Технический анализ валютных пар (Антон Ганзенко)

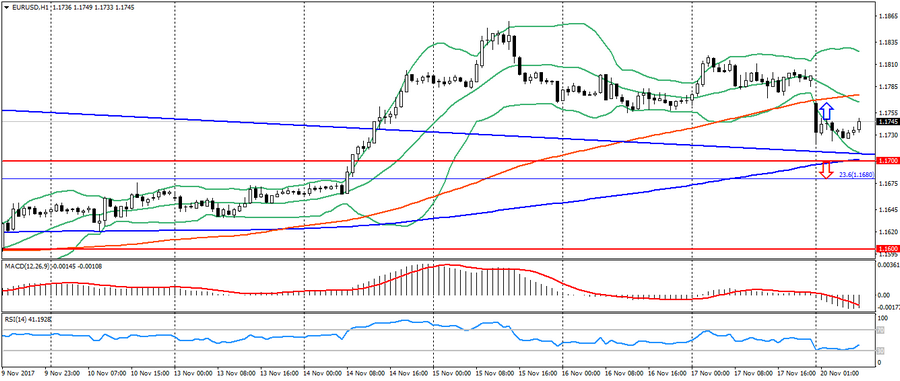

EUR USD (текущая цена: 1.1750)

- Уровни поддержки: 1.1700 (максимум августа 2015 года), 1.1600(максимум 2016 года), 1.1470.

- Уровни сопротивления: 1.2000, 1.2100, 1.2270 (минимум ноября 2014 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в нейтрально зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1.1760, 1.1780 (MA 100), 1.1820.

- Альтернативная рекомендация: вход на покупку от 1.1700 (MA 200), 1.1680 (Фибо. 23.6 от минимума декабря 2016 года), 1.165.

Евро остаётся торговаться под давлением после снижения в начале дня на росте политических опасений в Германии. Динамика данной пары продолжает оставаться нисходящей, оставаясь возле значимых уровней поддержки.

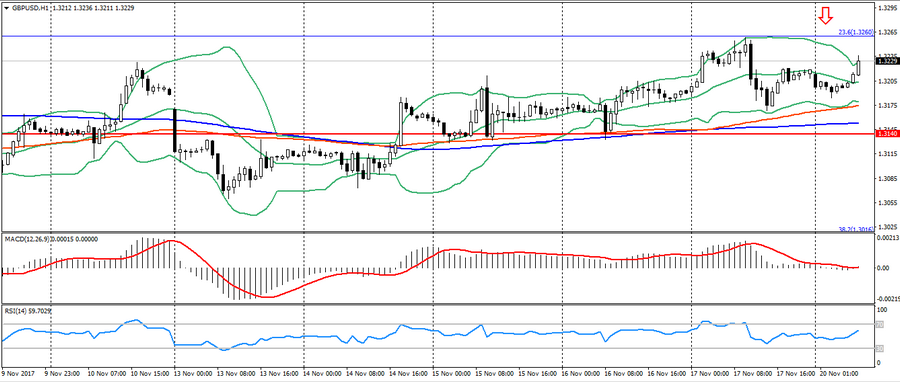

GBP USD (текущая цена: 1.3230)

- Уровни поддержки: 1.3140, 1.2900, 1.2740 (минимум августа 2017 года).

- Уровни сопротивления: 1.3500, 1.3660, 1.3830(минимум февраля 2016 года).

- Компьютерный анализ: MACD (сигнал – флэт): индикатор возле 0. RSI в нейтрально зоне. Bollinger Bands (период 20): перекупленность, растущая волатильность.

- Основная рекомендация: вход на продажу от 1.3230, 1.3260 (Фибо. 23.6 от минимума января), 1.3290.

- Альтернативная рекомендация: вход на покупку от 1.3180 (MA 100), 1.3150 (MA 200), 1.3120.

Британский фунт торгуется с укреплением на слабости евро и поддержке через кросс EUR/GBP. Динамика пары также остаётся ограничиваться боковым трендом.

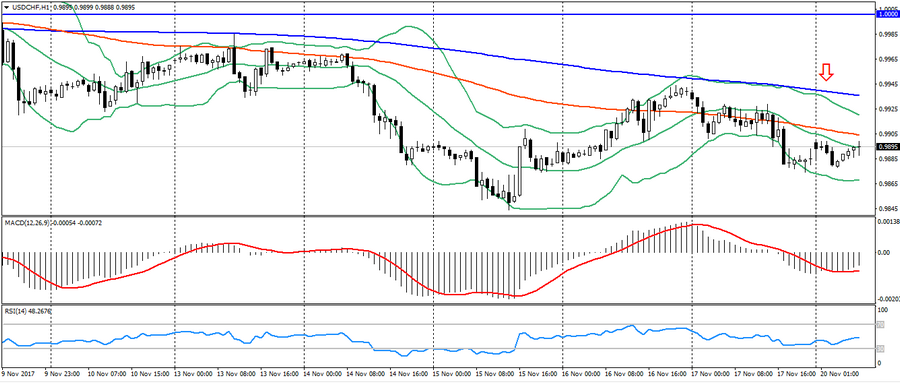

USD CHF (текущая цена: 0.9890)

- Уровни поддержки: 0.9700, 0.9600, 0.9530.

