U.S. retail sales data

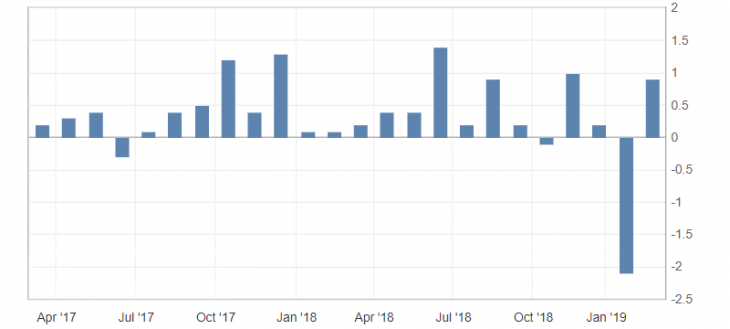

- Core Retail Sales (m/m) (January), fact of 0.9%, forecast 0.4%.

- Retail Sales (m/m) (Jan), fact 0.2%, forecast 0.0%.

U.S. retail sales rose significantly after a sharp decline earlier. As a result, this indicator returned to normal movement, indicating a rapid recovery in consumer spending.

Fig. 1. U.S. Core retail sales index (m/m) (January) chart

The US dollar index reacted very cautiously to these statistics, while maintaining a restrainingly downward trend. At the same time, very positive data on retail sales in the United States can restore optimism on the American dollar at the start of the US trading session, effectively confirming the upward trend in the dollar. Support levels for the US dollar index are: 97.20 and 97.00, resistance: 97.50 and 97.70.

Fig. 2. The US dollar index. The current price is 97.30 (10-year government bonds yield is the blue line)

Read also: “The Japanese economy in the context of a long ultra-soft monetary policy”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Emerging markets and their prospects

- The US Dollar Index (DXY) as an auxiliary indicator for trading in commodity currencies

- To increase or not to increase, the difficult choice of the US Federal Reserve

Current Investment ideas: