Технический анализ валютных пар (Антон Ганзенко)

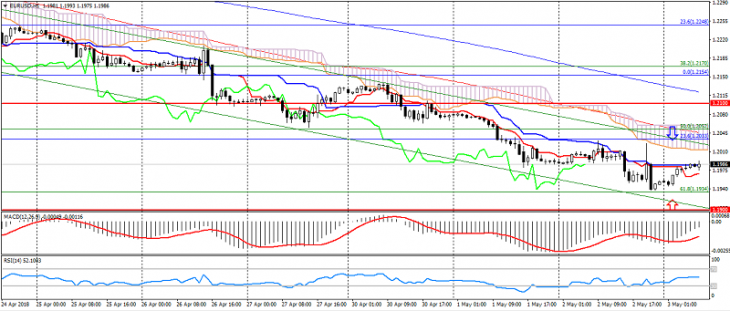

EUR USD (текущая цена: 1.1980)

- Уровни поддержки: 1.2100 (максимум сентября 2017 года), 1.1900, 1.1700.

- Уровни сопротивления: 1.2600, 1.2750 (минимум марта 2013 года), 1.2270 (минимум ноября 2014 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.2010, 1.2040, 1.2060.

- Альтернативная рекомендация: вход на покупку от 1.1940, 1.1900, 1.1880.

Пара евро доллар торгуется с небольшой коррекцией в начале дня, на технической коррекции и бычьей дивергенции (MACD).

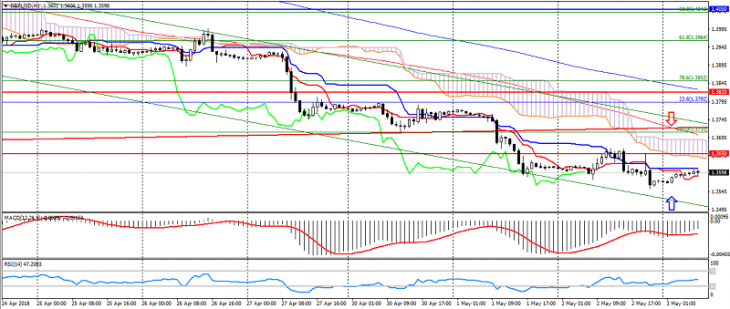

GBP USD (текущая цена: 1.3600)

- Уровни поддержки: 1.3820, 1.3650 (максимум сентября 2017 года), 1.3450.

- Уровни сопротивления: 1.4050, 1.4350, 1.4500.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.3650, 1.3700, 1.3730.

- Альтернативная рекомендация: вход на покупку от 1.3550, 1.3520, 1.3500.

Британский фунт также торгуется во флэте с небольшим укреплением на коррекции и дивергенции.

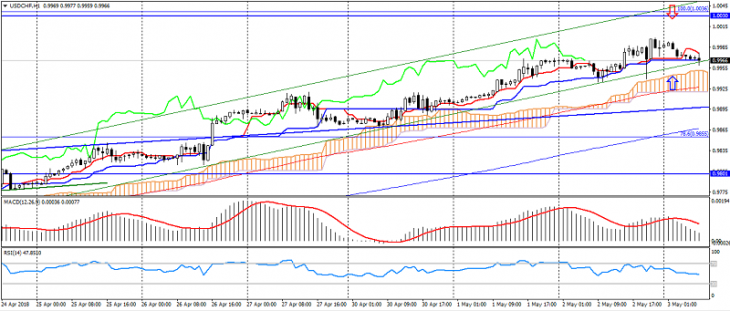

USD CHF (текущая цена: 0.9960)

- Уровни поддержки: 0.9250 (минимум августа 2015 года), 0.9150, 0.9050 (минимум мая 2015 года).

- Уровни сопротивления:, 0.9550, 0.9800, 1.0030 (максимум ноября 2017 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.0000, 1.0030, 1.0050.

- Альтернативная рекомендация: вход на покупку от 0.9950, 0.9920, 0.9890.

Швейцарский франк остаётся в нисходящем тренде, ограничиваясь психологией 1.0000.

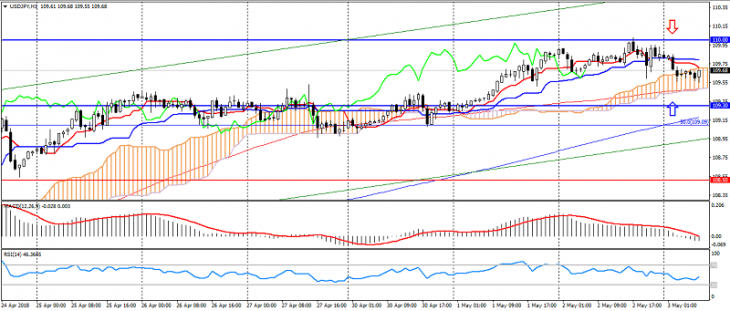

USD JPY (текущая цена: 109.70)

- Уровни поддержки: 108.50, 107.50, 106.70.

- Уровни сопротивления: 109.30, 110.00, 110.50.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen ниже линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 109.80, 110.00, 110.30.

- Альтернативная рекомендация: вход на покупку от 109.40, 109.20, 109.00.

Пара доллар США японская иена торгуется с понижением в начале дня на коррекции американца.

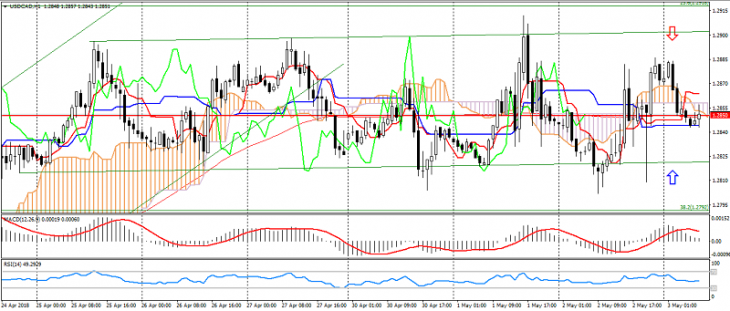

USD CAD (текущая цена: 1.2850)

- Уровни поддержки: 1.2950, 1.2730, 1.2600.

- Уровни сопротивления: 1.3030, 1.3150, 1.3280.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen выше линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 1.2870, 1.2900, 1.2920.

- Альтернативная рекомендация: вход на покупку от 1.2830, 1.2800, 1.2780.

Пара доллар США канадский доллар остаётся торговаться во флэте.

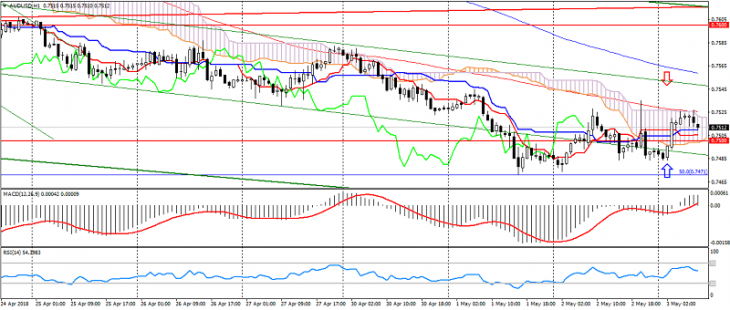

AUD USD (текущая цена: 0.7410)

- Уровни поддержки: 0.7600, 0.7500, 0.7450.

- Уровни сопротивления: 0.7700, 0.7820, 0.7900.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen возле линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 0.7540, 0.7560, 0.7580.

- Альтернативная рекомендация: вход на покупку от 0.7500, 0.7480, 0.7460.

Австралиец получил поддержку в начале дня на позитивных данных по сальдо торгового баланса Австралии, но ограничивается общим нисходящим трендом, который, в свою очередь, может замедлиться на слабости американца.

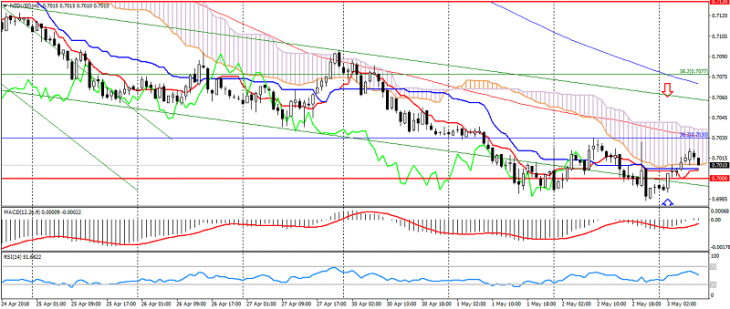

NZD USD (текущая цена: 0.7010)

- Уровни поддержки: 0.7130 (минимум августа 2017 года), 0.7000, 0.6950.

- Уровни сопротивления: 0.7250, 0.7380, 0.7450 (максимум 2018 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.7030, 0.7050, 0.7080.

- Альтернативная рекомендация: вход на покупку от 0.6980, 0.6960, 0.6940.

Новозеландский доллар остаётся в нисходящем тренде, ограничиваясь бычьей дивергенцией и слабостью американца.

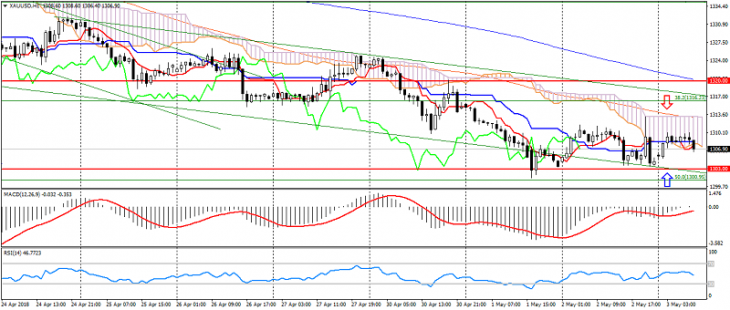

XAU USD (текущая цена: 1306.00)

- Уровни поддержки: 1320.00, 1303.00, 1280.00.

- Уровни сопротивления: 1355.00 (максимум мая 2016 года), 1374.00, 1290.00 (максимум марта 2016 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1312.00, 1315.00, 1320.00.

- Альтернативная рекомендация: вход на покупку от 1303.00, 1300.00, 1295.00.

Золото по-прежнему остаётся под давлением нисходящего тренда, несмотря на попытки коррекции.