- Уровни сопротивления:, 1.0000, 1.0050, 1.0100 (максимум мая).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 0.9900 (MA 100), 0.9940 (MA 200), 0.9980.

- Альтернативная рекомендация: вход на покупку от 0.9870, 0.9850, 0.9810.

Швейцарский франк остаётся торговаться на уровне открытия дня, склонен к снижению, но сохраняет восходящий тренд.

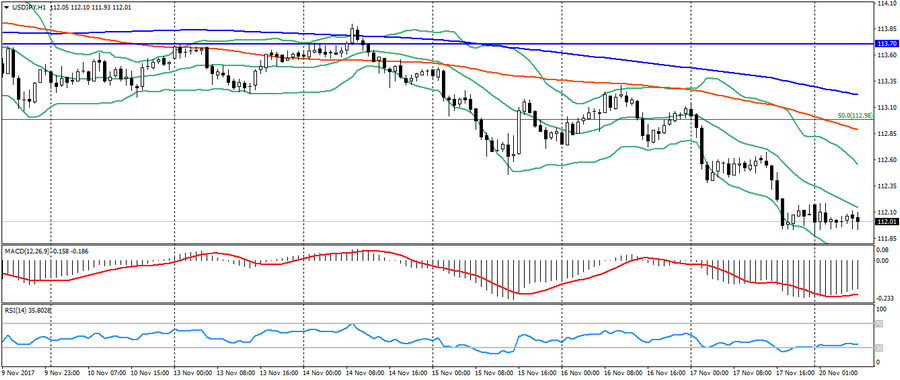

USD JPY (текущая цена: 111.90)

- Уровни поддержки: 108.90, 108.10 (минимум апреля 2017 года), 107.30 (минимум 2017 года).

- Уровни сопротивления: 113.70, 114.50 (максимум июля 2017 года), 115.00.

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI в зоне перепроданности. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 112.40, 112.70, 112.90 (Фибо. 50.0 от максимума декабря).

- Альтернативная рекомендация: вход на покупку от 111.80, 111.60 (Фибо. 38.2 от максимума декабря), 111.40.

Японская иена сохраняет рост на бегстве инвесторов от рисков, невзирая на слабые данные по Японии.

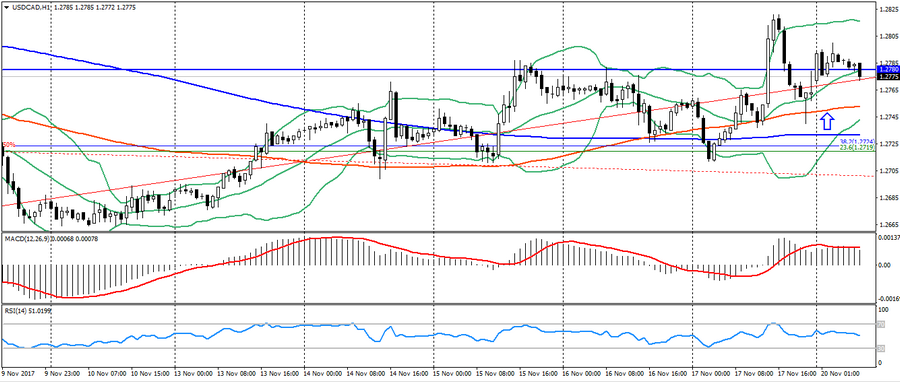

USD CAD (текущая цена: 1.2780)

- Уровни поддержки: 1.2200, 1.2060 (минимум 2017 года), 1.1950 (минимум 2015 года).

- Уровни сопротивления: 1.2780 (максимум августа 2017), 1.3000, 1.3160.

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1.2800 (MA 200), 1.2820, 1.2850.

- Альтернативная рекомендация: вход на покупку от 1.2750, 1.2730 (MA 200), 1.2720.

Канадский доллар торгуется весьма сдержанно в начале недели на неоднозначной динамике сырья, но сохраняет общий восходящий тренд, несмотря на торговлю возле значимых уровней поддержки.

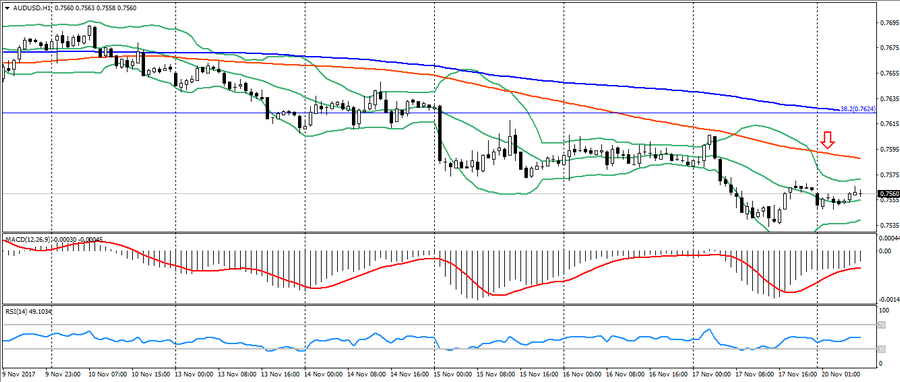

AUD USD (текущая цена: 0.7560)

- Уровни поддержки: 0.7740, 0.7320 (минимум 2017 года), 0.7120.

- Уровни сопротивления: 0.8120 (максимум 2017 года), 0.8200, 0.8290 (максимум 2014 года).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI в нейтрально зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 0.7580 (MA 100), 0.7600, 0.7630 (Фибо. 38.2 от минимума 2016 года).

- Альтернативная рекомендация: вход на покупку от 0.7550, 0.7530, 0.7500.

Австралиец также остаётся торговаться весьма сдержанно в нисходящем тренде в силу перепроданности.

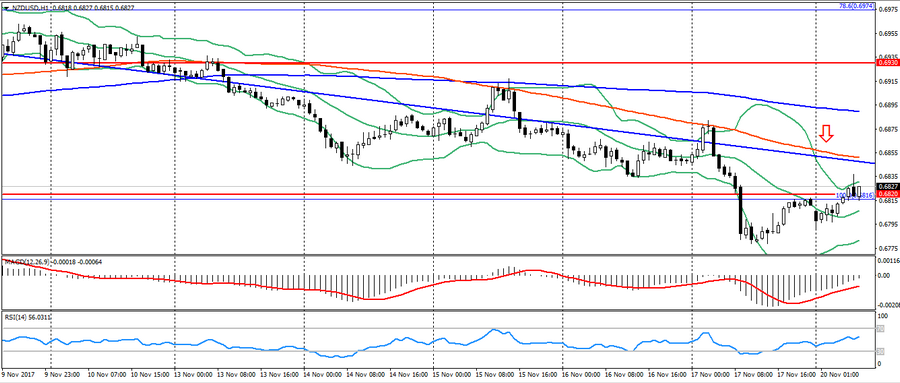

NZD USD (текущая цена: 0.6820)

- Уровни поддержки: 0.7000, 0.6930, 0.6820 (минимум текущего года).

- Уровни сопротивления: 0.7380, 0.7450, 0.7550 (максимум 2017 года).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI в нейтрально зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 0.6850 (MA 100), 0.6880 (MA 200), 0.6890.

- Альтернативная рекомендация: вход на покупку от 0.6830, 0.6820 (минимум октября), 0.6800.

Новозеландский доллар торгуется с укреплением на коррекции против пятницы, но ограничивается нисходящим трендом.

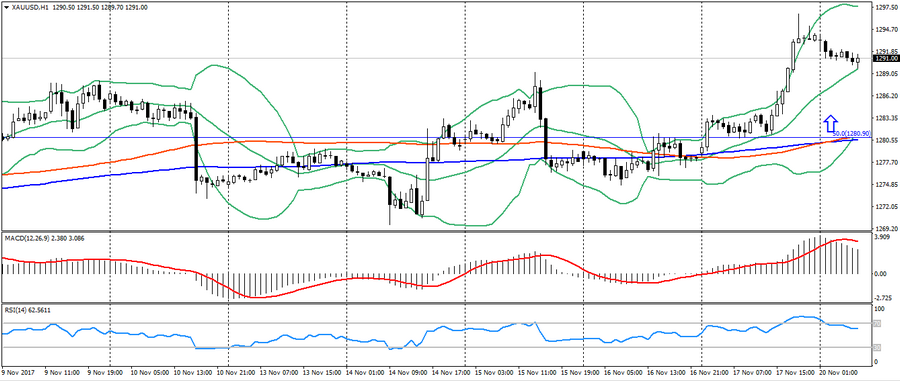

XAU USD (текущая цена: 1291.00)

- Уровни поддержки: 1250.00, 1226.00, 1200.00.

- Уровни сопротивления: 1340.00, 1355.00, 1374.00 (максимум 2016 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1293.00, 1296.00, 1298.00 (Фибо. 38.2 от минимума июля).

- Альтернативная рекомендация: вход на покупку от 1287.00 (MA 200), 1282.00, 1280.00 (MA 200).

Золото также ослабло на коррекции после роста в пятницу, но общая динамика продолжает оставаться восходящей.