Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

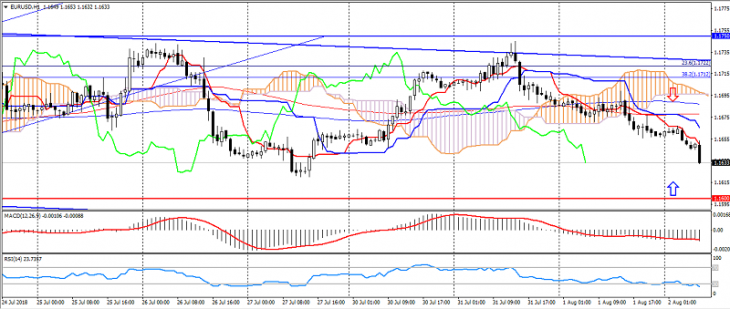

EUR USD (current price: 1.1630)

- Support levels: 1.1600 (significant psychology), 1.1500 (local minimum), 1.1450.

- Resistance levels: 1.1750, 1.1850 (June maximum), 1.2000 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.1660, 1.1680, 1.1700.

- Alternative recommendation: buy entry is from 1.1620, 1.1600, 1.1580.

The euro-dollar pair accelerated the decline on the growth of optimism in the dollar, but is limited by oversold and growing risks.

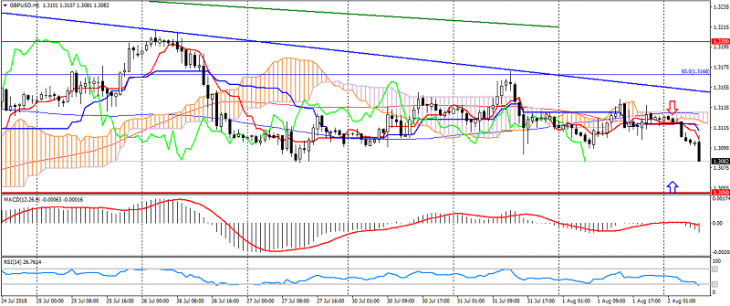

GBP USD (current price: 1.3080)

- Support levels: 1.3200 (the minimum of May), 1.3050, 1.3000 (strong psychology).

- Resistance levels: 1.3350 (June maximum), 1.3460, 1.3600 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3110, 1.3130, 1.3150.

- Alternative recommendation: buy entry is from 1.3070, 1.3050, 1.3030.

The British pound also accelerated the decline, limited to oversold.

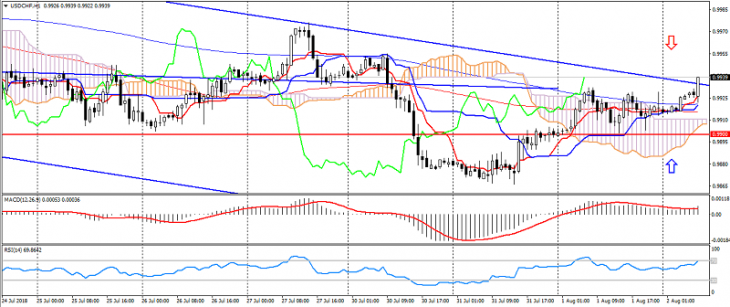

USD CHF (current price: 0.9940)

- Support levels: 0.9900, 0.9850 (local minimum), 0.9700 (minimum of June).

- Resistance levels: 1.000 (significant psychology), 1.0050 (May maximum), 1.0100.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.9960, 0.9980, 0.9990.

- Alternative recommendation: buy entry is from 0.9910, 0.9890, 0.9860.

The Swiss franc maintains an upward dynamics, limiting itself to a downward trend.

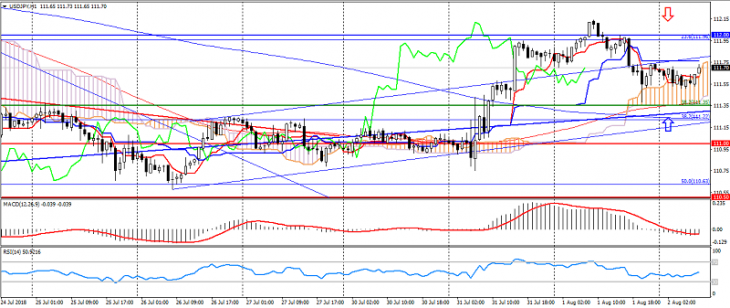

USD JPY (current price: 111.70)

- Support levels: 111.00, 110.50, 109.80.

- Resistance levels: 112.00, 113.30 (maximum of January), 114.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 111.80, 112.00 112.20.

- Alternative recommendation: buy entry is from 111.50, 111.30, 111.00.

The US dollar the Japanese yen maintains an upward trend, despite a correction.

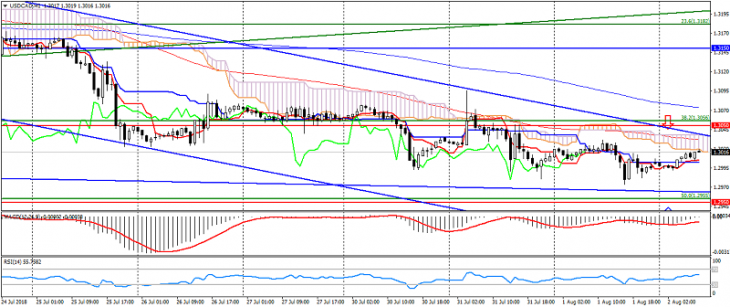

USD CAD (current price: 1.3020)

- Support levels: 1.3050 (May high), 1.2950, 1.2850.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the line Tenkan-sen near the line Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 1.3050, 1.3080, 1.3100.

- Alternative recommendation: buy entry is from 1.2980, 1.2950, 1.2920.

The US dollar pair the Canadian dollar maintains a downtrend, limited to support levels of 1.2970-50.

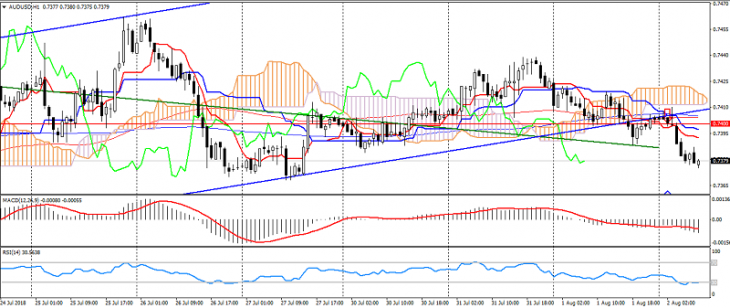

AUD USD (current price: 0.7380)

- Support levels: 0.7400, 0.7320, 0.7250.

- Resistance levels: 0.7500, 0.7550, 0.7600.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.7400, 0.7430, 0.7450.

- Alternative recommendation: buy entry is from 0.7370, 0.7350, 0.7330.

The Australian dollar resumed the decline, returning to the general downward trend.

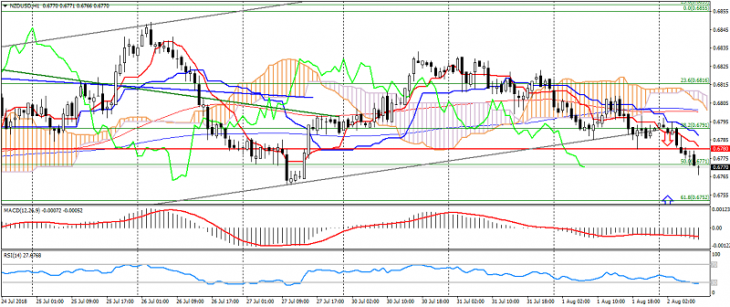

NZD USD (current price: 0.6770)

- Support levels: 0.6780, 0.6700 (significant psychology), 0.6650.

- Resistance levels: 0.6880, 0.6920, 0.6970.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6780, 0.6800, 0.6820.

- Alternative recommendation: buy entry is from 0.6760, 0.6750, 0.6720.

The New Zealand dollar accelerated the decline, thereby forming a reversal.

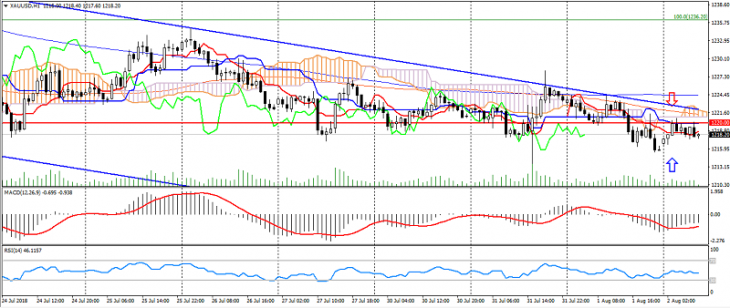

XAU USD (current price: 121800)

- Support levels: 1220.00, 1205.00, 1193.00.

- Resistance levels: 1240.00, 1250.00, 1265.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1220.00, 1225.00, 1228.00.

- Alternative recommendation: buy entry is from 1215.00, 1213.00, 1210.00.

Gold retains a downward trend, limited to the level of 1220-15.00.