Eurozone Inflation Data

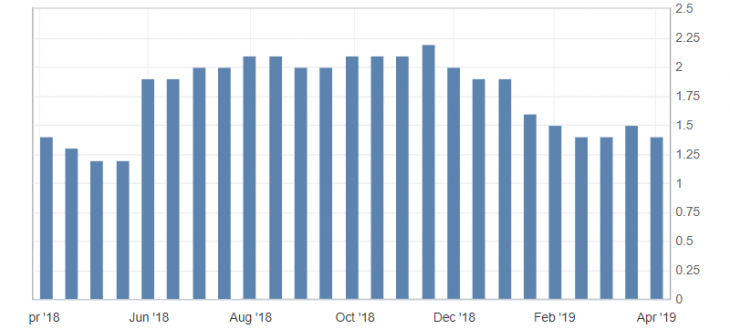

- Core Consumer Price Index (CPI) (y/y), fact 0.8%, forecast 0.9%.

- Consumer Price Index (CPI) (y/y) (Mar), fact 1.4%, forecast 1.5%.

- Unemployment rate (Feb), fact 7.8%, forecast 7.8%.

Data on inflationary pressure in the Eurozone for March worsened in all respects. At the same time, the euro did not actually respond to weak statistics, staying near daily highs against the US dollar. The Consumer Price Index (CPI), on an annualized basis, has returned to its minimum values, indicating that the downward trend in this indicator has continued.

Fig. 1. Eurozone consumer price index (CPI) (y) chart

Strengthening of the EUR/USD pair is caused by the general decline of the American dollaron the optimistic market sentiment. But previously published data on business activity in the manufacturing sector (PMI) in the eurozone, which turned out to be very weak, and a slowdown in inflation in the eurozone is likely to cause a correction in the single currency. As a result, the EUR/USD pair is expected to resume its decline and return to the side channel. Support levels: 1.1200 and 1.1200, resistance: 1.1250 and 1.1270.

Fig. 2. EUR/USD chart. Current price – 1.1240

Read also: “Emerging markets and their prospects”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

Current Investment ideas: