Analysis of the past week

At the end of the week, the US dollar index weakened by 0.50%, having updated a low at the level of 96.80. The main driver for the sale of the US dollar during the week was political risks in the United States and the overly mild rhetoric of the US Federal Reserve, which virtually completely abandoned the possibility of raising rates this year.

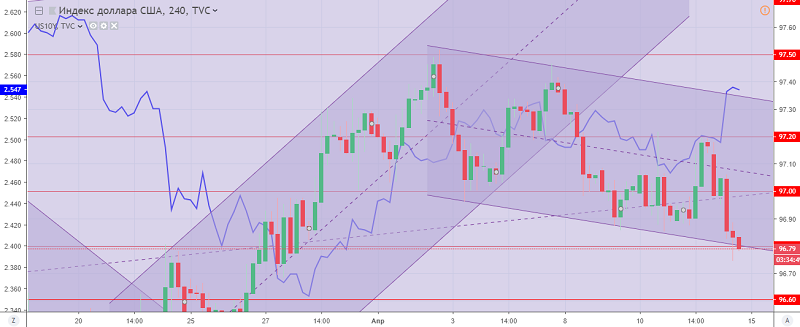

The dollar index at the end of the week and month remains in a downtrend, limited to oversold and support levels: 96.80 and 96.60. It is also worth noting a significant oversold of the American dollar, which may indicate a low-key correction to the resistance level: 97.00 and 97.20 in the future.

The US dollar index H4 chart. The current price is 96.80 (10-year government bonds yield is the blue line)

Hanzenko Anton