The Central Bank of Canada – the prospects for monetary policy. Alexander Sivtsov.

The article will be about the main financial institution of the country, which is among the top 10 countries in the world for life. We will talk about the Bank of Canada and the further development of its monetary and credit policy.

Bank of Canada was founded in 1934 as a private corporation, and the bank itself was launched in March 1935. In 1938, the bank became a state bank, taking over the functions that had previously been performed by other organizations, including the issue of banknotes. The Bank regulates the Bank of Canada Law, which, since 1934, has often changed, but it has not lost the main essence of the bank’s work “regulation of lending and the monetary system in the interests of the country’s economic activity.”

Bank of Canada – The organizational structure includes 10 departments:

- Department of Scientific Research;

- Department of Financial Markets;

- Management of monetary and financial research;

- Department of International Relations;

- Debt Management Office;

- Management of services of top management and legal services;

- Department of Banking Operations;

- Control management;

- Department of General Services;

- Management of communications.

The Board of Directors of the Bank of Canada includes 12 elected people, chairman of the Bank (Stephen Poloz) and his first deputy. The current activities of the Bank of Canada are handled by the Board of Governors, which consists of 6 people. Also, on the board of directors is the Deputy Minister of Finance, who has no voting rights.

Bank of Canada – Monetary Policy

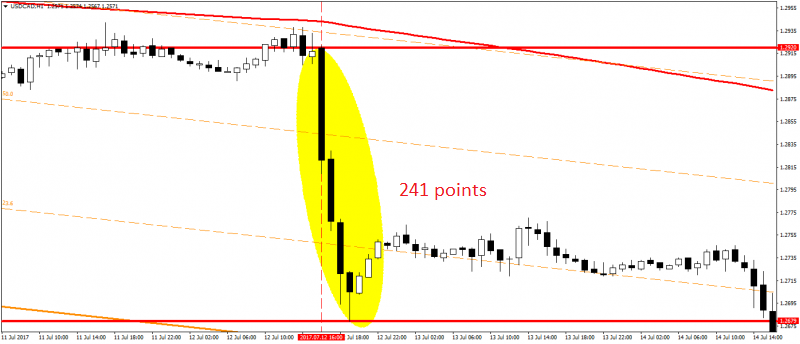

The monetary policy of the Bank of Canada is aimed at keeping the inflation rate in the range of 1-3% and maintaining a stable economic growth of the country. According to the latest data, the inflation rate in Canada is 1.3%, which is below the midpoint of the target range at 2.0%. This level of inflation is associated with low oil prices, the extraction of which is the most significant production in Canada. On July 12, 2017, it was decided to change the Bank of Canada discount rate from 0.50% to 0.75%, which provided significant support to the Canadian currency and along with the comments of the head of the bank Stephen Poloz led to the strengthening of the Canadian dollar against the US dollar by more than 200 points.

Prospects for further development of the monetary policy of the Bank of Canada

Basically, after any changes in monetary policy, which includes a change in the interest rate, it can take from 18 to 24 months to study the effect of the changes. But if we proceed from Stephen Poloz’s statements that the discount rate at 0.75% is still quite low, one should expect an earlier increase, as the effect from this level may be insignificant and not noticeable. Also, Poloz noted that the country has already adapted to the conditions of low oil prices and the slowdown in the rate of inflation may be temporary.

The next meeting of the Bank of Canada is scheduled for October 25, 2017, before which the bank’s management will closely monitor changes in GDP and inflation, since the change in these indicators plays a key role in the decision to change the interest rate. It is possible that in October the interest rate will remain at the level of 0.75%, but at the same time one should expect signals about further increase.

Follow the opinions of experts on the website of the Ester Holdings Inc. companyto be aware of the current state of the market and the upcoming significant events that will give you an opportunity tomake money.

Alexander Sivtsov