Eurozone data

- Germany’s GDP (y/y) (Q1), a fact of 0.6%, the forecast of 0.6%.

- Germany’s GDP (q/q) (Q1), fact 0.4%, forecast 0.4%.

- Composite Business Activity Index (PMI) of Germany (May), fact 52.4, forecast 52.0 52.2

- German Manufacturing PMI (May), fact 44.3, forecast 44.8.

- German index of business activity in the services sector (May), fact 55.0, forecast 55.5.

- German Business Expectations Index, fact 95.3, forecast 95.2.

- Assessment of the current situation in Germany, fact 100.6, forecast 103.6.

- German IFO Business Climate Index, fact 97.9, forecast 99.2.

- The manufacturing business index (PMI) (May) in the eurozone, fact 47.7, forecast 48.1.

- Markit Eurozone Composite Business Activity Index (PMI) (May), fact 51.6, forecast 51.7.

- The index of business activity in the services sector (May), the euro area, fact 52.5, forecast 53.0.

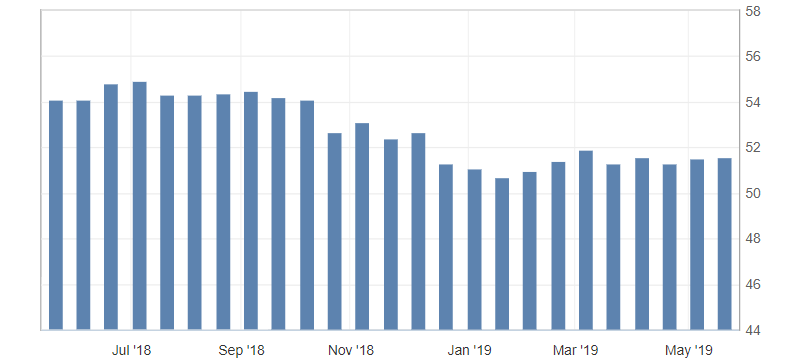

Published business reports (PMI) in Germany and the eurozone were very weak, showing a sustained slowdown in business activity in the eurozone. Reports also confirmed a slowdown in the downward trend of this indicator near the average annual level of the current year.

Fig. 1. Graph of composite index of business activity (PMI) from Markit in the eurozone

In addition to weak eurozone data, pressure on the single currency continues to exert political risks around the elections to the European Parliament. This eventually increased the pressure on the euro against most competitors.

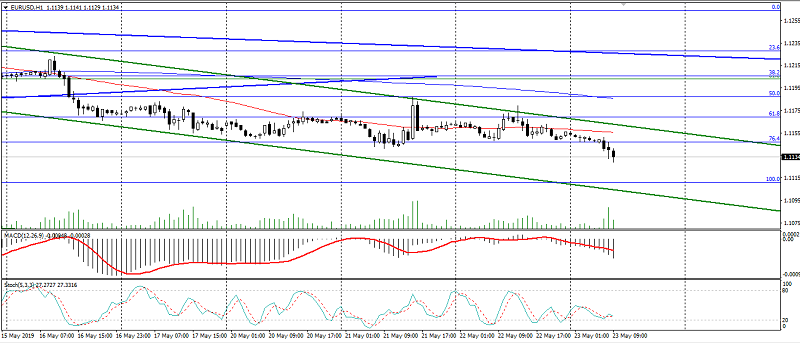

The EUR/USD pair has accelerated the decline in maintaining the downtrend, thereby becoming oversold and limited by the support levels: 1.1100 and 1.1080. Resistance is located at the levels: 1.1150 and 1.1180.

Fig. 2. EUR/USD chart. Current price – 1.1130

Read also: “Incidents of the 21st century,

that had an impact on the financial market “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Cryptocurrencies as new safe haven assets

- The impact of the trade war on the US stock market

- Expectations from the AUD/USD pair for May

Current Investment ideas: