Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

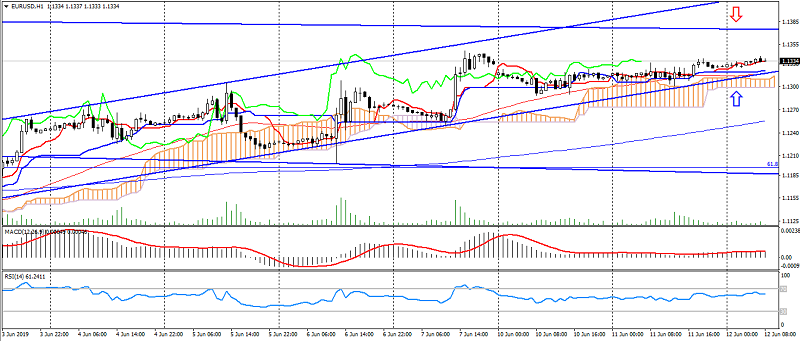

EUR USD (current price: 1.1330)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line near Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 1.1350, 1.1380, 1.1400.

- Alternative recommendation: buy entry is from 1.1300, 1.1280, 1.1250.

A pair of euro dollar is traded with a moderate strengthening on the preservation of the upward dynamics and the preservation of risks.

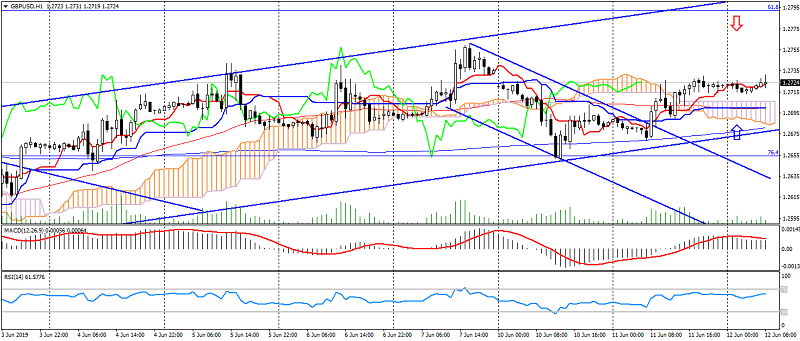

GBP USD (current price: 1.2730)

- Support levels: 1.2500, 1.2300, 1.2100.

- Resistance levels: 1.3300, 1.3600, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.2740, 1.2770, 1.2790.

- Alternative recommendation: buy entry is from 1.2700, 1.2680, 1.2650.

The British pound is trading with attempts of growth on the resumption of upward dynamics.

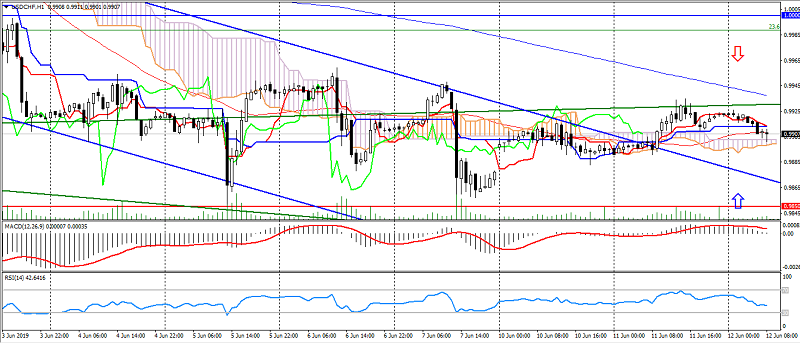

USD CHF (current price: 0.9910)

- Support levels: 0.9850, 0.9750, 0.9650.

- Resistance levels: 1.0000, 1.0060, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line near Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 0.9930, 0.9960, 0.9980.

- Alternative recommendation: buy entry is from 0.9880, 0.9850, 0.9820.

The US dollar Swiss franc keeps movement in the flat, accelerating the decline in risk.

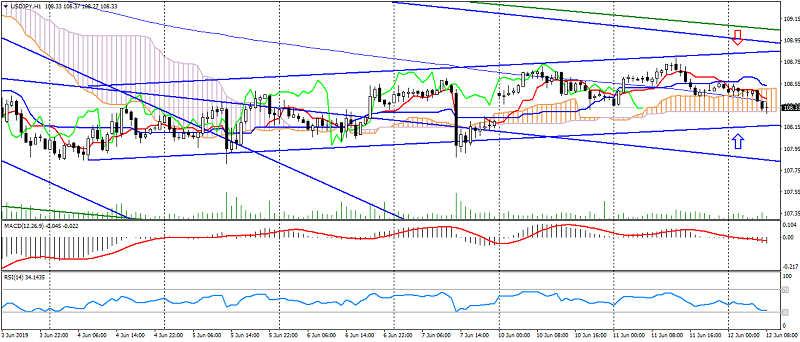

USD JPY (current price: 108.30)

- Support levels: 104.50, 103.00, 100.50.

- Resistance levels: 110.00, 112.00, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold area. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 108.60, 108.80, 109.00.

- Alternative recommendation: buy entry is from 108.20, 108.00, 107.80.

A pair of the US dollar Japanese yen has moved to a decrease in risk renewal, maintaining an uptrend.

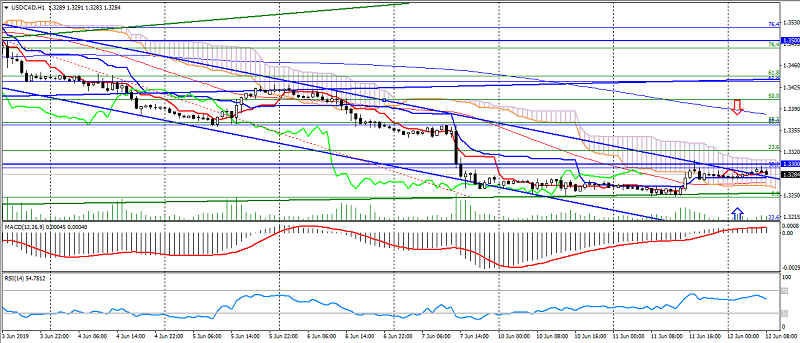

USD CAD (current price: 1.3280)

- Support levels: 1.3100, 1.3000, 1.2900.

- Resistance levels: 1.3300, 1.3500, 1.3700.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line near Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.3300, 1.3330, 1.3360.

- Alternative recommendation: buy entry is from 1.3270, 1.3250, 1.3220.

A pair of the US dollar Canadian dollar slowed downward movement, on increasing risks.

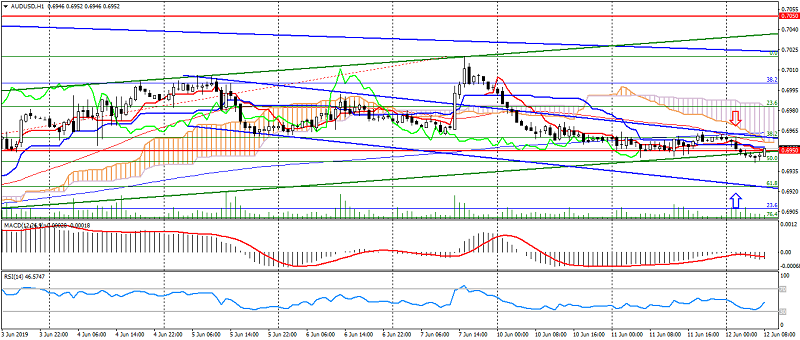

AUD USD (current price: 0.6950)

- Support levels: 0.7050, 0.6950, 0.6850.

- Resistance levels: 0.7200, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6970, 0.7000, 0.7020.

- Alternative recommendation: buy entry is from 0.6940, 0.6930, 0.6900.

Since the beginning of the day, the Australian dollar has been trading down with increasing risk of a worsening trade war.

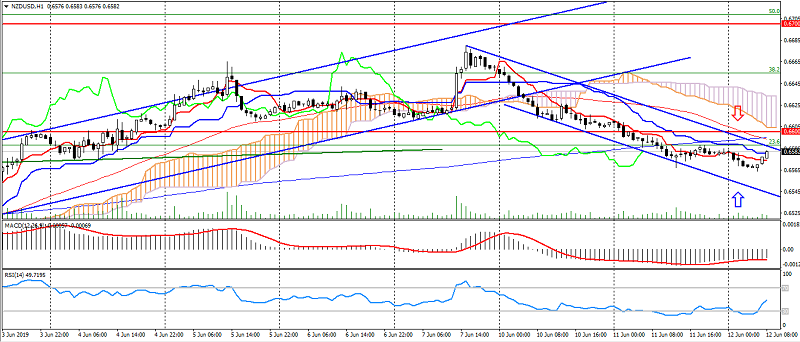

NZD USD (current price: 0.6580)

- Support levels: 0.6700, 0.6600, 0.6500.

- Resistance levels: 0.6880, 0.6950, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6600, 0.6620, 0.6650.

- Alternative recommendation: buy entry is from 0.6560, 0.6540, 0.6520.

The New Zealand dollar shows a moderate decline in exacerbation of risks.

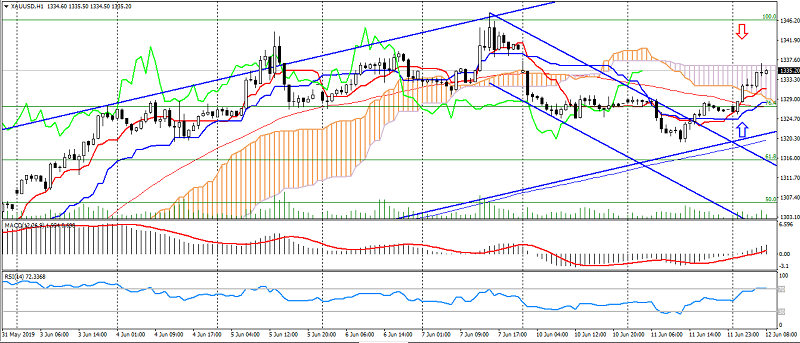

XAU USD (current price: 1335.00)

- Support levels : 1300.00, 1335.00, 1360.00.

- Resistance levels: 1265.00, 1240.00, 1220.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) overbought. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line is above Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1340.00, 1345.00, 1350.00.

- Alternative recommendation: buy entry is from 1330.00, 1325.00, 1320.00.

Gold has returned to growth on renewed risk, limited to overbought.