Eurozone Inflation Data

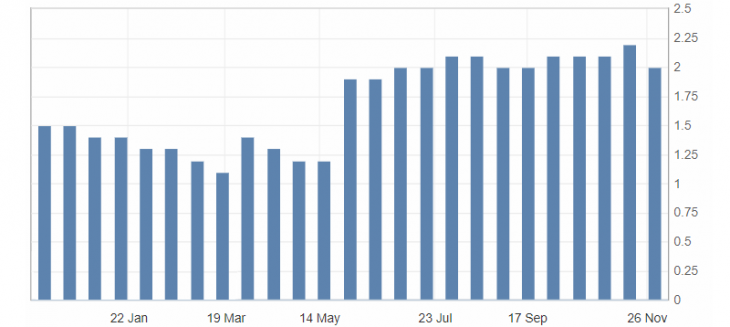

- Core Consumer Price Index (CPI) (y/y), fact 1.0%, forecast 1.1%.

- Consumer Price Index (CPI) (y/y) (November), fact 2.0%, forecast 2.1%.

- Unemployment (oct), fact 8.1%, forecast 8.0%.

Preliminary inflation data in the eurozone for November were very negative and didn’t meet the market expectations. At the same time, the main index of consumer prices returned to the level of early September, which slowed the upward dynamics. Additional pressure on the euro is exerted by the unemployment rate, which remains unchanged near the lows for the third month.

Fig. 1. Eurozone’s Consumer price index (CPI) (y/y) chart

On the publication of weak inflation data in the eurozone, the EUR/USD pair accelerated the decline and at the same time maintains the upward dynamicd of recent days. The main pressure on the euro comes from reduced stock indices in Europe. Significant support is located at levels: 1.1360 and 1.1340, resistance are: 1.1380 and 1.1400.

Fig. 2. EUR/USD chart. The current price is 1.1370.

Read also: “Pattern 123. Just as 1-2-3!”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Doji candlesticks on the FOREX market

- Expectations from the NZD/USD pair at year’s end!

- An engulfing strategy. A Trend reversal.

Current Investment ideas: