Технический анализ валютных пар (Антон Ганзенко)

Индикаторы Forex использующиеся в Техническом анализе: MACD, RSI, Ichimoku Kinko Hyo, Равноудалённый канал, Линии Фибоначчи, Ценовые Уровни.

Зарабатывайте с помощью сервиса торговли на новостях Erste News!

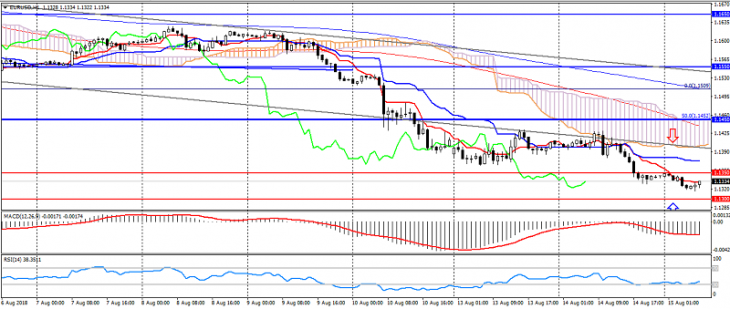

EUR USD (текущая цена: 1.1330)

- Уровни поддержки: 1.1350, 1.1300, 1.1200.

- Уровни сопротивления: 1.1450, 1.1550, 1.1650.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.1380, 1.1400, 1.1420.

- Альтернативная рекомендация: вход на покупку от 1.1300, 1.1280, 1.1250.

Пара евро доллар торгуется с понижением на роте рисков, ограничиваясь перепроданностью.

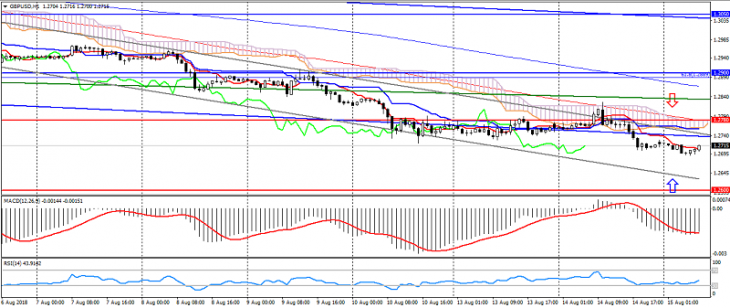

GBP USD (текущая цена: 1.2710)

- Уровни поддержки: 1.2780, 1.2600 (минимум июня 2017), 1.2370 (минимум апреля 2017).

- Уровни сопротивления: 1.2900, 1.3050, 1,3150.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.2750, 1.2780, 1.2800.

- Альтернативная рекомендация: вход на покупку от 1.2700, 1.2670, 1.2650.

Британский фунт также ускорил снижение на росте доллара США, при этом фунт ограничивается назревающей дивергенцией.

USD CHF (текущая цена: 0.9960)

- Уровни поддержки: 0,9900, 0.9850 (локальный минимум), 0.9700 (минимум июня).

- Уровни сопротивления: 1.000 (значимая психология), 1.0050 (максимум мая), 1.0100.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.9970, 0.9990, 1.0020.

- Альтернативная рекомендация: вход на покупку от 0.9950, 0.9920, 0.9900.

Доллар США швейцарский франк торгуется со снижением на росте доллара, тем самым указывая на разворот тренда.

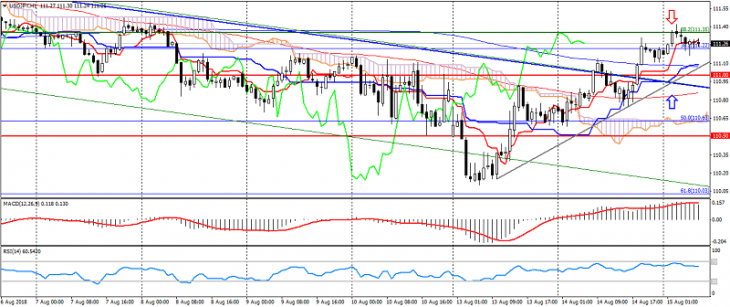

USD JPY (текущая цена: 111.30)

- Уровни поддержки: 111.00, 110.50, 109.80.

