Тechnical analysis of currency pairs (Anton Hanzenko)

EUR USD (current price: 1.2340)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12,26,9) (signal-upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal-upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.2350, 1.2370, 1.2390.

- Alternative recommendation: buy entry is started from 1.2320, 1.2300, 1.2280.

The euro is traded near a significant resistance to the weakness of the American because of the aggravation of the trade war, but at the same time it is limited to a significant resistance level of 1.2350-70.

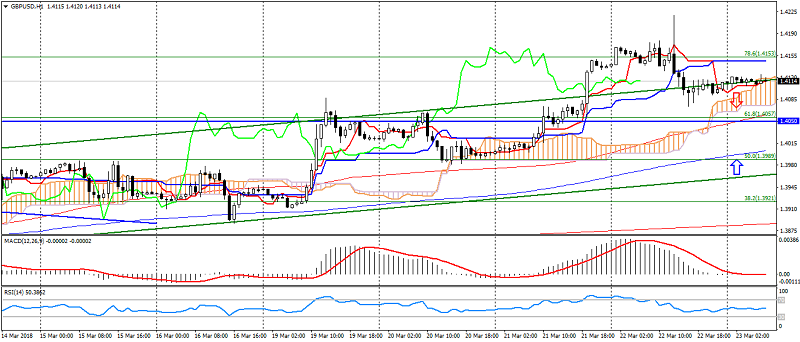

GBP USD (current price: 1.4120)

- Support levels: 1.3820,1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12,26,9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – flat): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.4150, 1.4190, 1.4220.

- Alternative recommendation: buy entry is started from 1.4080, 1.4050, 1.4020.

The British pound continues to trade in an upward trend, limited to overbought.

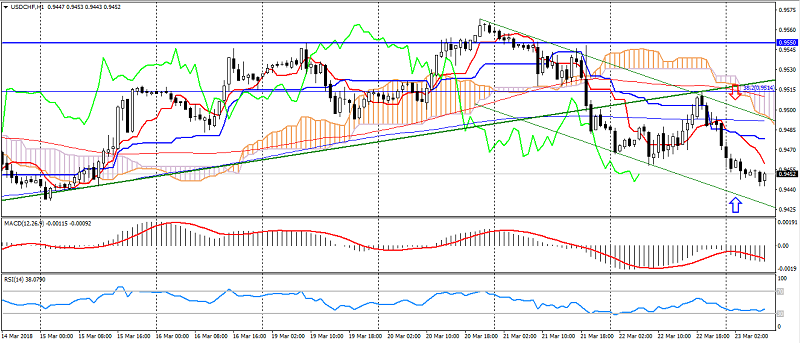

USD CHF (current price: 0.9450)

- Support levels: 0.9250 (August 2015 minimum), 0.9150, 0.9050 (May 2015 minimum).

- Resistance levels: 0.9550, 0.9800, 1.0030 (November 2017 maximum).

- Computer analysis: MACD (12,26,9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. IchimokuKinkoHyo (9,26,52) (signal- downward movement): the Tenkan-sen line is below the line Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is started from 0.9470, 0.9480, 0.9500.

- Alternative recommendation: buy entry is started from 0.9440, 0.9420, 0.9400.

The Swiss franc has appreciably strengthened on the weakness of the American on escape from risks.

USD JPY (current price: 104.80)

- Support levels: 105.50, 104.50, 103.40.

- Levels of resistance: 107.00, 108.00, 108.60.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. IchimokuKinkoHyo (9,26,52) (signal-downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 105.10, 105.30, 105.50.

- Alternative recommendation: buy entry is started from 104.80, 104.50, 104.20.

The Japanese yen is also traded with a strengthening on the weakness of the US dollar and the flight of investors from risks, limited to support of 104.50.

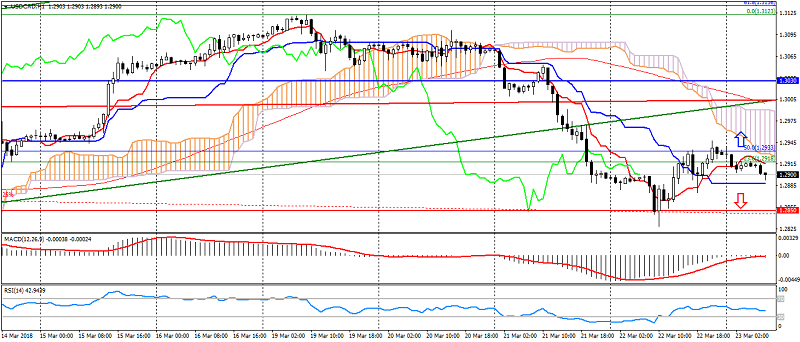

USD CAD (current price: 1.2900)

- Support levels: 1.2950, 1.2730.1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2940, 1.2970, 1.3000.

- Alternative recommendation: buy entry is started from 1.2880, 1.2850, 1.2820.

A pair managed to return to the uptrend on the weakness of the American.

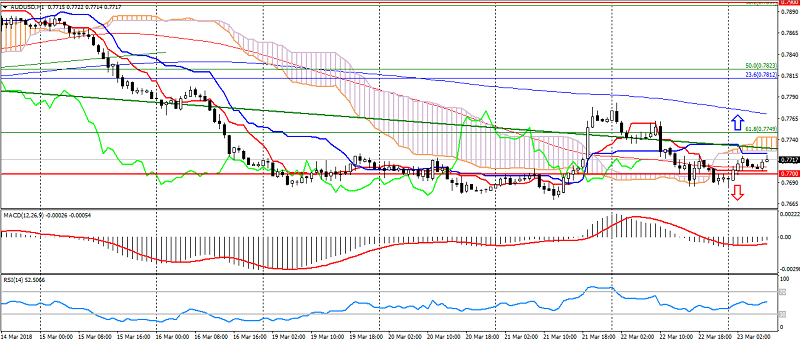

AUD USD (current price: 0.7720)

- Support levels: 0.7900, 0.7700 (March 2017 maximum), 0.7500.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7740, 0.7760, 0.7790.

- Alternative recommendation: buy entry is started from 0.7690, 0.7660, 0.7620.

The Australian remains in a downtrend, despite the slowdown in the trend.

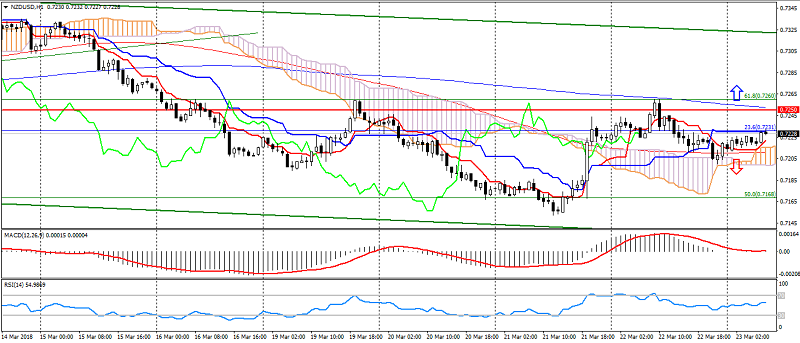

NZD USD (current price: 0.7230)

- Support levels: 0.7250, 0.7130 (August 2017 minimum), 0.7000.

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is near the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7250, 0.7280, 0.7300.

- Alternative recommendation: buy entry is started from 0.7200, 0.7180, 0.7160.

The New Zealand dollar is limited to the week’s maximum and the level of 0.7250.

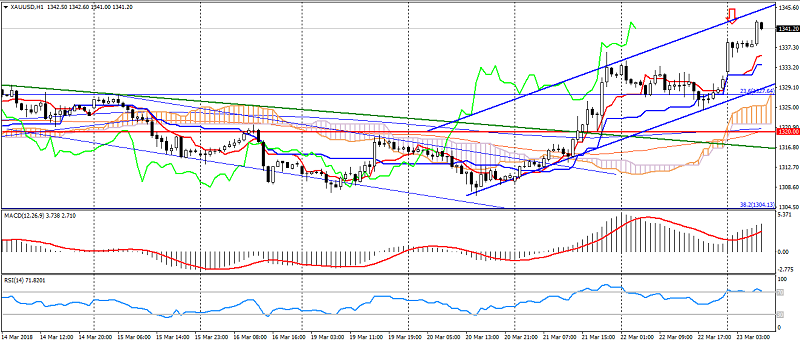

XAU USD (current price: 1341.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1345.00, 1348.00, 1350.00.

- Alternative recommendation: buy entry is started from 1337.00, 1330.00, 1325.00.

Gold maintains an upward trend in flight from risks, but is limited to overbought.