Технический анализ кросс-курсов. (Антон Ганзенко)

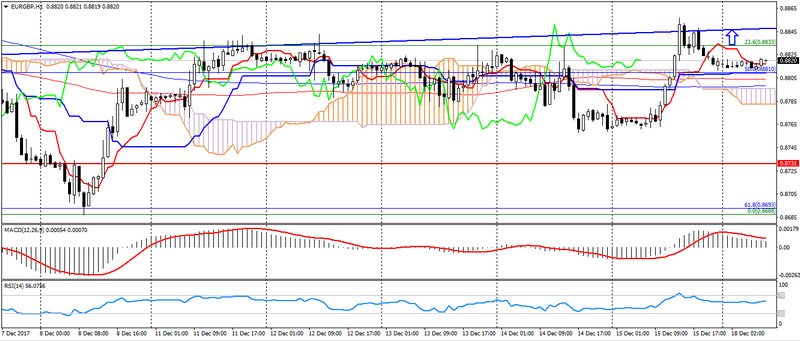

EUR GBP (текущая цена: 0.8820)

- Уровни поддержки: 0.8730 (минимум последних месяцев), 0.8650, 0.8530.

- Уровни сопротивления: 0.9020, 0.9170, 0.9300 (максимум текущего года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышдла с тела гистограммы.RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.8830, 0.8860, 0.8880.

- Альтернативная рекомендация: вход на покупку от 0.8810 (MA 100), 0.8790, 0.8760.

Пара евро фунт остаётся в боковом тренде, сохраняя некий нисходящий тренд, который ограничивается существующими проблемами по Brexit.

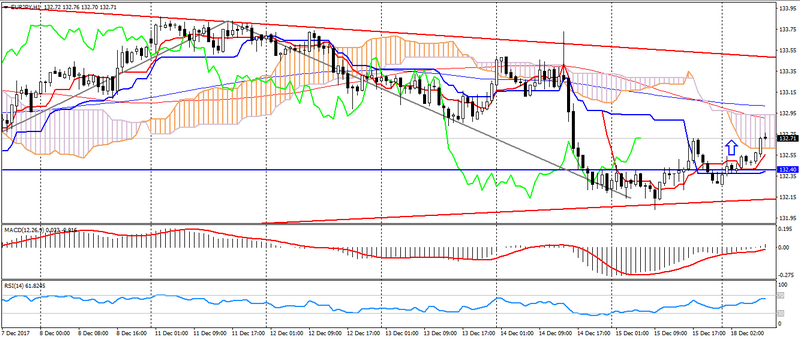

EUR JPY (текущая цена: 132.70)

- Уровни поддержки: 131.40 (минимум последних месяцев), 130.50, 129.80 (Фибо. 23.6 от минимума текущего года).

- Уровни сопротивления: 133.30, 134.40 (максимум текущего года), 135.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в зоне лёгкой перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение, флэт): линия Tenkan-sen выше линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 132.90, 133.20, 133.50.

- Альтернативная рекомендация: вход на покупку от 132.40, 132.10, 131.80.

Евро иена остаётся торговаться с укреплением на отбитии от уровня 132.40.

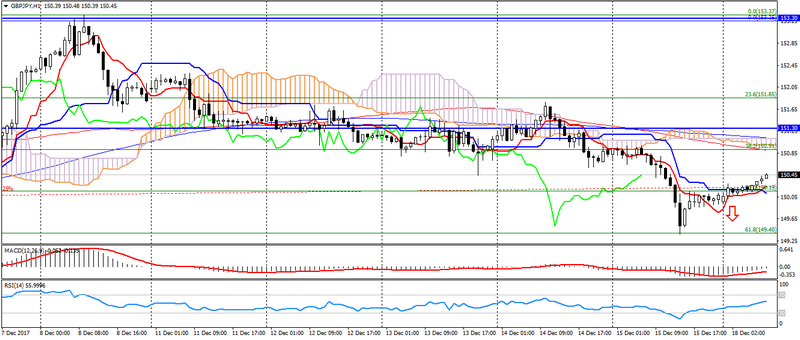

GBP JPY (текущая цена: 150.40)

- Уровни поддержки: 147.00 (минимум прошлого месяцев), 144.20 (Фибо. 50.0 от минимума апреля), 141.50.

- Уровни сопротивления: 151.30, 152.80 (максимум текущего года), 155.40.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы.RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 151.00, 151.30, 151.70.

- Альтернативная рекомендация: вход на покупку от 150.50, 150.20, 150.00.

Фунт иена торгуется с небольшим понижением, но ограничивается коррекцией.

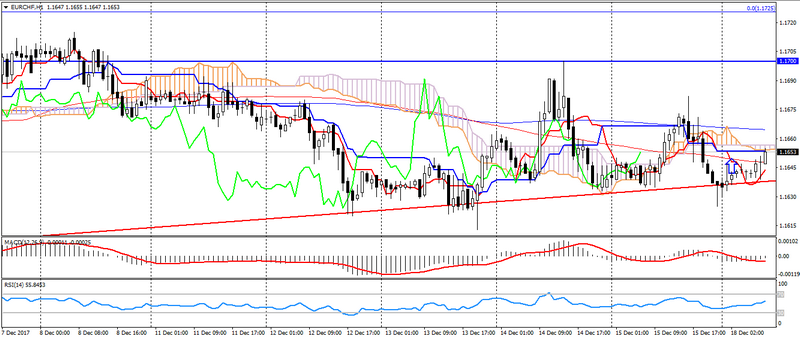

EUR CHF (текущая цена: 1.1650)

- Уровни поддержки: 1.1500, 1.1450 (Фибо. 23.6 от минимума текущего года), 1.1350.

- Уровни сопротивления: 1.1700 (максимум текущего года), 1.1750, 1.1800.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.1660 (MA 200), 1.1680 (MA 200), 1.1700.

- Альтернативная рекомендация: вход на покупку от 1.1640, 1.1620, 1.1600.

Пара евро франк корректируется против пятницы, но по-прежнему ограничивается восходящим трендом.