Технический анализ валютных пар (Антон Ганзенко)

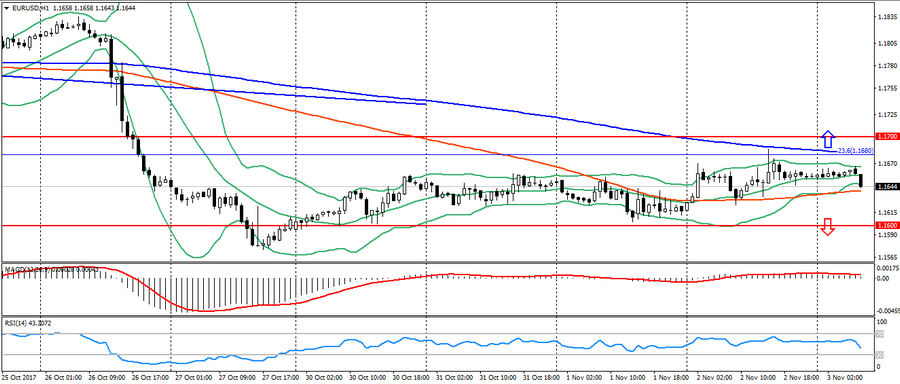

EUR USD (текущая цена: 1.1640)

- Уровни поддержки: 1.1700 (максимум августа 2015 года), 1.1600(максимум 2016 года), 1.1470.

- Уровни сопротивления: 1.2000, 1.2100, 1.2270 (минимум ноября 2014 года).

- Компьютерный анализ: MACD (сигнал – флэт): индикатор возле 0. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 1.1680 (Фибо 23.6 от декабря 2016 года), 1.1700 (сильная психология), 1.1740.

- Альтернативная рекомендация: вход на покупку от 1.1640 (MA 100), 1.1600 (cильная психология), 1.1580.

Пара EUR/USD четвёртый день продолжает оставаться в боковом тренде, торгуясь ниже ключевого сопротивления 1.1680 и выше поддержки 1.1600. Из-за продолжительного движения во флэте прогнозы по паре отменяются, к тому же рынок оживает после данных по занятости в США.

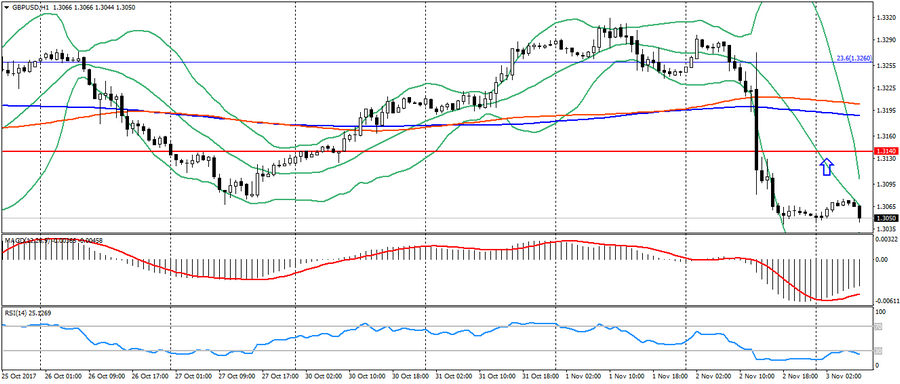

GBP USD (текущая цена: 1.3050)

- Уровни поддержки: 1.3140, 1.2900, 1.2740 (минимум августа 2017 года).

- Уровни сопротивления: 1.3500, 1.3660, 1.3830(минимум февраля 2016 года).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в зоне перепроданности. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1.3100, 1.3140, 1.3190 (MA 200).

- Альтернативная рекомендация: вход на покупку от 1.3050, 1.3020 (Фибо. 38.1 от минимума января), 1.3000.

Британский фунт остаётся торговаться возле минимума месяца на результатах заседания Банка Англии, ограничиваясь лишь значительной перепроданностю.

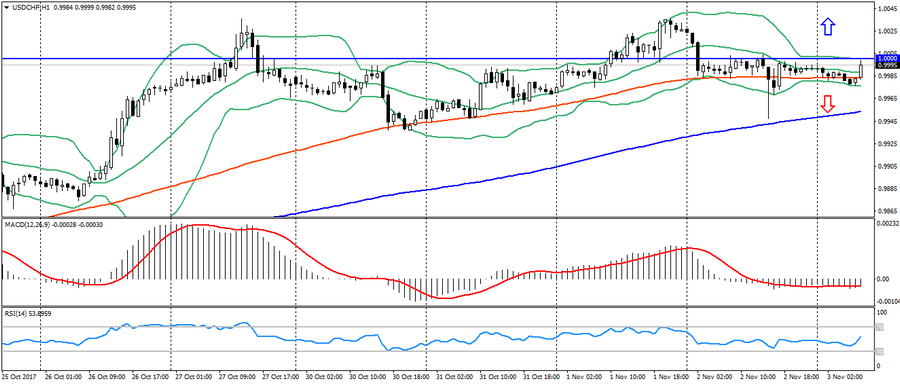

USD CHF (текущая цена: 0.9990)

- Уровни поддержки: 0.9700, 0.9600, 0.9530.

- Уровни сопротивления:, 1.0000, 1.0050, 1.0100 (максимум мая).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 1.0000, 1.0030 (локальный максимум), 1.0050.

- Альтернативная рекомендация: вход на покупку от 0.9950 (MA 200), 0.9930, 0.9900.

Швейцарский франк немного укрепился в начале дня на негативных настроениях по американцу, но дальнейшая динамика пары ограничивается предстоящими данными по США.

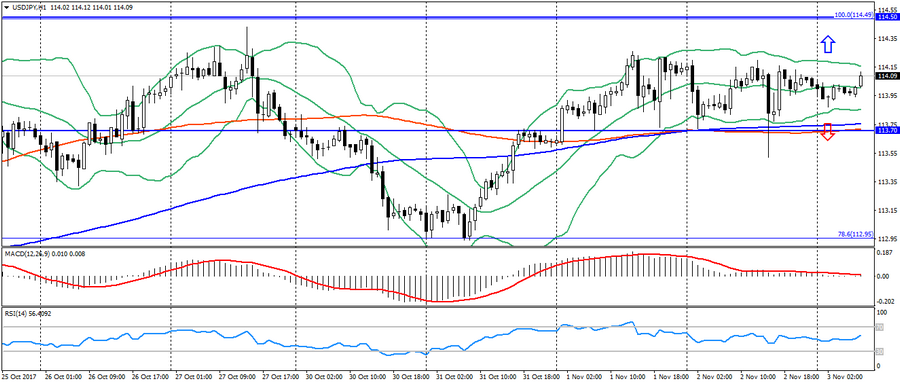

USD JPY (текущая цена: 114.10)

- Уровни поддержки: 108.90, 108.10 (минимум апреля 2017 года), 107.30 (минимум 2017 года).

- Уровни сопротивления: 113.70, 114.50 (максимум июля 2017 года), 115.00.

- Компьютерный анализ: MACD (сигнал – флэт): индикатор возле 0. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 114.20, 114.50 (максимум июля), 114.70.

- Альтернативная рекомендация: вход на покупку от 113.70 (MA 200), 113.50, 113.30 (Фибо. 78.6 от максимума июля).

Японская иена остаётся торговаться в боковом тренде, несмотря на неоднозначность фондовых индексов и ожидание новостей по США.

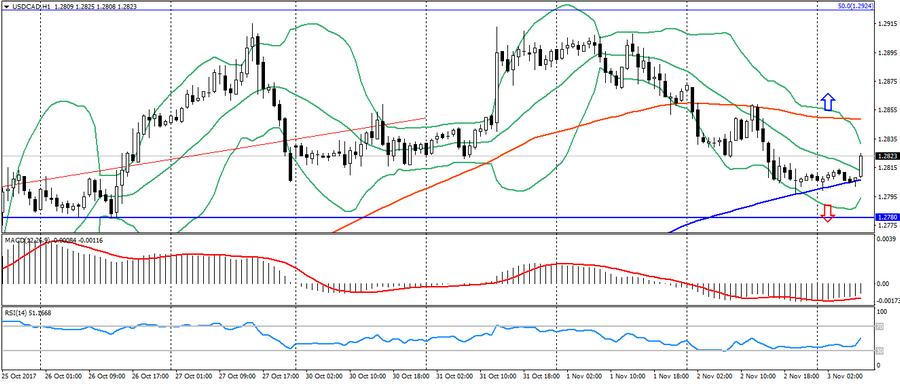

USD CAD (текущая цена: 1.2820)

- Уровни поддержки: 1.2200, 1.2060 (минимум 2017 года), 1.1950 (минимум 2015 года).

- Уровни сопротивления: 1.2780 (максимум августа 2017), 1.3000, 1.3160.

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1.2830, 1.2850 (MA 100), 1.2900.

- Альтернативная рекомендация: вход на покупку от 1.2780, 1.2750, 1.2730 (Фибо. 38.2 от максимума мая).

Канадский доллар заметно ослаб в начале дня на коррекции позиций перед публикацией отчёта по занятости в США. На H4 сформировалась двойная вершина и медвежья дивергенция, что может усилить снижение по данной паре.

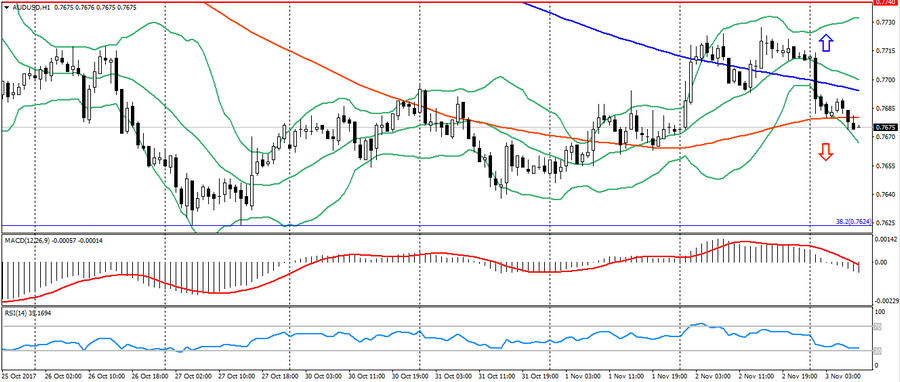

AUD USD (текущая цена: 0.7670)

- Уровни поддержки: 0.7740, 0.7320 (минимум 2017 года), 0.7120.

- Уровни сопротивления: 0.8120 (максимум 2017 года), 0.8200, 0.8290 (максимум 2014 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в зоне перепроданности. Bollinger Bands (период 20): перепроданность, растущая волатильность.

- Основная рекомендация: вход на продажу от 0.7690 (MA 200), 0.7720, 0.7740.

- Альтернативная рекомендация: вход на покупку от 0.7660, 0.7640, 0.7620 (Фибо. 38.2 от минимума января 2016 года).

Австралиец остаётся под давлением слабых данных и коррекции позиций относительно американца. Но дальнейшая динамика пары, как и остальных, остаётся ограниченной из-за ожидания данных по США.

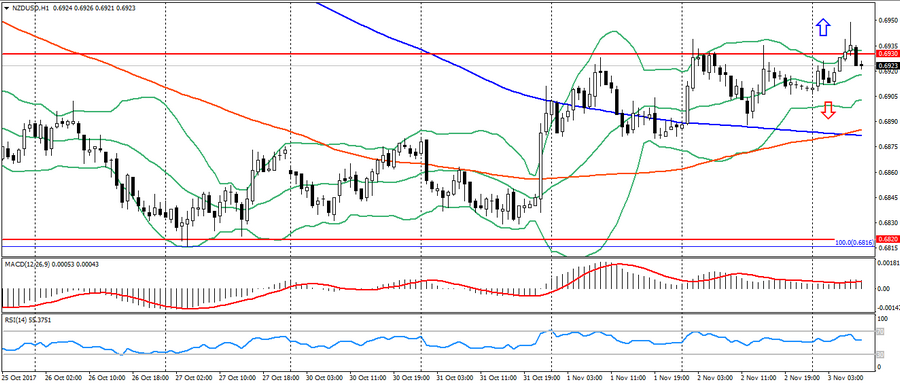

NZD USD (текущая цена: 0.6920)

- Уровни поддержки: 0.7000, 0.6930, 0.6820 (минимум текущего года).

- Уровни сопротивления: 0.7380, 0.7450, 0.7550 (максимум 2017 года).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI в нейтрально зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 0.6950, 0.6980 (Фибо. 78.6 от минимума апреля), 0.7000.

- Альтернативная рекомендация: вход на покупку от 0.6910, 0.6890 (MA 200), 0.6860 (MA 100).

Новозеландский доллар торгуется с небольшим укреплением, но также ограничивается предстоящими данными по США

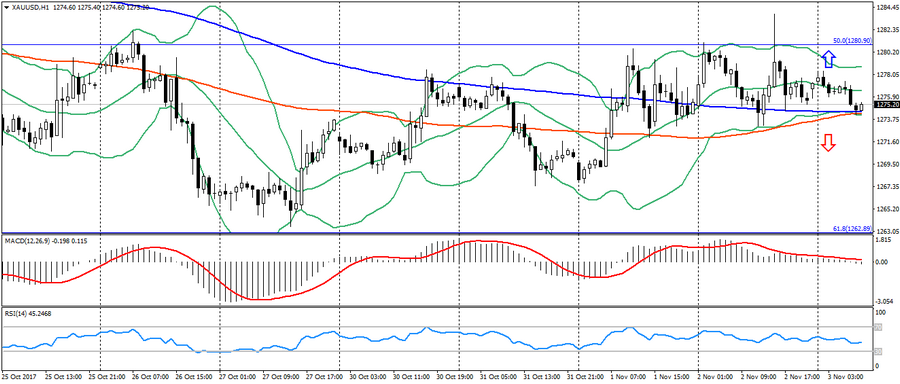

XAU USD (текущая цена: 1275.00)

- Уровни поддержки: 1250.00, 1226.00, 1200.00.

- Уровни сопротивления: 1340.00, 1355.00, 1374.00 (максимум 2016 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1279.00, 1281.00 (Фибо. 50.0 от минимума июля), 1283.00.

- Альтернативная рекомендация: вход на покупку от 1274.00 (MA 200), 1272.00 (MA 100), 1268.00.

Золото остаётся под давлением техники (дивергенции) , но также ограничивается низкой активностью перед данными по США.