Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

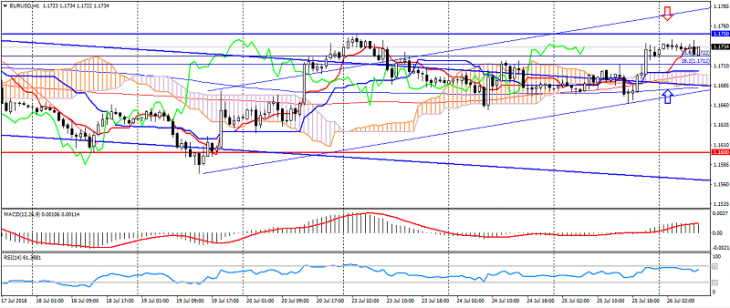

EUR USD (current price: 1.1730)

- Support levels: 1.1600 (significant psychology), 1.1500 (local minimum), 1.1450.

- Resistance levels: 1.1750, 1.1850 (June maximum), 1.2000 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.1750, 1.1770, 1.1790.

- Alternative recommendation: buy entry is from 1.1700, 1.1680, 1.1650.

The euro-dollar pair is trading with a strengthening on reducing trade risks, but is limited to waiting for the results of the ECB meeting.

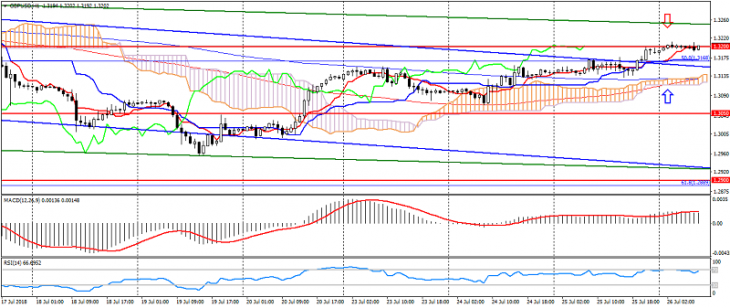

GBP USD (current price: 1.3200)

- Support levels: 1.3200 (the minimum of May), 1.3050, 1.3000 (strong psychology).

- Resistance levels: 1.3350 (June maximum), 1.3460, 1.3600 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3220, 1.3260, 1.3280.

- Alternative recommendation: buy entry is from 1.3170, 1.3130, 1.3090.

The British pound traded at the opening day, limited to a general downward trend.

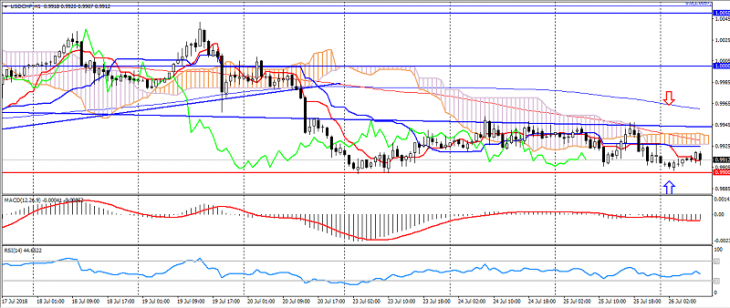

USD CHF (current price: 0.9910)

- Support levels: 0.9900, 0.9850 (local minimum), 0.9700 (minimum of June).

- Resistance levels: 1.000 (significant psychology), 1.0050 (May maximum), 1.0100.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9940, 0.9970, 1.0000.

- Alternative recommendation: buy entry is from 0.9900, 0.9880, 0.9860.

The Swiss franc Us dollar pair has returned to the downtrend, but is limited to flat.

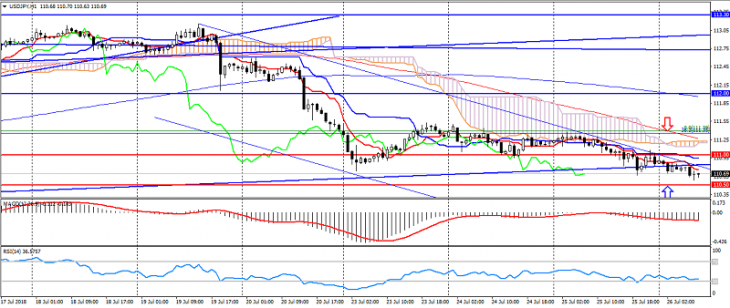

USD JPY (current price: 111.20)

- Support levels: 111.00, 110.50, 109.80.

- Resistance levels: 112.00, 113.30 (maximum of January), 114.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 111.00, 111.30 111.60.

- Alternative recommendation: buy entry is from 111.50, 110.20, 110.00.

The US dollar Japanese yen pair remains under pressure, but is limited to the support of 110.50-20.

