Технический анализ валютных пар (Антон Ганзенко)

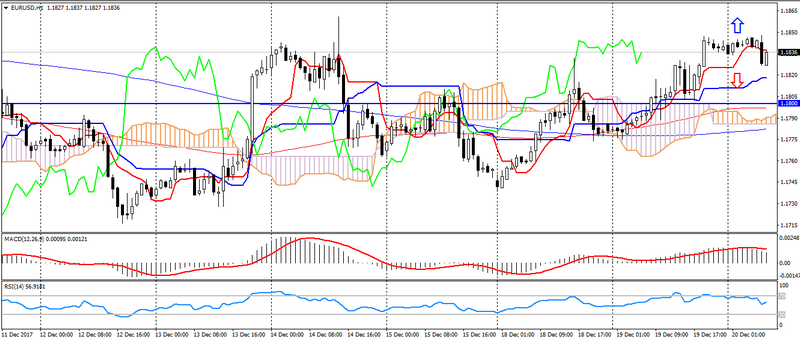

EUR USD (текущая цена: 1.1830)

- Уровни поддержки: 1.1700 (максимум августа 2015 года), 1.1600(максимум 2016 года), 1.1470.

- Уровни сопротивления: 1.2000, 1.2100, 1.2270 (минимум ноября 2014 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.1860, 1.1880, 1.1900.

- Альтернативная рекомендация: вход на покупку от 1.1820, 1.1800 (MA 100), 1.1780 (MA 200).

Евро торгуется с небольшой коррекцией после вчерашнего роста, но при этом сохраняет восходящий тренд, который демонстрирует некоторое замедление.

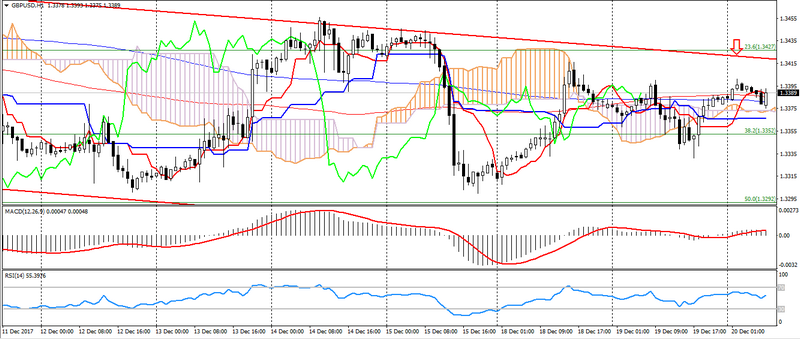

GBP USD (текущая цена: 1.3390)

- Уровни поддержки: 1.3140, 1.2900, 1.2740 (минимум августа 2017 года).

- Уровни сопротивления: 1.3500, 1.3660, 1.3830(минимум февраля 2016 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.3400, 1.3420, 1.3450.

- Альтернативная рекомендация: вход на покупку от 1.3340, 1.3310, 1.3280.

Британский фунт продолжает торговаться в пределах вчерашнего дня, оставаясь ограниченным нисходящим трендом.

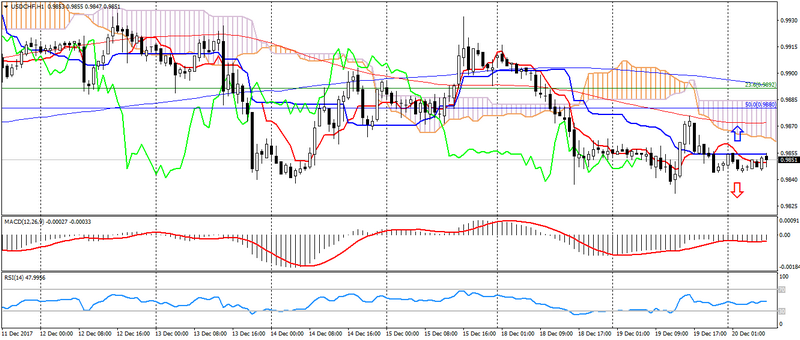

USD CHF (текущая цена: 0.9850)

- Уровни поддержки: 0.9700, 0.9600, 0.9530.

- Уровни сопротивления:, 1.0000, 1.0050, 1.0100 (максимум мая).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.9860 (MA 100), 0.9880, 0.9900.

- Альтернативная рекомендация: вход на покупку от 0.9830, 0.9800, 0.9770.

Швейцарский франк торгуется на уровне открытия дня на ожидании драйверов к движению.

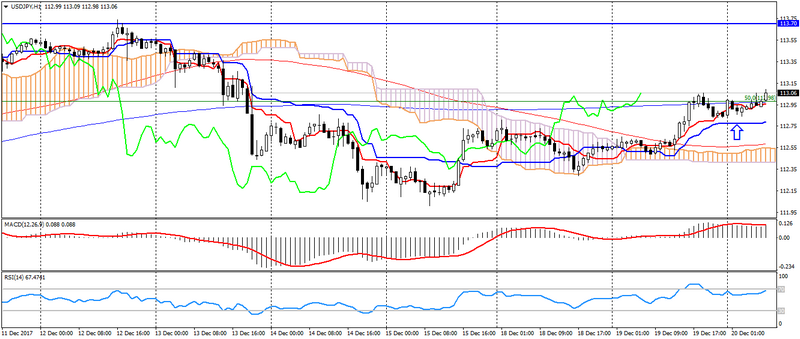

USD JPY (текущая цена: 113.00)

- Уровни поддержки: 108.90, 108.10 (минимум апреля 2017 года), 107.30 (минимум 2017 года).

- Уровни сопротивления: 113.70, 114.50 (максимум июля 2017 года), 115.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы.RSI (14) в зоне перекупленности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 113.20, 113.40, 113.30.

- Альтернативная рекомендация: вход на покупку от 112.70, 112.50 (MA 100), 111.90.

Японская иена остаётся под давлением рисков перед ожиданием отчёта Банка Японии.

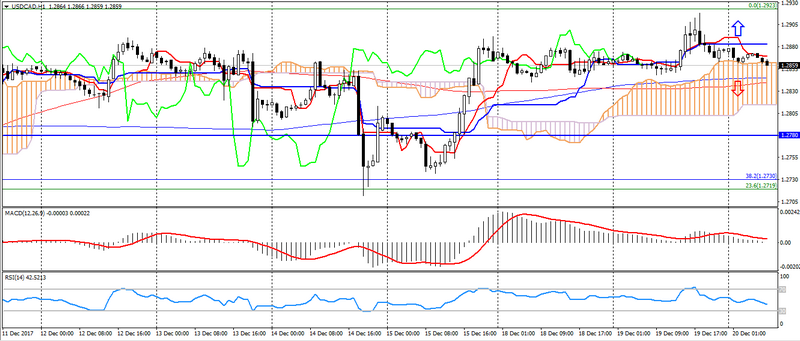

USD CAD (текущая цена: 1.2860)

- Уровни поддержки: 1.2200, 1.2060 (минимум 2017 года), 1.1950 (минимум 2015 года).

- Уровни сопротивления: 1.2780 (максимум августа 2017), 1.3000, 1.3160.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтрально зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen ниже линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 1.2890, 1.2930, 1.2950.

- Альтернативная рекомендация: вход на покупку от 1.2840 (MA 200), 1.2800, 1.2780.

Канадский доллар торгуется на уровне открытия, сохраняя неопределённость.

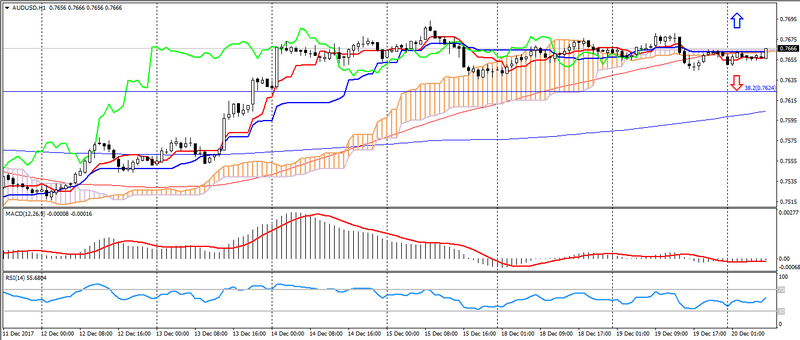

AUD USD (текущая цена: 0.7660)

- Уровни поддержки: 0.7740, 0.7320 (минимум 2017 года), 0.7120.

- Уровни сопротивления: 0.8120 (максимум 2017 года), 0.8200, 0.8290 (максимум 2014 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – флэт): индикатор возле 0. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen ниже линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 0.7680, 0.7710, 0.7740.

- Альтернативная рекомендация: вход на покупку от 0.7630, 0.7610, 0.7590.

Австралиец сохраняет позитивный настрой на слабости американца и росте цен на сырьё, но сохраняет боковой тренд.

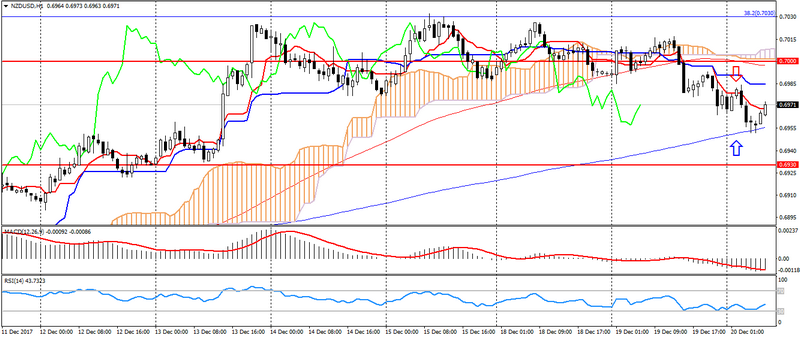

NZD USD (текущая цена: 0.6970)

- Уровни поддержки: 0.7000, 0.6930, 0.6820 (минимум текущего года).

- Уровни сопротивления: 0.7380, 0.7450, 0.7550 (максимум 2017 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.6980, 0.7000, 0.7020.

- Альтернативная рекомендация: вход на покупку от 0.6960 (MA 200), 0.6830, 0.6800.

Новозеландский доллар торгуется с понижением на слабых данных по сальдо торгового баланса Новой Зеландии.

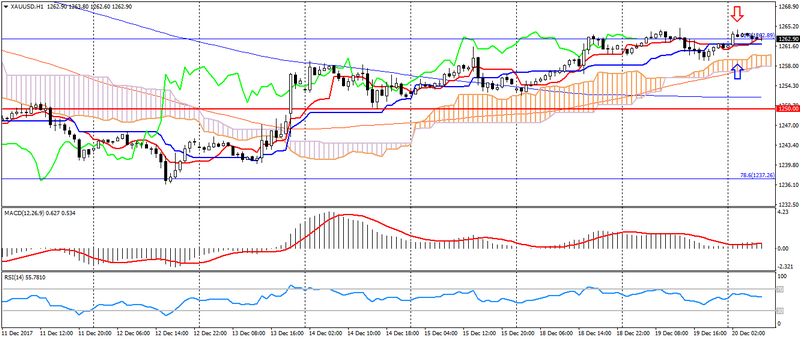

XAU USD (текущая цена: 1263.00)

- Уровни поддержки: 1250.00, 1226.00, 1200.00.

- Уровни сопротивления: 1340.00, 1355.00, 1374.00 (максимум 2016 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор вые 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1265.00 (Фибо 61.8 от минимума июля), 1269.00, 1273.00.

- Альтернативная рекомендация: вход на покупку от 1259.00, 1255.00, 1252.00.

Золото продолжает сохранять восходящий тренд, но демонстрирует небольшое замедление роста.