Технічний аналіз валютных пар (Антон Ганзенко)

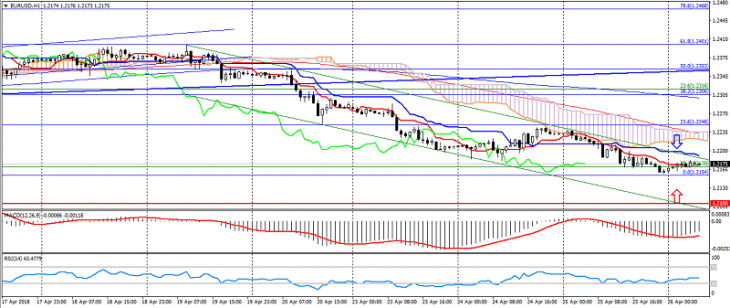

EUR USD (поточна ціна: 1.2170)

- Рівні підтримки: 1.2100 (максимум вересня 2017 року), 1.1900, 1.1700.

- Рівні опору: 1.2600, 1.2750 (мінімум березня 2013 року), 1.2270 (мінімум листопада 2014 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 1.2200, 1.2230, 1.2250.

- Альтернативна рекомендація: вхід на покупку від 1.2160, 1.2130, 1.2100.

Пара євро долар зберігає спадну динаміку, трохи розширивши торговий канал на корекції. При цьому ринок очікує даних від ЄЦБ, які вийдуть сьогодні.

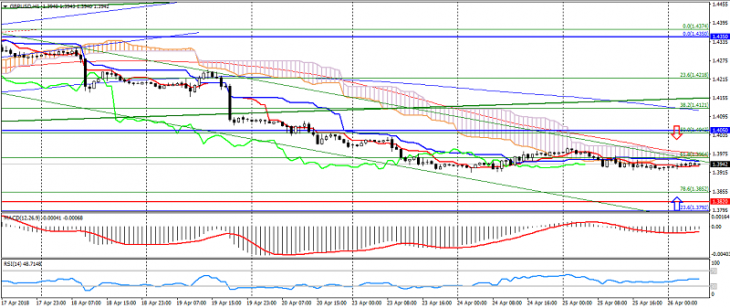

GBP USD (поточна ціна: 1.3940)

- Рівні підтримки: 1.3820, 1.3650 (максимум вересня 2017 року), 1.3450.

- Рівні опору: 1.4050, 1.4350, 1.4500.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 1.3960, 1.3990, 1.4050.

- Альтернативна рекомендація: вхід на покупку від 1.3900, 1.3880, 1.3850.

Британський фунт рухається у флеті, тим самим формуючи разворотню модель у вигляді «подвійного дна».

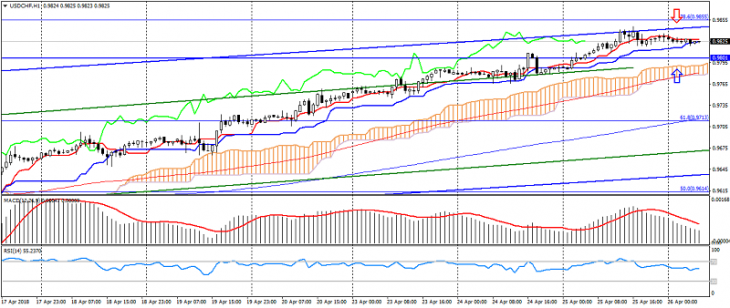

USD CHF (поточна ціна: 0.9830)

- Рівні підтримки: 0.9250 (мінімум серпня 2015 року), 0.9150, 0.9050 (мінімум травня 2015 року).

- Рівні опору :, 0.9550, 0.9800, 1.0030 (максимум листопада 2017 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтрально зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 0.9840, 0.9860, 0.9880.

- Альтернативна рекомендація: вхід на покупку від 0.9800, 0.9780, 0.9760.

Швейцарський франк залишається під тиском, обмежуючись перепроданостю.

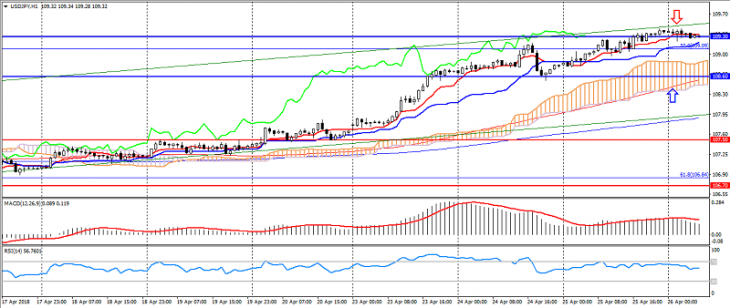

USD JPY (поточна ціна: 109.30)

- Рівні підтримки: 107.50, 106.70, 105.50.

- Рівні опору: 108.60, 109.30, 110.00.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 109.50, 109.70, 109.90.

- Альтернативна рекомендація: вхід на покупку від 109.00, 108.60, 108.30.

Пара долар США японська ієна продовжує зміцнюватися на збереженні оптимізму щодо американця, торгуючись в висхідному тренді і обмежуючись існуючим трендом.

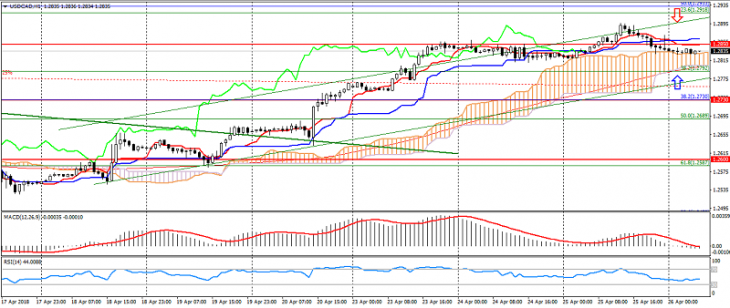

USD CAD (поточна ціна: 1.2830)

- Рівні підтримки: 1.2950, 1.2730, 1.2600.

- Рівні опору: 1.3030, 1.3150, 1.3280.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 1.2860, 1.2890, 1.2920.

- Альтернативна рекомендація: вхід на покупку від 1.2800, 1.2780, 1.2760.

Пара долар США канадський долар торгується в висхідному тренді, коректуючи бічним трендом.

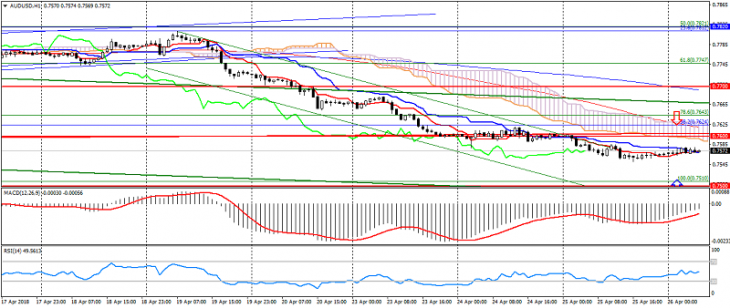

AUD USD (поточна ціна: 0.7570)

- Рівні підтримки: 0.7700 (максимум березня 2017 року), 0.7600, 0.7500.

- Рівні опору: 0.7820, 0.7900, 0.7980.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 0.7600, 0.7630, 0.7660.

- Альтернативна рекомендація: вхід на покупку від 0.7550, 0.7530, 0.7500.

Австралієць залишається під тиском, але сповільнився на перепроданості, тим самим обмежуючи рівнями підтримки.

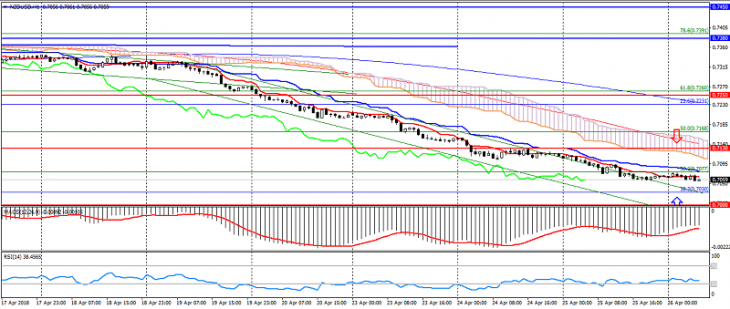

NZD USD (поточна ціна: 0.7060)

- Рівні підтримки: 0.7250, 0.7130 (мінімум серпня 2017 року), 0.7000.

- Рівні опору: 0.7380, 0.7450, 0.7550 (максимум 2017 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 0.7090, 0.7130, 0.7180.

- Альтернативна рекомендація: вхід на покупку від 0.7080, 0.7050, 0.7030.

Новозеландський долар сповільнивзниження, але залишається в спадному тренді.

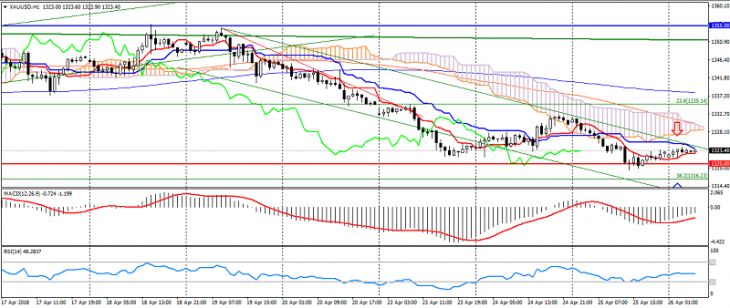

XAU USD (поточна ціна: 1323.00)

- Рівні підтримки: 1320.00, 1303.00, 1280.00.

- Рівні опору: 1355.00 (максимум травня 2016 року), 1374.00, 1290.00 (максимум березня 2016 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 1328.00, 1332.00, 1337.00.

- Альтернативна рекомендація: вхід на покупку від 1320.00, 1316.00, 1313.00.

Золото залишається під тиском американця, обмежуючись мінімумом місяці на рівні 1320.00-1315.00.