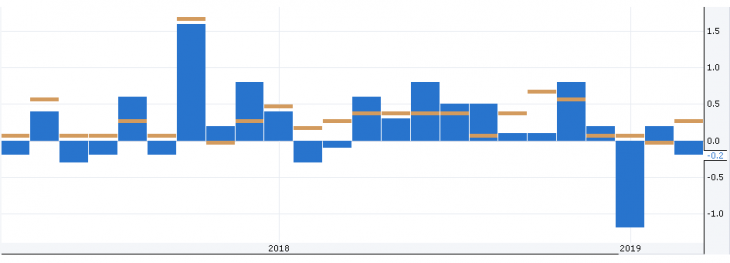

U.S. retail sales data

- “Retail Control Group” (Feb), fact -0.2%, forecast 0.4%.

- Retail Sales (m/m) (Feb), fact -0.2%, forecast 0.3%

Retail sales in the US in February slowed down in all major indicators, thereby indicating a decline in consumer spending and putting pressure on the US currency.

Fig. 1.U.S. retail sales (m/m) chart for February

As a result, the US dollar was again under the pressure from weak the US statistics and growing fears of a slowdown in the economy. The US dollar index resumed its decline against a basket of competitors. With the preservation of optimistic sentiment on the stock markets, the American dollar is likely to resume its decline to support levels: 97.00 and 96.90. Resistance is located at marks: 97.20 and 97.30.

Fig. 2. The US dollar index chart. The current price is 96.10 (10-year government bonds yield is the blue line)

Read also: “ZIGZAG – not simple properties of a simple indicator!”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- World central banks are preparing for lower rates

- Financial quarter correction

- Prospects for the euro based on the ECB policy

Current Investment ideas: