U.S. Retail Sales Data

- Core retail sales index (m/m) (oct), fact 0.2%, forecast 0.4%.

- Export Price Index (m/m) (oct), fact -0.1%, forecast -0.1%.

- Import Price Index (m/m) (oct), fact -0.5%, forecast -0.2%.

- NY Empire State Industrial Activity Index (Nov), fact 2.90, forecast 5.00.

- Retail sales (m/m) (oct), fact 0.3%, forecast 0.2%.

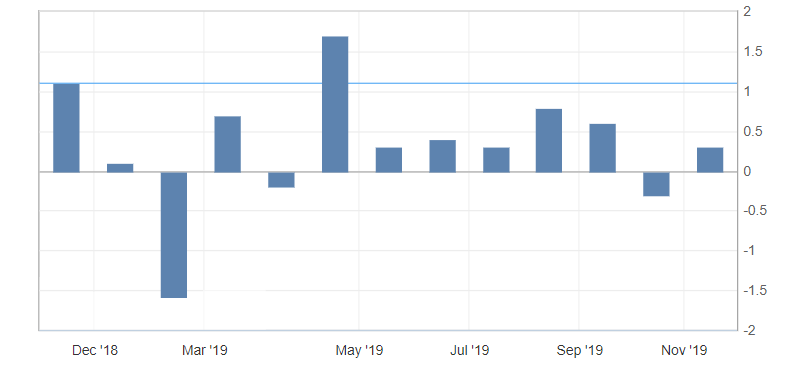

U.S. retail sales showed less significant growth in October than expected. At the same time, they returned to positive dynamics after negative values. It is also worth to note a more significant increase in retail sales, which indicates the ambiguity of the report. As a result, despite the unjustified expectations of the US retail sales market, this report can be considered restrained negative.

Fig. 1. US Retail Sales Chart

The US dollar index did not actually respond to the US data, continuing to trade with a restrained decline on trade uncertainty and growth in risky assets. The US dollar index is limited by support levels: 98.10 and 98.00.

Fig. 2. The US dollar index chart. Current price – 98.10 (10-year US government bonds yield – blue line)

Read also: “The oil market and its cloudy prospects”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- What does the decline in active drilling rigs in the USA indicate?

- The U.S.-China trade agreement news

- The trade war risks are coming back

Current Investment ideas: