Dark zones of Black gold. Analysis of the nearest prospects of oil.

Very glad to start a new week. I am sure that it will bring not only income, but also pleasure from trade. As always, with you – Andrew Green.

At the beginning of the article, a small warning to those traders who have not previously encountered financial instruments of oil, beware and be careful – here, in the commodity market, you can earn TOO MUCH 🙂

The dynamics of the oil market averages 1.5-2% per day, and often more. While the foreign exchange market trades on average 0.8% a day.

Well, let’s return to the market of black gold. The tool that we analyze in this article is WTI oil.

Having broken a strong historic resistance level of 50 USD per barrel three months ago, WTI oil was rapidly gaining momentum practically without any visible corrections, and now it is approaching the value of USD 70 per barrel. A positive sentiment for further movement is more evident in geopolitical conflicts around Iran, Syria and other countries of the Middle East. The restriction of the supply of oil to the market by these participants creates a temporary deficit and, correspondingly, growth that benefits other market players in the US, Russia, Saudi Arabia, etc. These are obvious facts, and it works like a newly-lubricated mechanism.

In the opposite direction, there are increasing capacities for the production of shale oil in the US, as well as the development of alternative energy, which are like checkpoints. They restrain further growth of supplies, offering an alternative replacement of oil at a price above 70 USD.

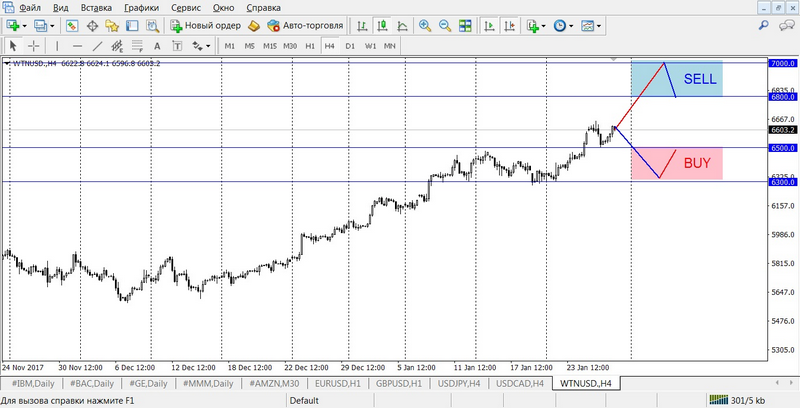

As for me, the situation is simple: in the medium term, the level of 70-80 dollars per barrel, it is very difficult to break through. It makes sense to form a pool of medium-term sales in this range. As for a short period, then let’s take a look at the timeframe H1 (Figure # 1).

As you can see, I propose trading on correction using two options:

- Continuation of the dynamics on growth to levels of 70 and a reversal

example of the transaction:

SELL limit 69.80, SL 71.00, TP 68.00

- Corrective reversal to the level of 63.00 with a subsequent reverse to the growth.

example of the transaction:

BUY limit 63.20, SL 62.00, TP 65.00

I recommend also to apply in this case the tactics of cloning transactions, it is most effective at narrow flute movements. The essence of the tactics: after the transaction closes on TP, you put the clone of the transaction that worked for the correction to the previously used position. And do this until the moment the SL does not work.

If you want to receive more detailed information on this tactic and others, write to the technical support of Ester company support@esterholdings.com with a note for Andrew Green, and also sign up for an individual training course for the tactics of constant trade ADRENALIN.

[maxbutton id = “4” url = “https://esterholdings.com/en/#modal-3” text = “Sign up for a course!” ]

More information on this course can also be obtained by writing a support letter to support@esterholdings.com with a note marked ADRENALIN.

Do not limit yourself to an unlimited financial market, experiment, look for and develop yuorself! Force is in motion, and success is in trade.

Andrew Green