Технічний аналіз валютних пар (Антон Ганзенко)

Індикатори Forex використовуються в Технічному аналізі: MACD, RSI, Ichimoku Kinko Hyo, рівновіддалений канал, Лінії Фібоначчі, Цінові Рівні.

Заробляйте за допомогою сервісу торгівлі на новинах Erste News!

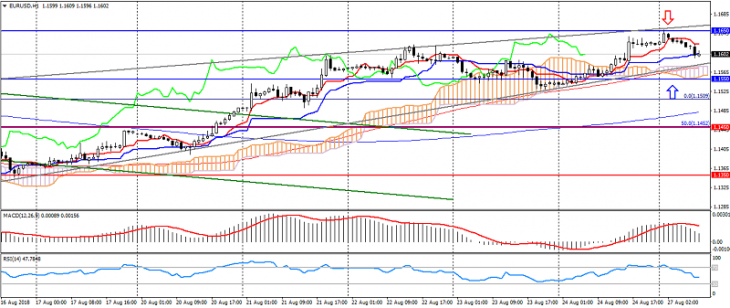

EUR USD (поточна ціна: 1.1600)

- Рівні підтримки: 1.1450, 1.1350, 1.1200.

- Рівні опору: 1.1550, 1.1650, 1.1740.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 1.1620, 1.1650, 1.1680.

- Альтернативна рекомендація: вхід на покупку від 1.1550, 1.1520, 1.1480.

Пара євро долар торгується зі зниженням на руху проти п’ятниці, обмежуючись рівнем 1.1550.

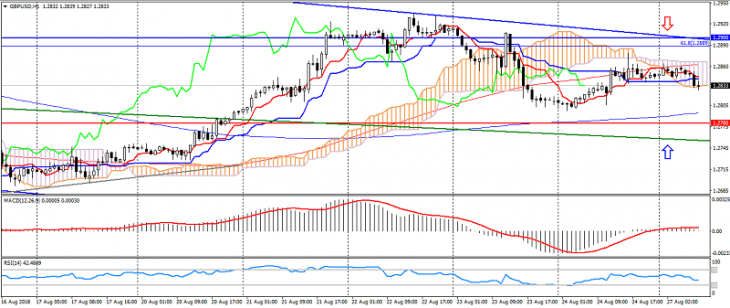

GBP USD (поточна ціна: 1.2830)

- Рівні підтримки: 1.2780, 1.2600 (мінімум червня 2017), 1.2370 (мінімум квітня 2017).

- Рівні опору: 1.2900, 1.3050, 1,3150.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen біля лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 1.2860, 1.2900, 1.2920.

- Альтернативна рекомендація: вхід на покупку від 1.2800, 1.2780, 1.2750.

Британський фунт також перейшов до корекції, тим самим вказуючи на можливість розвороту і відновлення спадного тренда.

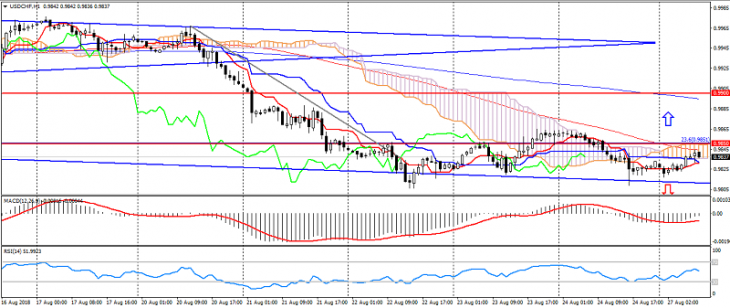

USD CHF (поточна ціна: 0.9840)

- Рівні підтримки: 0,9900, 0.9850 (локальний мінімум), 0.9700 (мінімум червня).

- Рівні опору: 1.000 (значуща психологія), 1.0050 (максимум травня), 1.0100.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen біля лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 0.9850, 0.9880, 0.9900.

- Альтернативна рекомендація: вхід на покупку від 0.9820, 0.9800, 0.9780.

Долар США швейцарський франк продовжує формувати відбиті від нижньої межі каналу, формуючи «подвійне дно».

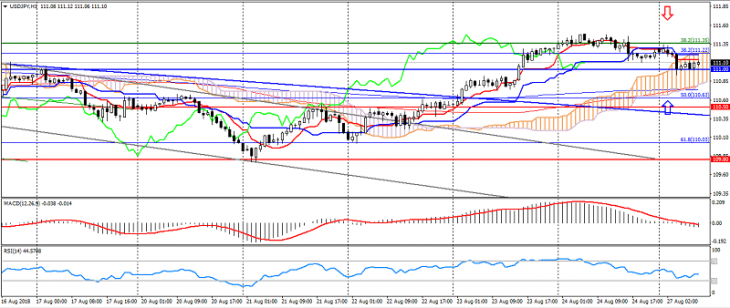

USD JPY (поточна ціна: 111.10)

- Рівні підтримки: 110.50, 109.80, 109.00.

- Рівні опору: 111.00, 112.00, 113.30 (максимум січня).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen нижче лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 111.30, 111.50 111.80.

- Альтернативна рекомендація: вхід на покупку від 111.00, 110.80, 110.50.

Пара долар США японська ієна перейшла до корекції після тижневого зростання.

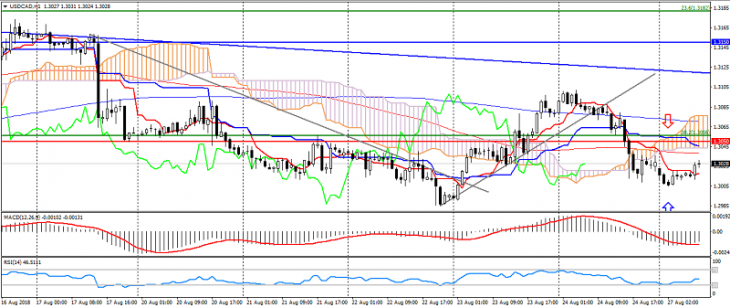

USD CAD (поточна ціна: 1.3030)

- Рівні підтримки: 1.3050 (максимум травня), 1.2950, 1.2850.

- Рівні опору: 1.3150, 1.3250, 1.3380.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 1.3050, 1.3080, 1.3100.

- Альтернативна рекомендація: вхід на покупку від 1.3000, 1.2980, 1.2860.

Пара долар США канадський долар також торгується зі зміцненням, але залишається під тиском.

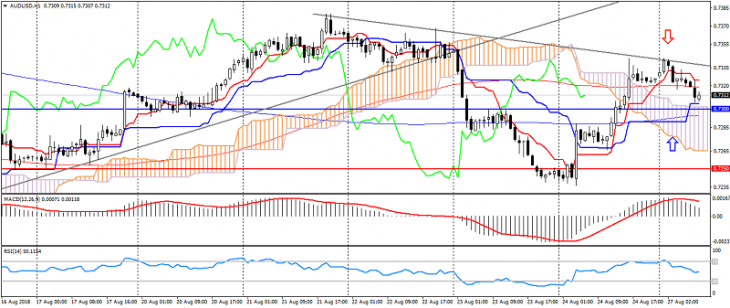

AUD USD (поточна ціна: 0.7310)

- Рівні підтримки: 0.7250, 0.7200, 0.7100.

- Рівні опору: 0.7300, 0.7400, 0.7500.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 0.7340, 0.7360, 0.7380.

- Альтернативна рекомендація: вхід на покупку від 0.7300, 0.7280, 0.7250.

Австралієць під тиском корекції, але зберігає потенціал до зростання.

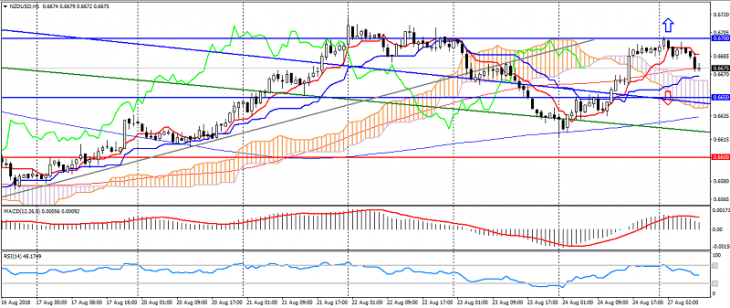

NZD USD (поточна ціна: 0.6670)

- Рівні підтримки 0.6600, 0.6550, 0.6500.

- Рівні опору: 0.6650, 0.6700, 0.6800.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 0.6700, 0.6720, 0.6750.

- Альтернативна рекомендація: вхід на покупку від 0.6670, 0.6650, 0.6630.

Новозеландський долар відбився від рівня 0.6700, тим самим вказуючи на формування «подвійної вершини».

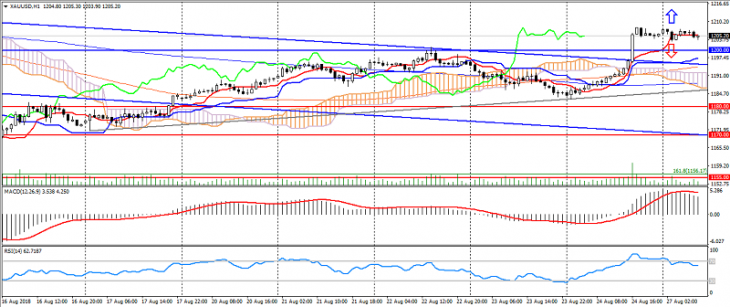

XAU USD (поточна ціна: 1205.00)

- Рівні підтримки: 1180.00, 1170.00, 1155.00.

- Рівні опору: 1200.00, 1220.00, 1240.00.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограмми.RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 1210.00, 1215.00, 1220.00.

- Альтернативна рекомендація: вхід на покупку від 1200.00, 1195.00, 1190.00.

Золото переломило спадний тренд на зниженні долара, але залишається перекупленим.