Bank of Canada raises interest rates!

- Bank of Canada interest rate decision, fact 1.75%, previous value 1.50%.

The Bank of Canada raised its key interest rate by 25 b.p. to 1.75% as expected and supporting the Canadian currency. In addition, the Canadian dollar was supported by the statement without the approval of a gradual increase in interest rates, indicating greater determination in the future. It is also confirmed by the policy of further raising rates in Canada. At the same time, the positive effect of the trade agreement between the USA and Canada was also noted. On the other hand, the risks of trade confrontation between the United States and Canada remain.

Regarding forecasts of the Bank of Canada, GDP in 2018 and 2019 is expected to reach 2.1%, and in 2020 about 1.9%. Inflation is expected at around 2% by the end of 2020. As a result, the results of the Bank of Canada meeting turned out to be very positive, despite some risks of a slowdown in GDP, and trade confrontation.

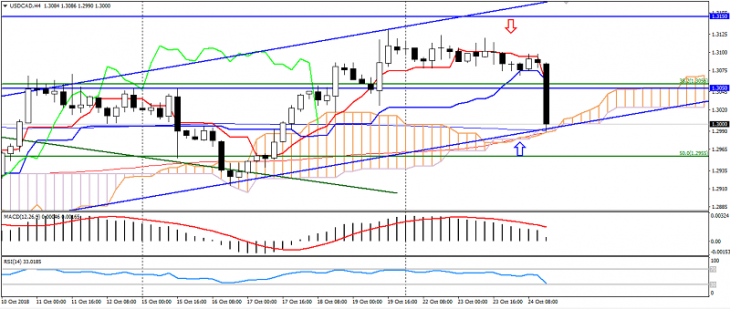

The USD/CAD pair accelerated the decline on the positive signals of the Central Bank of Canada, but at the same time continues to be limited to a three-week uptrend and support levels: 1.3000 and 1.2980, which corresponds to the lower boundary of the channel, so a correction may form in this zone, more significant support is at the level of 1.2950.

USD/CAD chart. Current price – 1.2990

Read also: “It’s easy to get rich, but try to stay rich”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Dow Theory – the basics of technical analysis.

- The US economy continues its growth, confirming the rates hike policy.

- Prospects for recovery of emerging markets.

Current Investment ideas: