The main reasons for the weakening of the US dollar. Fed’s rates cut

A series of high-profile statements was the reason for the volatile trading on the US dollar on Friday (May 31). In turn, they caused even more significant movement in the market, in the form of a collapse of the US dollar on the expectation of lower rates from the US Federal Reserve.

Influence of the US – China trade confrontation

The persistence of trade confrontation between the United States and China was the main risk factor for both the conflicting countries and the world economy as a whole. This has forced global central banks to increase their stimulus measures to avoid risks.

If China did not cease to stimulate the national economy, artificially reducing the cost of the yuan to reduce the cost of exports, the States found themselves in a very unprofitable situation, raising interest rates in December 2018. While the rest of the world Central Bank continue to cut rates and do not even consider the possibility of raising it.

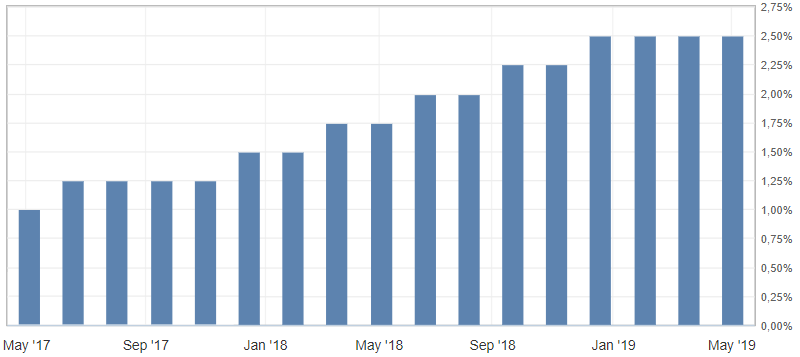

Fig. 1. The US Federal Reserve interest rates chart

Earlier, the US President D. Trump and his administration were often criticized because of attacks on the US Federal Reserve. Mainly due to the fact that Trump with sharp criticism of the Fed with the Chairman D. Powell. He continues to adhere to tight monetary policy, questioning the effectiveness of Trump’s reform and actually creating unfavorable conditions for the US economy in a trade war.

In the conditions of the next aggravation of the US-Chinese trade war, which has already gone very far, sticking with the rigid monetary policy of the Fed is stupid. In the conditions of further exacerbation of trading risks, the decline in rates in the United States remains a matter of time.

Friday’s collapse of the US dollar was the actual expectation of lower rates in the United States. The driver for this was two news at once:

- Trump’s statement about the introduction of 5% of trade duties on Mexican goods in response to the lack of a solution to the migration issue between the US and Mexico.

- Further exacerbation of trade tension between the United States and China, where the latter is ready to limit the sale of rare-earth minerals to the United States as part of a trade war.

As a result, the market has developed all the conditions for lowering rates in the United States. And given the pace of growth of risks and the growing geography of the trade war, the market began to expect more rates cut from the Fed. So, earlier, before the end of the year, they expected from 1 to 2 rate cuts. Now this amount can vary from 3 to 4 by the end of the year. This sounds very unlikely if it were not for the dynamics of the Fed rate cut forecasts and fundamental factors.

So, the main reason for the collapse of the US dollar was the likelihood of lower rates in the US in June and July. The probability of a reduction in the Fed’s interest rates from 2.50% to 2.25% is 20%, while on May 23-27 this probability varied from 10 to 3.3%.

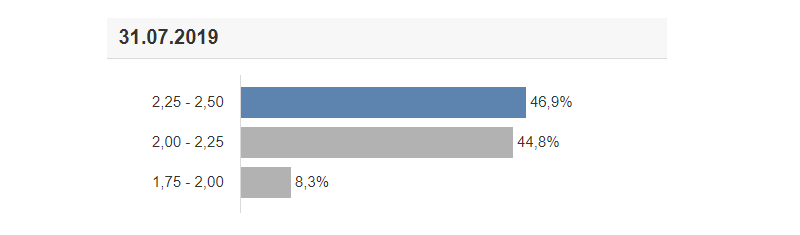

From the July meeting, the Fed is expected to have almost the same probability of reducing and maintaining rates, approximately 45% each. Given the dynamics of growth in trading risks, by the end of June the probability of lowering rates will increase.

Fig. 2. The probability of changes in the Fed’s rates in July

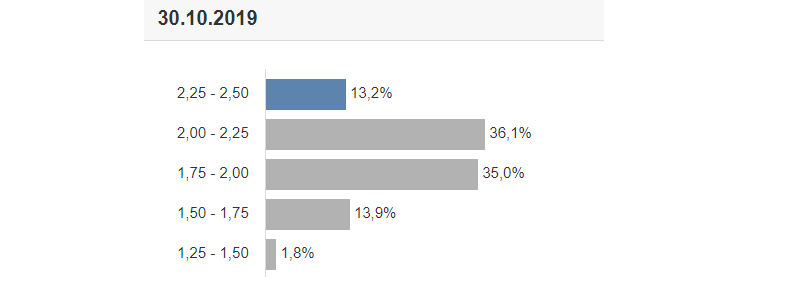

Separately, it is worth highlighting the forecasts for the October Fed meeting, where the probability of accepting rates at 2.25% and 2.00% is 35%, actually indicating that by the end of the year the market expects at least two rates from the Fed.

Fig. 3. The probability of changes in the Fed’s rates in October

It is worth noting that these expectations correspond to the situation at the end of May, and the situation with the trade war is deteriorating. Therefore, the possibility is not excluded with earlier rates cut in the United States.

Anton Hanzenko