Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

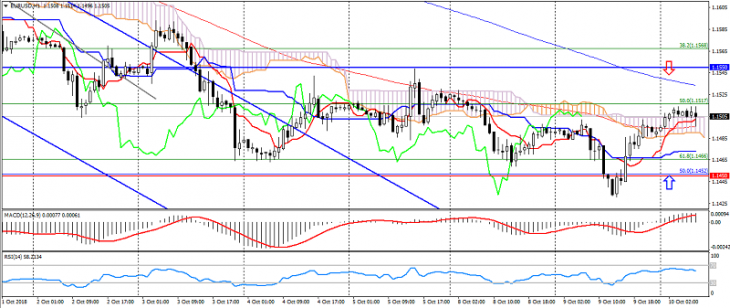

EUR USD (current price: 1.1500)

- Support levels: 1.1450, 1.1350, 1.1200.

- Resistance levels: 1.1550, 1.1650, 1.1740.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.1520, 1.1550, 1.1658.

- Alternative recommendation: buy entry is from 1.1480, 1.1450, 1.1430.

The euro dollar pair resumed its growth on the weakness of the American dollar, but is limited to the Friday-Monday trading range.

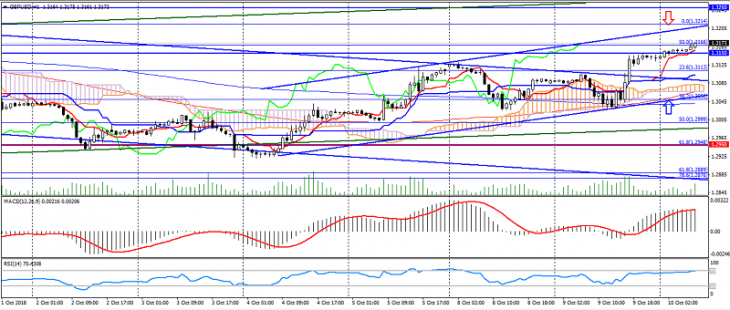

GBP USD (current price: 1.3170)

- Support levels: 1.2950, 1.2780, 1.2600 (June 2017 minimum).

- Resistance levels: 1.3150, 1.3250, 1.3350.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.3180, 1.3200, 1.3230.

- Alternative recommendation: buy entry is from 1.3150, 1.3120, 1.3100.

The British pound maintains a positive trend, accelerating growth on the growth of optimism about Brexit.

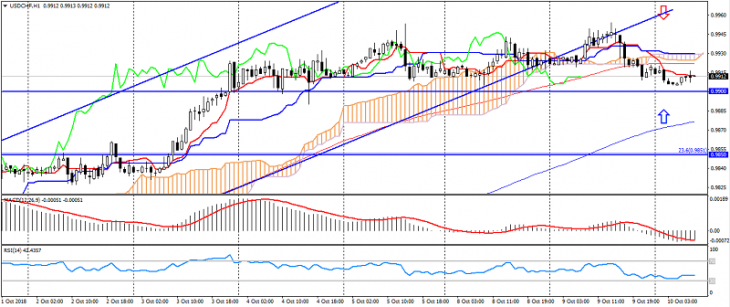

USD CHF (current price: 0.9910)

- Support levels: 0.9700, 0.9600, 0.9550.

- Resistance levels: 0.9850, 0.9900, 1.0000.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is lower than Kijun-sen line, the price is below the cloud.

- Primary recommendation: sale entry is from 0.9930, 0.9950, 0.9970.

- Alternative recommendation: buy entry is from 0.9880, 0.9850, 0.9830.

US dollar Swiss franc is back to a sideways trend on the weakness of the dollar.

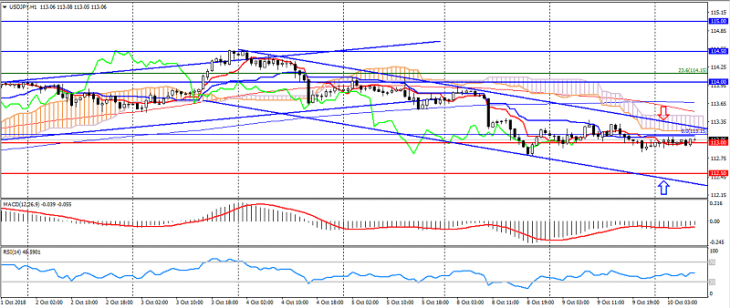

USD JPY (current price: 113.00)

- Support levels: 113.00, 112.50, 112.00.

- Resistance levels: 114.00, 114.50, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 113.30, 113.50 113.80.

- Alternative recommendation: buy entry is from 112.70, 112.50, 112.20.

A pair of US dollar the Japanese yen remains in a downtrend, while maintaining the potential for decline.

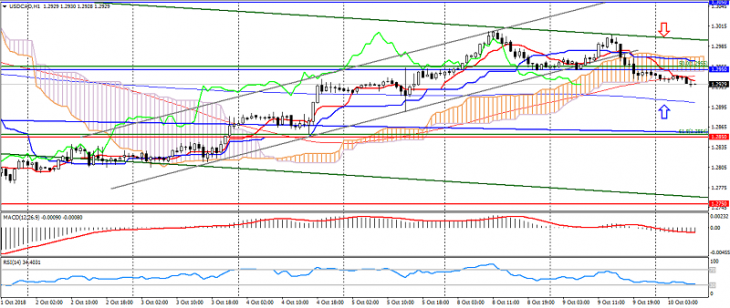

USD CAD (current price: 1.2930)

- Support levels: 1.2850, 1.2750, 1.2700.

- Resistance levels: 1.2950, 1.3050, 1.3150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold area. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2950, 1.2980, 1.3020.

- Alternative recommendation: buy entry is from 1.2900, 1.2880, 1.2850.

A pair of US dollar the Canadian dollar remains in the correction phase, maintaining the overall downtrend.

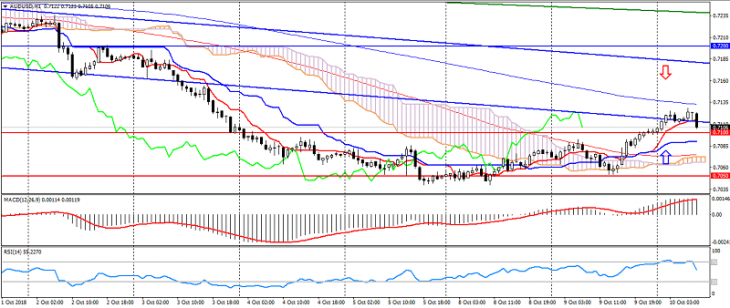

AUD USD (current price: 0.7120)

- Support levels: 0.7100, 0.7040, 0.6950.

- Resistance levels: 0.7100, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 0.7130, 0.7150, 0.7180.

- Alternative recommendation: buy entry is from 0.7100, 0.7070, 0.7050.

The Australian dollar has moved to growth, but retains general downtrend.

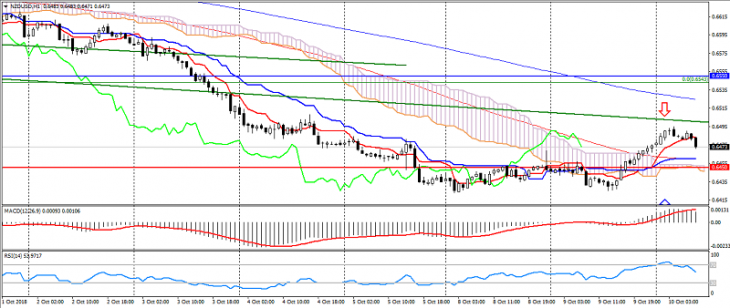

NZD USD (current price: 0.6470)

- Support levels are: 0.6450, 0.6350, 0.6300.

- Resistance levels: 0.6550, 0.6630, 0.6700.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 0.6500, 0.6520, 0.6550.

- Alternative recommendation: buy entry is from 0.6450, 0.6430, 0.6400.

The New Zealand dollar also remains under pressure from a downtrend, despite attempts to grow.

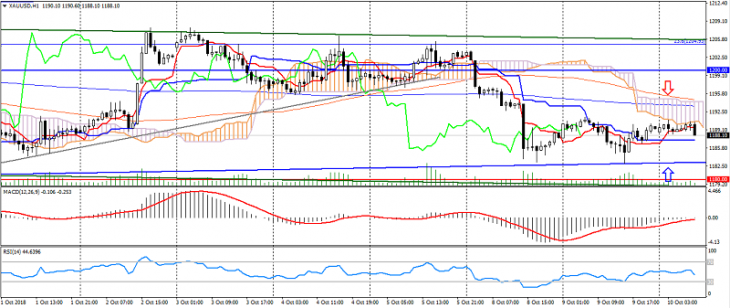

XAU USD (current price: 1189.00)

- Support levels: 1180.00, 1170.00, 1155.00.

- Resistance levels: 1200.00, 1220.00, 1240.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1195.00, 1200.00, 1205.00.

- Alternative recommendation: buy entry is from 1185.00, 1180.00, 1175.00.

Gold remains to be traded in the side channel, limited to the general growth of the dollar.