Технічний аналіз валютных пар (Антон Ганзенко)

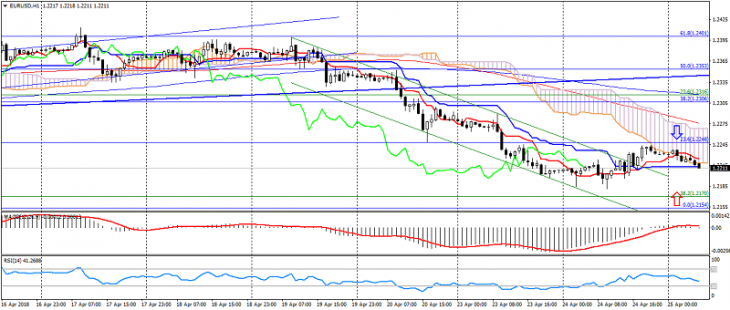

EUR USD (поточна ціна: 1.2210)

- Рівні підтримки: 1.2100 (максимум вересня 2017 року), 1.1900, 1.1700.

- Рівні опору: 1.2600, 1.2750 (мінімум березня 2013 року), 1.2270 (мінімум листопада 2014 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – флет): індикатор біля 0. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 1.2250, 1.2280, 1.2300.

- Альтернативна рекомендація: вхід на покупку від 1.2200, 1.2170, 1.2150.

Пара євро долар формує бічний тренд після зниження, але при цьому зберігає потенціал до зниження.

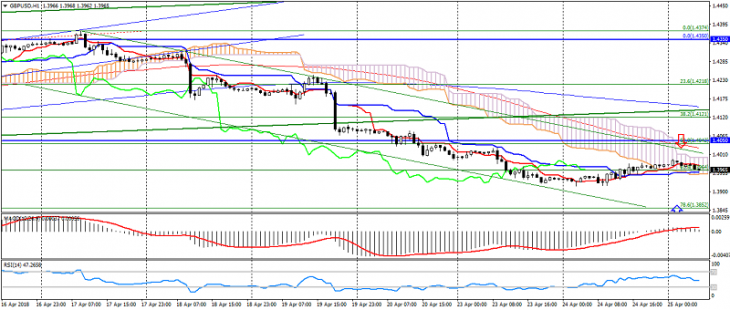

GBP USD (поточна ціна: 1.3960)

- Рівні підтримки: 1.3820, 1.3650 (максимум вересня 2017 року), 1.3450.

- Рівні опору: 1.4050, 1.4350, 1.4500.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen вище лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 1.4010, 1.4030, 1.4050.

- Альтернативна рекомендація: вхід на покупку від 1.3940, 1.3900, 1.3880.

Британський фунт трохи зміцнився на корекції, але обмежується низхідним трендом.

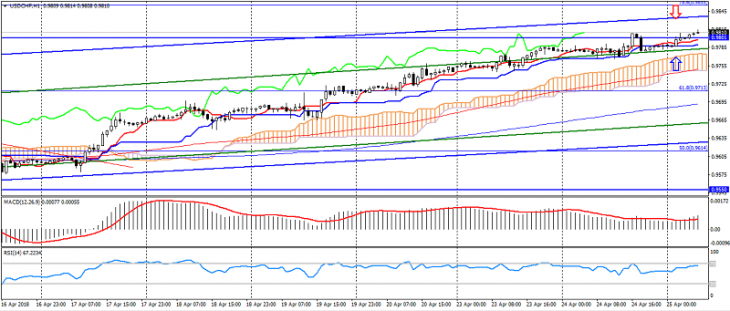

USD CHF (поточна ціна: 0.9810)

- Рівні підтримки: 0.9250 (мінімум серпня 2015 року), 0.9150, 0.9050 (мінімум травня 2015 року).

- Рівні опору :, 0.9550, 0.9800, 1.0030 (максимум листопада 2017 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор вище 0, сигнальна лінія в тілі гістограми. RSI (14) в зоні перекупленності. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 0.9830, 0.9850, 0.9870.

- Альтернативна рекомендація: вхід на покупку від 0.9780, 0.9750, 0.9730.

Швейцарський франк залишається під тиском, обмежуючись перепроданостю.

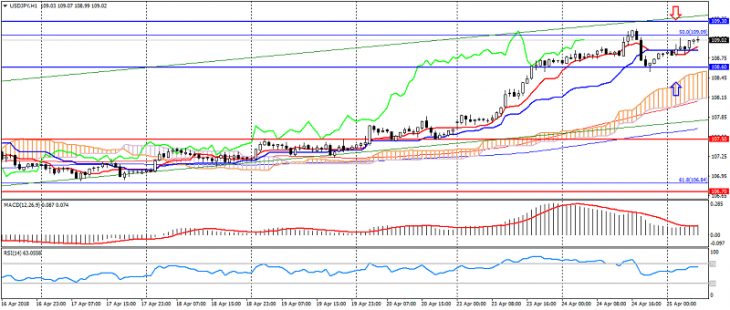

USD JPY (поточна ціна: 109.00)

- Рівні підтримки: 107.50, 106.70, 105.50.

- Рівні опору: 108.60, 109.30, 110.00.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор вище 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 108.30, 109.50, 109.70.

- Альтернативна рекомендація: вхід на покупку від 108.80, 108.60, 108.30.

Пара долар США японська ієна продовжує зміцнюватися на збереженні оптимізму щодо американця, торгуючись в висхідному тренді.

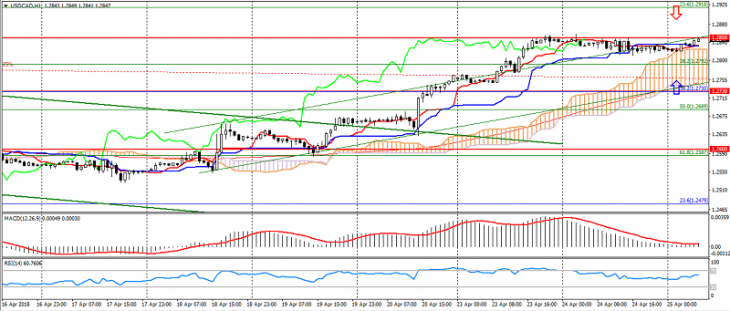

USD CAD (поточна ціна: 1.2850)

- Рівні підтримки: 1.2950, 1.2730, 1.2600.

- Рівні опору: 1.3030, 1.3150, 1.3280.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор вище 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 1.2870, 1.2890, 1.2920.

- Альтернативна рекомендація: вхід на покупку від 1.2810, 1.2780, 1.2760.

Пара долар США канадський долар залишається в висхідному тренді, обмежуючись перекупленістю.

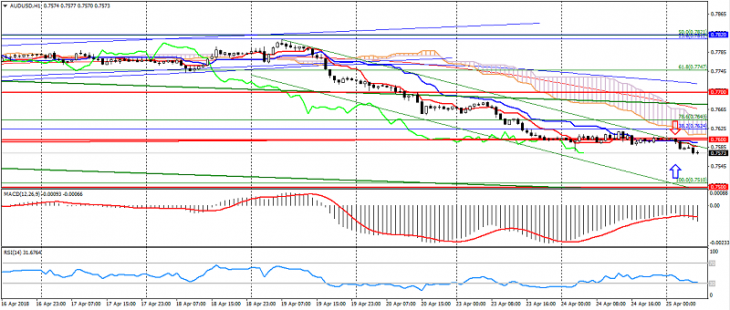

AUD USD (поточна ціна: 0.7570)

- Рівні підтримки: 0.7700 (максимум березня 2017 року), 0.7600, 0.7500.

- Рівні опору: 0.7820, 0.7900, 0.7980.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в зоні перепроданості. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 0.7600, 0.7630, 0.7660.

- Альтернативна рекомендація: вхід на покупку від 0.7550, 0.7530, 0.7500.

Австралієць залишається під тиском на зниженні вартості сировини і низькiй активності на азіатській сесії через вихідний день в Австралії і Новій Зеландії.

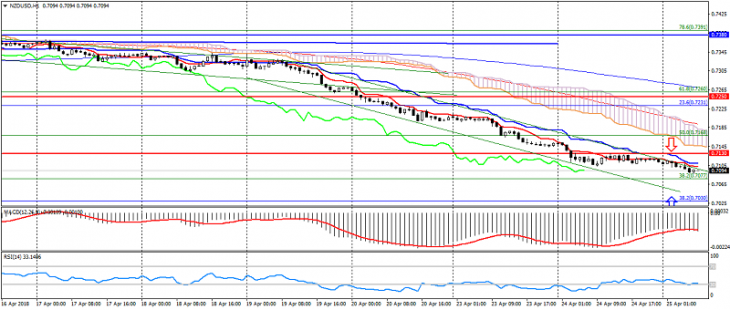

NZD USD (поточна ціна: 0.7090)

- Рівні підтримки: 0.7250, 0.7130 (мінімум серпня 2017 року), 0.7000.

- Рівні опору: 0.7380, 0.7450, 0.7550 (максимум 2017 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в зоні перепроданості. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 0.7130, 0.7150, 0.7180.

- Альтернативна рекомендація: вхід на покупку від 0.7080, 0.7050, 0.7030.

Новозеландський долар залишається під значним тиском, незважаючи на перепроданість.

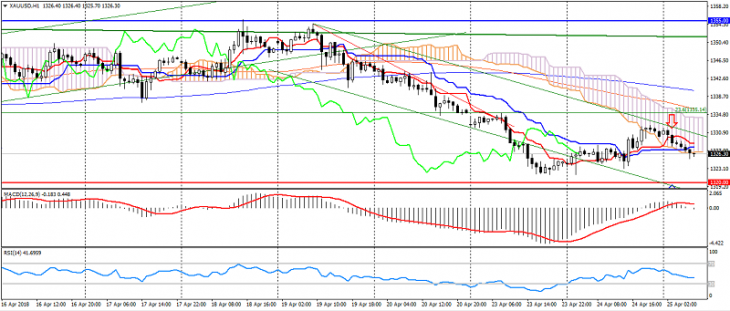

XAU USD (поточна ціна: 1326.00)

- Рівні підтримки: 1320.00, 1303.00, 1280.00.

- Рівні опору: 1355.00 (максимум травня 2016 року), 1374.00, 1290.00 (максимум березня 2016 року).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 1332.00, 1335.00, 1338.00.

- Альтернативна рекомендація: вхід на покупку від 1324.00, 1321.00, 1317.00.

Золото залишається під тиском американця, обмежуючись мінімумом місяці на рівні 1320.00 і перепроданості активу.