U.S. data

- Core Producer Price Index (PPI) (m/m) (Mar), fact 0.3%, forecast 0.2%.

- Initial jobless claims, fact 196K, forecast 211K.

- Producer Price Index (PPI) (m/m) (Mar), fact 0.6%, forecast 0.3%.

Published data on producer prices (PPI) and the number of applications for unemployment benefits supported the US currency, showing a marked increase in producer prices, which supports inflation in the country. The number of initial claims for unemployment benefits fell to multi-year lows, indicating the strong position of the US labor market.

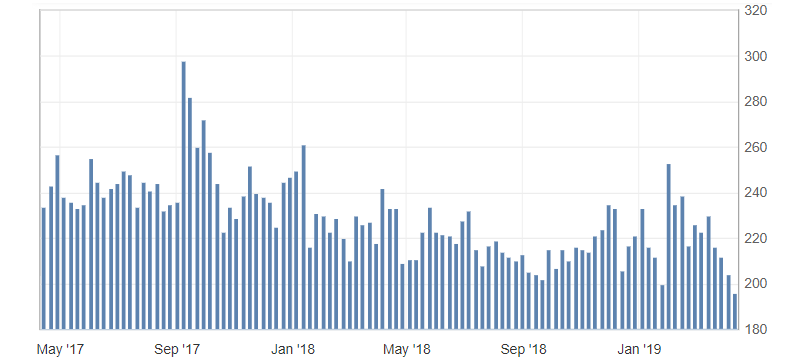

Fig. 1. U.S. initial jobless claims

As a result, the US dollar index received a significant support, reinforcing the growth in optimism, which was traced earlier. The US dollar index managed to retreat from the lows and gain a foothold above the level of 97.00. Further strengthening of the American dollar is limited by its overbought and the preservation of risks. Resistance levels: 97.20-30, support: 97.00 and 96.80.

Fig. 2. The US dollar index chart. The current price is 97.10 (10-year government bonds yield is the blue line)

Read also: “Nuclear agreement with Iran, nuclear threat or a lever of influence on the oil market”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Oil market: results and forecasts

- World reserve currencies and their popularity

- Stock indices and their impact on the Forex market

Current Investment ideas: