The political risks in the UK are escalating

The widespread collapse of the British pound this week was due to political risks in the UK, which worsened after the British government once again failed to find an effective solution to the issue of Brexit. The British opposition demanded that Prime Minister T. May announce the date of resignation, threatening to do it on their own.

So far, May has immunity until December after the unsuccessful announcement of a vote of no confidence last year. The main pressure on T. May comes from the side of Brexit, the deal on which can be realized after her resignation.

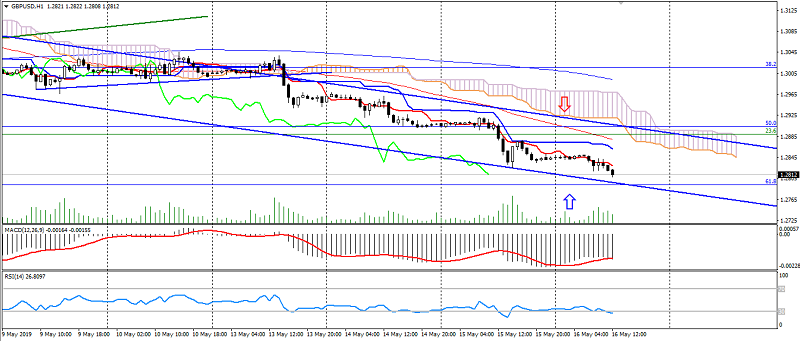

In the face of increasing political uncertainty and the lack of a Brexit deal, the British pound remains under considerable pressure, while limiting itself to oversold and attempts to correct for a general recovery of optimism. The GBP/USD pair is limited by oversold and upward divergence, but retains the downward channel of the current month. Support levels: 1.2800 and 1.2750, resistance: 1.2870 and 1.2900.

Fig. GBP/USD chart. Current price – 1.2810

Read also: “The future of the cryptocurrency market: Cryptocurrency and large corporations”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Expectations from the AUD/USD pair for May

- Escalation of the US-China trade war and what it means for the market

- Skills each investor must develop

Current Investment ideas: