Технический анализ валютных пар (Антон Ганзенко)

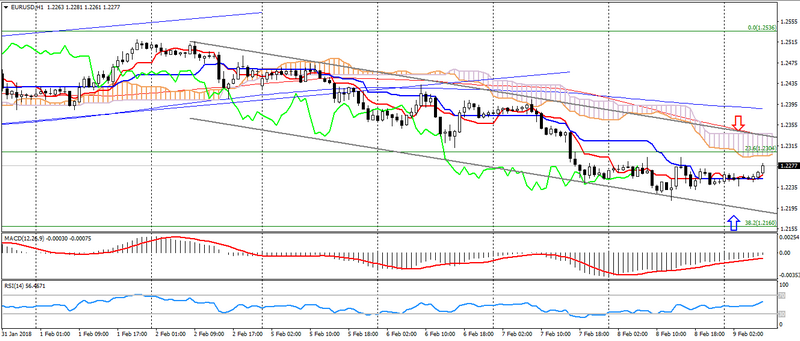

EUR USD (текущая цена: 1.2280)

- Уровни поддержки: 1.2100 (максимум сентября 2017года), 1.1900, 1.1700.

- Уровни сопротивления: 1.2600, 1.2750 (минимум марта 2013 года), 1.2270 (минимум ноября 2014 года).

- Компьютерный анализ: MACD (12,26,9) (сигнал –восходящее движение): индикатор ниже 0, сигнальная линия вышла стела гистограммы.RSI(14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.2310, 1.2350, 1.2380.

- Альтернативная рекомендация: вход на покупку от 1.2240, 1.2210, 1.2180.

Евро доллар сохраняет боковой тренд, ограничиваясь сохранностью нисходящей динамики, которая в дальнейшем, вероятно, вызовет повторное снижение данной пары.

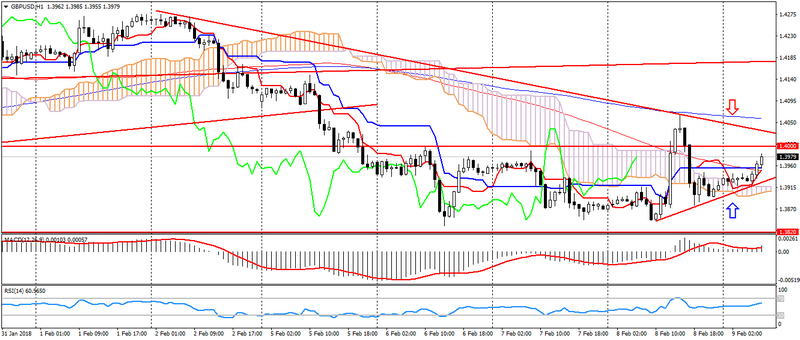

GBP USD (текущая цена: 1.3900)

- Уровни поддержки: 1.4000 (минимум апреля 2016 года), 1.3820, 1.3650(максимум сентября 2017 года).

- Уровни сопротивления: 1.43500, 1.4500, 1.4750(максимум мая 2016 года).

- Компьютерный анализ:MACD (12,26,9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – восходящее движение): линия Tenkan-senвыше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.4000, 1.4050, 1.4090.

- Альтернативная рекомендация: вход на покупку от 1.3920, 1.3870, 1.3820.

Британский фунт с небольшим укреплением на сохранении оптимизма после публикации прокола Банка Англии, ограничиваясь лишь психологией 1.4000.

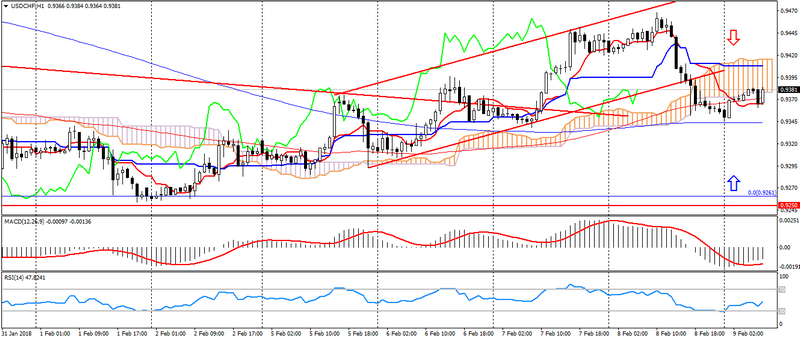

USD CHF (текущая цена: 0.9480)

- Уровни поддержки: 0.9250 (минимум августа 2015 года), 0.9150, 0.9050 (минимум мая 2015 года).

- Уровни сопротивления:, 0.9550, 0.9800, 1.0030 (максимум ноября 2017 года).

- Компьютерный анализ: MACD (12,26,9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла стела гистограммы. RSI (14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.9400, 0.9440, 0.9470.

- Альтернативная рекомендация: вход на покупку от 0.9340, 0.9320, 0.9300.

