Procter & Gamble дав заробити! Розгляд інвестиційної ідеї червня.

Інвестиційна ідея: «Споживчий гігант приносить величезну прибуток!» себе повністю виправдала. І той, хто підключився до інвестиційної ідеї по Procter & Gamble на початку червня, вже заробив. З результатами даної ідеї можна ознайомитися за посиланням. Через технічні проблеми стейтмент зі звітом не вдалося надати, але точки входу і цілі себе повністю виправдали, що підтверджують очікування в ідеї.

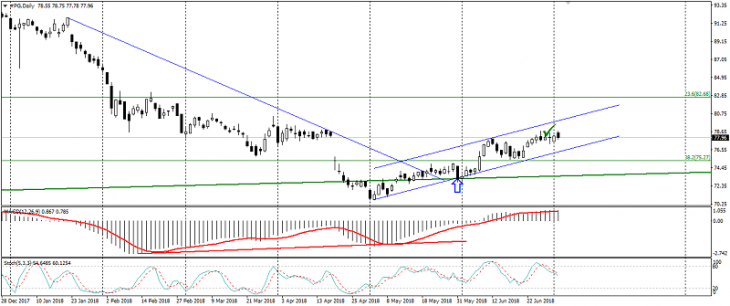

Розглянемо докладніше точки входу, відпрацювання та закриття угоди по акціях Procter & Gamble.

Вхід в угоду

Технічно безпосередній вхід в угоду на зміцненні акцій Procter & Gamble припав на початок травня, на що вказує старт відпрацювання бичачої дивергенції на D1 і вихід Stochс зони перепроданості на тайфреймі W1. Основним фактором підтвердження входу в покупку стало повернення акцій в загальний висхідний тренд, який простежується з початку 2009 року. Також додатковим сигналом стало повернення ціни вище рівня Фібо. 38.2 (75.20-30) від мінімуму 2009 року до максимуму 2017 року.

Мал. 1. Графік акцій Procter & Gamble

Відпрацювання угоди

Перша консервативна мета по акціях була досягнута швидко, 7 днів з офіційного старту ідеї. Цьому посприяло закриття гепа квітня. Після індекс DowJons 30, в який входять акції P & G, потрапив під тиск ризиків. В результаті дані акції так і не змогли вийти з корекції. Вплив на індекс і ринок акцій США продовжують надавати фундаментальні ризики, пов’язані з торговим протистоянням США, які і стали приводом до ручного закриття угоди по акціях.

Мал. 2. Графік індексу DowJones 30

Закриття угоди

Як говорилося раніше, вплив на динаміку акцій і всього індексу надали фундаментальні фактори, які змусили закрити операцію вручну, не чекаючи другої мети в діапазоні 80.50-82.30.

Варто відзначити, що потенціал до досягнення даних рівнів зберігається, але в силу зростаючих ризиків може бути більш тривалим, ніж очікувалося. Також не варто відкидати можливості розширення торгового діапазону травня, червня. Також варто відзначити, що акції P & G вийшли з низхідної хвилі і торгуються в висхідному тренді висхідної хвилі.

Також Ви можете ознайомитися з розглядом угоди по акціям Facebook та іншою корисною інформацією в Блозі Трейдера. Слідкуйте за іншими інвестиційними ідеями липня від компанії EsterHoldings і не пропустіть свій шанс заробити!

Антон Ганзенко