Doji candlesticks on the FOREX market

Articles on Doji candlesticks you can often meet on this portal and it can be found here and here. This topic is always relevant in technical analysis and serves as an excellent signal for a trend reversal in the market. The published an engulfing strategy also has a lot in common with doji candlesticks.

The main common feature of these strategies is that they indicate a trend reversal on market uncertainty, which is expressed by an engulfing pattern or a Doji candlestick.

Doji candles

Doji candlesticks are Japanese candlestick charts that have an abnormally small candle body. In this case, the shadow of the same candle can be quite large, both at the top and bottom.

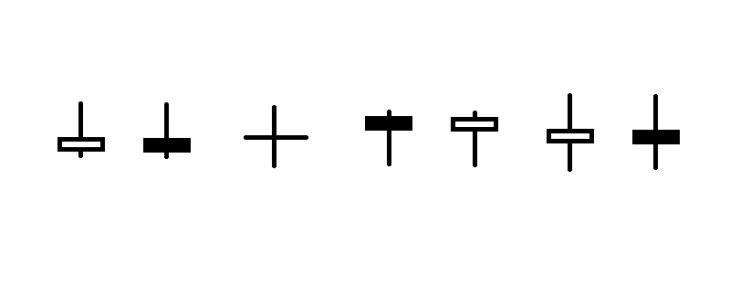

Figure 1. Doji Candlesticks

The picture above is an example of a classic Doji Candlesticks. The main essence of this candlestick indicates that the opening and closing of the candle occurs at almost the same price. With different timeframes on which it is formed, this value can be from several points to several dozen points. The shadows of these candlesticks can be either symmetrical or shifted to one side.

These candlesticks are formed often in a low active market or in a flat phase, when these candlesticks go one by one and in fact indicate a lack of movement in the market. Several candles going in a row do not carry practical value and should be ignored.

A situation where a doji candleticks is preceded by a full candlestick or a uniform upward/downward trend is considered as a signal for a trend reversal.

Example

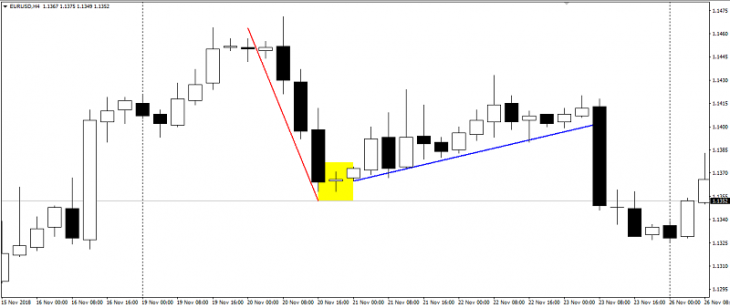

Figure 2. EUR/USD chart. Candlestick working out

The figure shows an example of a trend reversal after the formation of a Doji candlestick. Three downward candlesticks formed a downtrend. As a result, a Doji candlestick formed on the chart and the trend changed direction, showing growth.

A similar signal is formed on the EUR/GBP currency pair on the D1 timeframe, which in the end can serve as an excellent signal to buy.

It is worth noting that Doji candlestick formed on the larger timeframe is more likely to work out. It is due to less market noise on higher timeframes.

In the next article we will talk about some rare varieties of Doji candlesticks.

Anton Hanzenko