U.S. data

- Initial jobless claims, fact 216K, forecast 216K.

- Philadelphia Fed Manufacturing Index (July), fact 21.8, forecast 5.0.

- Philadelphia Fed Employment Index (July), fact 30.0, forecast 15.4.

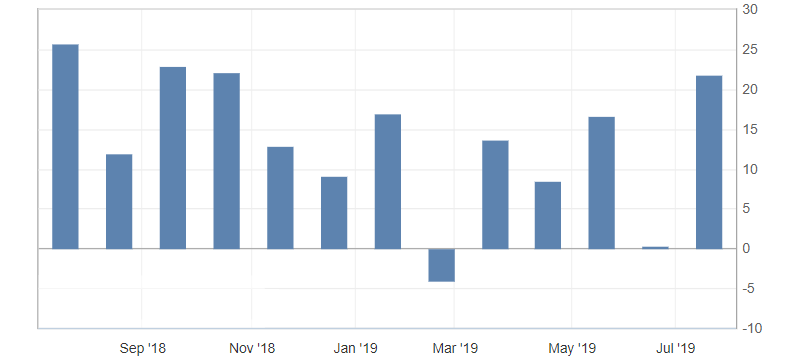

Production activity from the Federal Reserve Bank of Philadelphia rapidly increased in July, reaching maximum values for the current year, which indicates the strength of the economic state of the region. Also worth noting is the reduction in the number of applications for unemployment benefits, which indicate the strength of the labor market.

Fig. 1. Philadelphia Fed manufacturing activity index in the USA

The reaction of the US dollar to published data remains restrained. Risks and negative sentiment remain the limiting factor for an American, the reason for which continues to be the possibility of a worsening trade war and a slowdown in the US economy.

The US dollar index is trading with a moderate strengthening after rising on the collapse of the euro, limited to resistance levels: 97.20 and 97.30.

Fig. 2. The US dollar index chart. The current price is 97.20 (10-year US government bonds yield is the blue line)

Read also: “British Pound (GBP) –

Features of trading on crosses»

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The trade war. Relations between Japan and South Korea

- The Japanese yen: expectations and prospects.

- US and China return to the negotiation table

Current Investment ideas: