Oil is traded near zero marks during the Asian session.

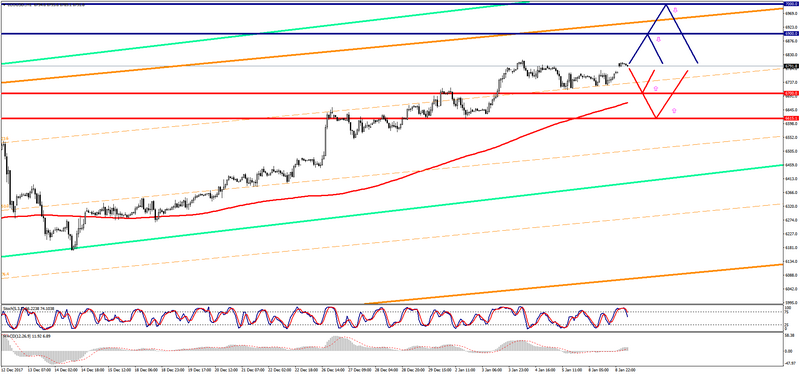

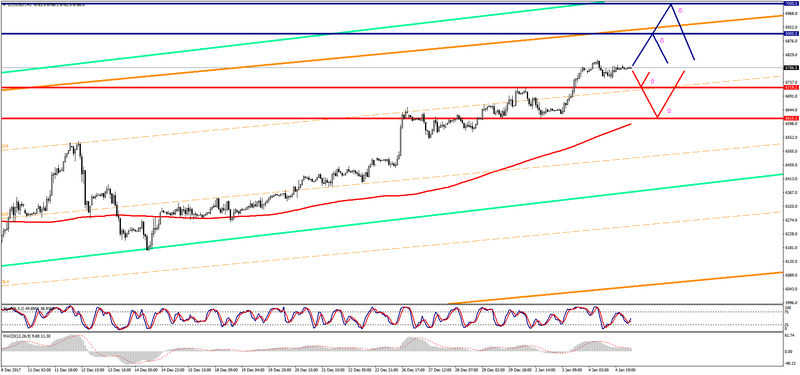

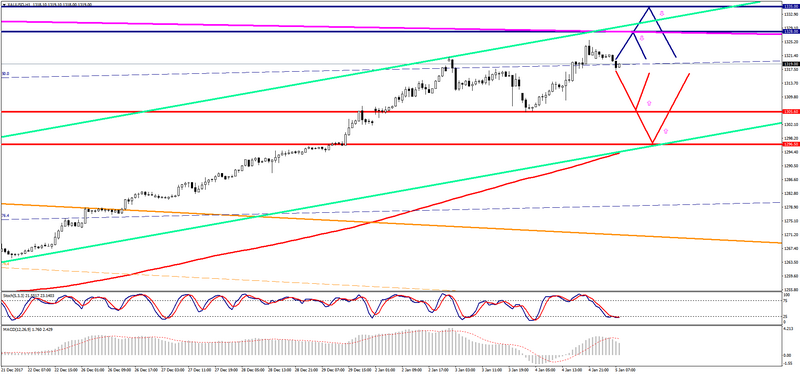

The Brent graph (current price: $ 6786.50 per 100 barrels)

The Brent brand is traded slightly below the zero mark during the Asian session.

- Resistance 1: From $ 6900.00 (psychological level)

- Resistance 2: From $ 7000.00 (psychological level)

- Support 1: From $ 6719.20 (January 2 maximum)

- Support 2: From $ 6615.10 (January 2 minimum)

Computer analysis: The Stochastic Oscillator movings on the charts of H1 and H4 are in the neutral zone, the consolidation of the Brent price is possible.

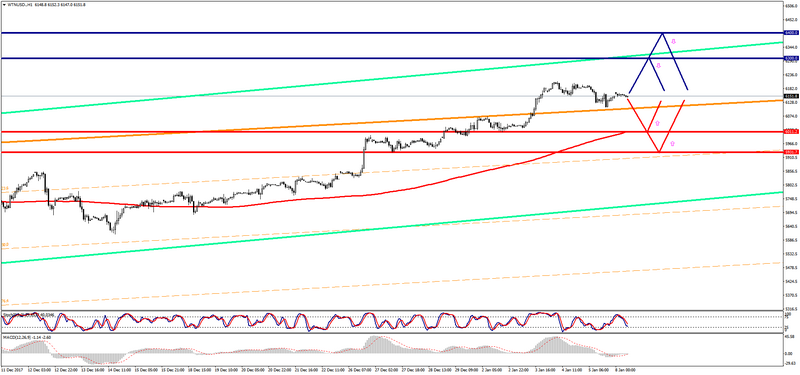

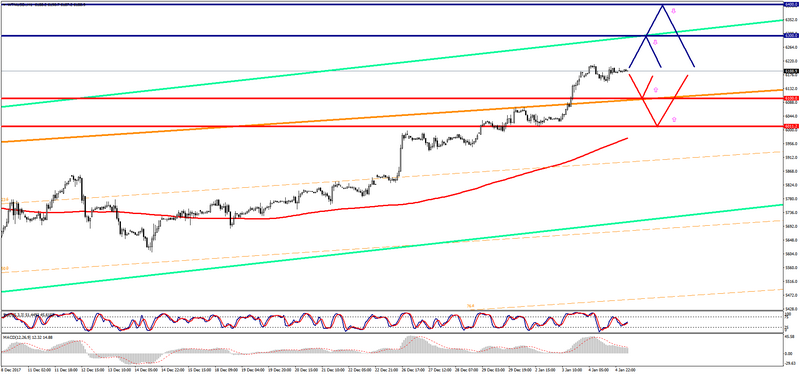

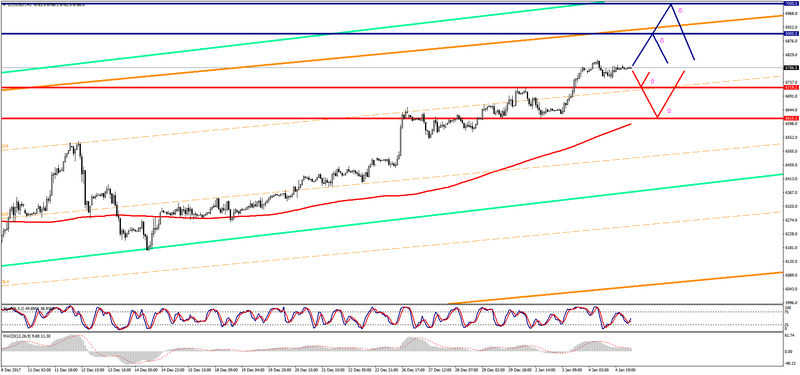

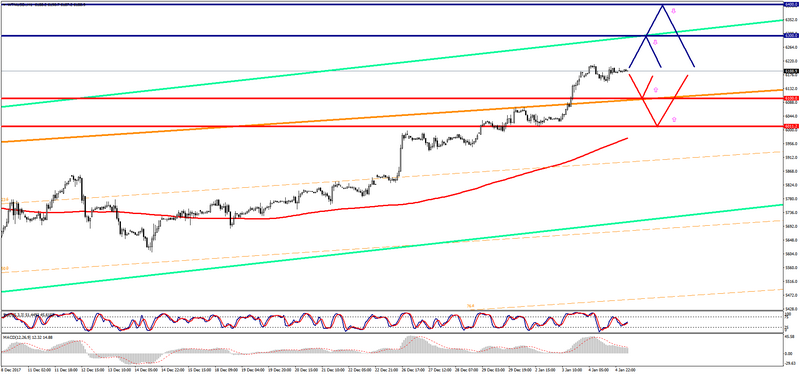

The WTI graph (current price: $ 6188.90 per 100 barrels)

The WTI brand is traded with a small minus during the Asian session.

- Resistance 1: From $ 6300.00 (psychological level)

- Resistance 2: From $ 6400.00 (psychological level)

- Support 1: From $ 6100.00 (psychological level)

- Support 2: From $ 6011.20 (January 2 minimum)

Computer analysis: The Stochastic Oscillator movings on the charts of H1 and H4 are in the neutral zone, one should expect the continuation of the consolidation of the WTI price.