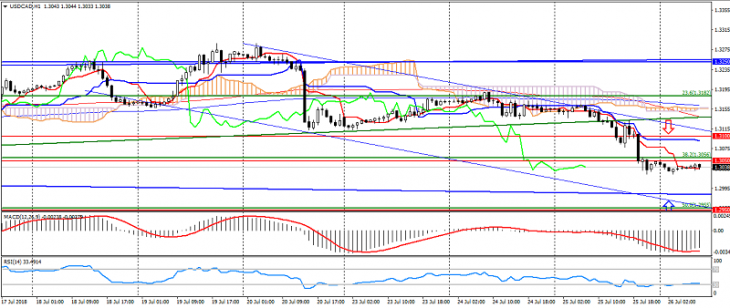

USD CAD (current price: 1.3040)

- Support levels: 1.3100, 1.3050 (May high), 1.2950.

- Resistance levels: 1.3250, 1.3380, 1.3480.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation:sale entry is from 1.3080, 1.3100, 1.3120.

- Alternative recommendation: buy entry is from 1.3020, 1.3000, 1.2980.

The US Canadian dollar pair is trading lower on the weakness of the American dollar, thereby indicating the possibility of a deep correction.

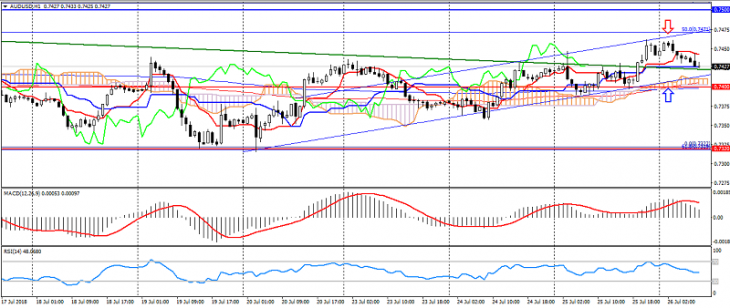

AUD USD (current price: 0.7430)

- Support levels: 0.7400, 0.7320, 0.7250.

- Resistance levels: 0.7500, 0.7550, 0.7600.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from0.7460, 0.7480, 0.7500.

- Alternative recommendation: buy entry is from 0.7400, 0.7380, 0.7360.

The Australian dollar also received support for the decline of the American dollar, thereby leaving the established channel.

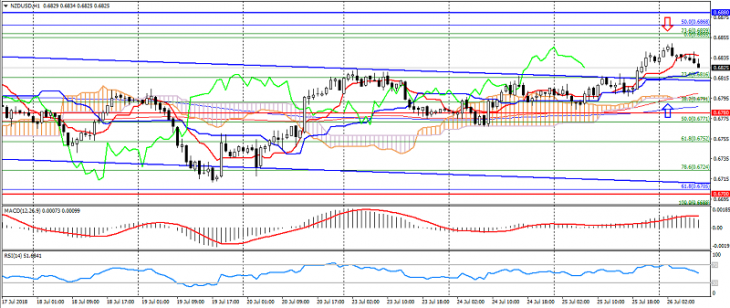

NZD USD (current price: 0.6830)

- Support levels: 0.6780, 0.6700 (significant psychology), 0.6650.

- Resistance levels: 0.6880, 0.6920, 0.6970.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.6850, 0.6870, 0.6890.

- Alternative recommendation: buy entry is from 0.6800, 0.6780, 0.6750.

The New Zealand dollar also strengthened, thereby slowing the downward trend.

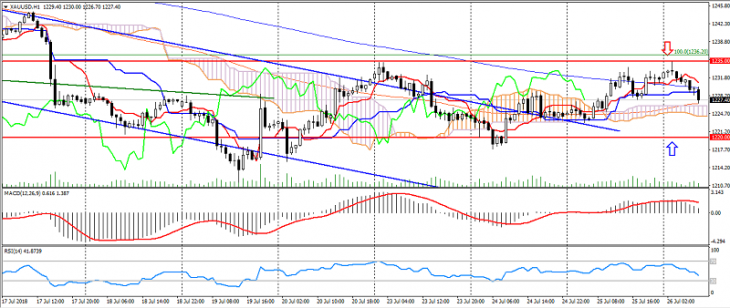

XAU USD (current price: 1227.00)

- Support levels: 1235.00 (minimum of December 2017), 1220.00, 1205.00.

- Resistance levels: 1250.00, 1265.00, 1275.00 (local maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1230.00, 1232.00, 1235.00.

- Alternative recommendation: buy entry is from 1220.00, 1218.00, 1214.00.

Gold is limited to lateral dynamics, thereby limiting the decline.