Швейцарский франк укрепился на торгах в четверг на бегстве от рисков и снижении американца, тем самым сохраняя неопределённость на рынке.

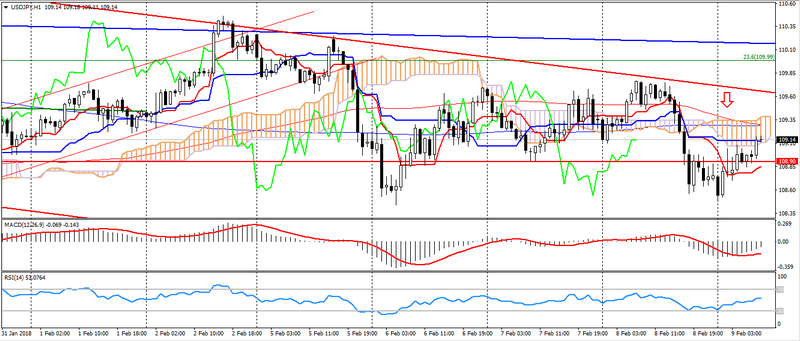

USD JPY (текущая цена: 109.10)

- Уровни поддержки: 108.90, 108.10 (минимум апреля 2017 года), 107.30 (минимум 2017 года).

- Уровни сопротивления: 110.80, 111.70 (минимум октября 2017 года), 113.70.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла стела гистограммы. RSI (14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал –нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 109.30, 109.60, 109.80.

- Альтернативная рекомендация: вход на покупку от 108.90, 108.60, 108.30.

Японская иена сохраняет восходящий тренд на негативных настроениях рынка и слабости американца.

USD CAD (текущая цена: 1.2590)

- Уровни поддержки: 1.2340,1.2200, 1.2060 (минимум 2017 года).

- Уровни сопротивления: 1.2500, 1.2650, 1.2770 (максимум августа 2017 года).

- Компьютерный анализ:MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.2630, 1.2660, 1.2690.

- Альтернативная рекомендация: вход на покупку от 1.2560, 1.2530, 1.2500.

Канадский доллар сохраняет боковой тренд, ограничиваясь психологией 1.2600, сохраняя общий восходящий тренд.

AUD USD (текущая цена: 0.7780)

- Уровни поддержки: 0.7900, 0.7700 (максимум марта 2017 года), 0.7500.

- Уровни сопротивления: 0.8120 (максимум 2017 года), 0.8200, 0.8290 (максимум 2014 года).

- Компьютерный анализ:MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.7800, 0.7830, 0.7850.

- Альтернативная рекомендация: вход на покупку от 0.7750, 0.7720, 0.7700.

Австралиец сохраняет устойчивый нисходящий тренд, также оставаясь в зоне перепроданности.

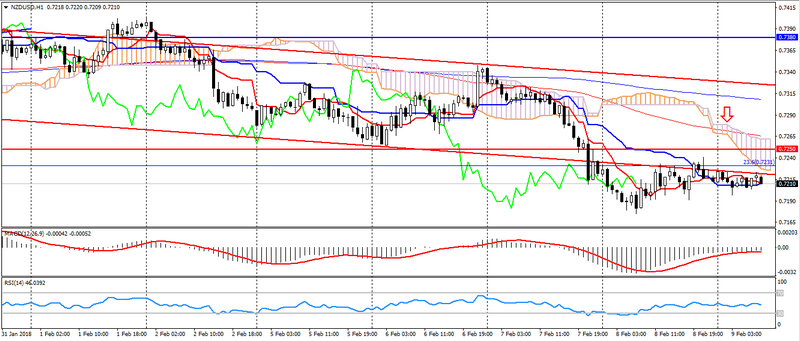

NZD USD (текущая цена: 0.7210)

- Уровни поддержки: 0.7250, 0.7130 (минимум августа 2017 года), 0.7000.

- Уровни сопротивления: 0.7380, 0.7450, 0.7550 (максимум 2017 года).

- Компьютерный анализ:MACD (12, 26, 9) (сигнал –восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.7230, 0.7250, 0.7290.

- Альтернативная рекомендация: вход на покупку от 0.7190, 0.7170, 0.7150.

Новозеландский доллар также остаётся под давлением негативных настроений рынка нисходящей динамикой пары.

XAU USD (текущая цена: 1315.00)

- Уровни поддержки: 1320.00, 1303.00, 1280.00.

- Уровни сопротивления: 1355.00(максимум мая 2016 года), 1374.00, 1290.00 (максимум марта 2016 года).

- Компьютерный анализ:MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтрально зоне. IchimokuKinkoHyo (9,26,52) (сигнал –нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1320.00, 1329.00, 1333.00.

- Альтернативная рекомендация: вход на покупку от 1310.00, 1308.00, 1300.00.

Золото сохраняет нисходящую динамику, несмотря на формирование разворотной формации на дню и сохранению общего восходящего тренда.