U.S. employment data

- Average hourly earnings (m/m) (Apr), fact 0.2%, forecast 0.3%.

- Goods trade balance (Mar), fact -71,45B, forecast -73,00B.

- Nonfarm payrolls (Apr), fact 263K, forecast 181K.

- Private nonfarm payrolls (Apr), fact 236K, forecast 179K.

- The unemployment rate (April), a fact of 3.6%, the forecast of 3.8%.

The US labor market remains very strong, showing a significant increase in new jobs and a decrease in unemployment to a historic low. At the same time, the strengthening of the American currency against the basket of competitors was limited by data on wage reductions, which indicates the low quality of new jobs and the risks of slowing inflation. It is also worth noting that the American dollar is overbought after the Fed meeting.

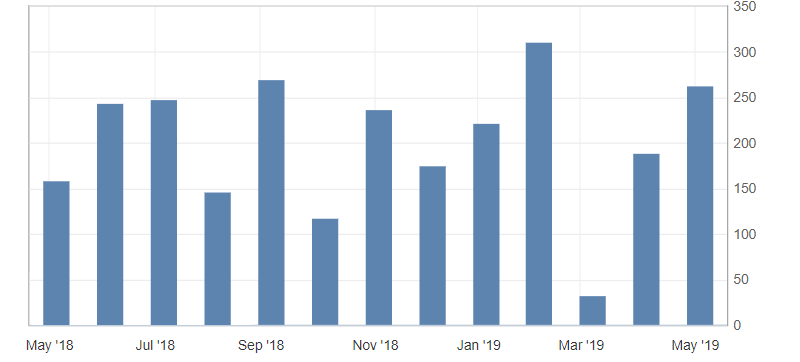

Fig. 1. Graph of changes in the number of people employed in the US nonfarm sector

The US dollar index, after updating the high at 98.10, moved to a decline, which is facilitated by the correction and the growth of negative expectations for inflation in the US. It is worth noting that the upward trend in the dollar is likely to continue. Support levels: 97.80 and 97.70, resistances: 98.10 and 98.20.

Fig. 2. The US dollar index chart. The current price is 97.90 (10-year government bonds yield is the blue line)

Read also: “Prospects for the oil market. What to expect? “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Stock Indices: Storming Historic Highs

- Sanctions against Iran, their aggravation and impact on the world market

- Multifactorial analysis of the Forex market

Current Investment ideas: