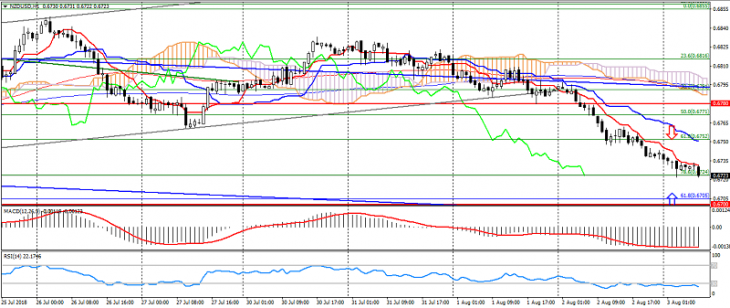

NZD USD (current price: 0.6720)

- Support levels: 0.6780, 0.6700 (significant psychology), 0.6650.

- Resistance levels: 0.6880, 0.6920, 0.6970.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6740, 0.6760, 0.6780.

- Alternative recommendation: buy entry is from 0.6700, 0.6680, 0.6850.

The New Zealand dollar remains under pressure of aggravation of trade relations.

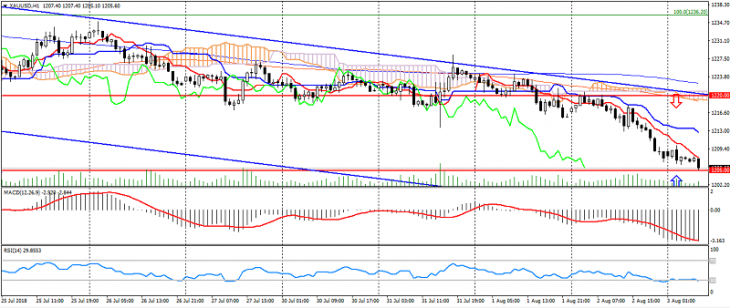

XAU USD (current price: 1205.00)

- Support levels: 1220.00, 1205.00, 1193.00.

- Resistance levels: 1240.00, 1250.00, 1265.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward motion): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1210.00, 1213.00, 1220.00.

- Alternative recommendation: buy entry is from 1205.00, 1200.00, 1190.00.

Gold accelerated the decline on the growth of the American dollar.