- Уровни сопротивления: 112.00, 113.30 (максимум января), 114.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 111.40, 111.60 111.80.

- Альтернативная рекомендация: вход на покупку от 111.00, 110.80, 110.50.

Пара доллар США японская иена торгуется с укреплением на росте доллара и развороте тренда.

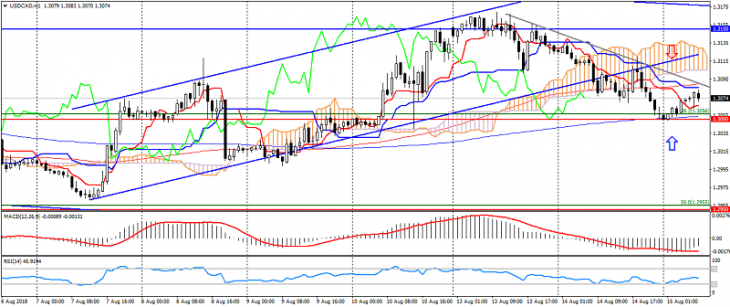

USD CAD (текущая цена: 1.3070)

- Уровни поддержки: 1.3050 (максимум мая), 1.2950, 1.2850.

- Уровни сопротивления: 1.3150, 1.3250, 1.3380.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.3090, 1.3120, 1.3150.

- Альтернативная рекомендация: вход на покупку от 1.3050, 1.3030, 1.3000.

Пара доллар США канадский доллар перешла к снижению на возобновлении нисходящего тренда, но по-прежнему ограничивается возможными рисками.

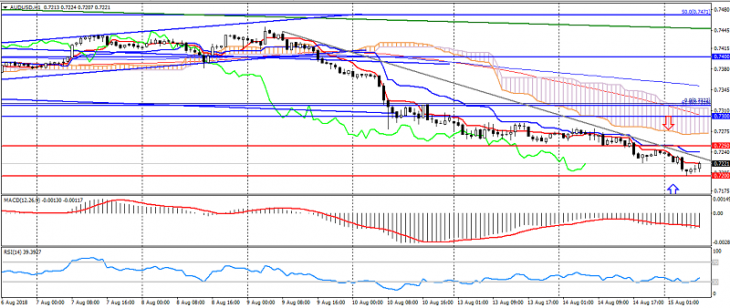

AUD USD (текущая цена: 0.7220)

- Уровни поддержки: 0.7250, 0.7200, 0.7100.

- Уровни сопротивления:0.7300, 0.7400, 0.7500.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.7250, 0.7280, 0.7300.

- Альтернативная рекомендация: вход на покупку от 0.7200, 0.7180, 0.7150.

Австралиец также остаётся под давлением рисков.

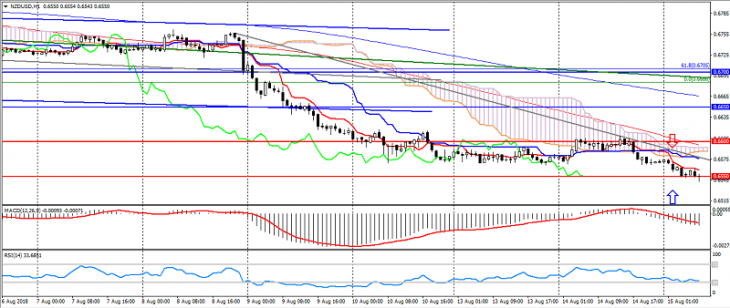

NZD USD (текущая цена: 0.6550)

- Уровни поддержки 0.6600, 0.6550, 0.6500.

- Уровни сопротивления: 0.6650, 0.6700, 0.6800.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.6570, 0.6600, 0.6630.

- Альтернативная рекомендация: вход на покупку от 0.6530, 0.6500, 0.6480.

Новозеландский доллар ускорил снижение на возобновлении рисков.

XAU USD (текущая цена: 1187.00)

- Уровни поддержки: 1205.00, 1193.00, 1180.00.

- Уровни сопротивления: 1220.00, 1240.00, 1250.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1193.00, 1197.00, 1205.00.

- Альтернативная рекомендация: вход на покупку от 1185.00, 1180.00, 1178.00.

Золото остаётся под давлением нисходящей динамики, ограничиваясь назревающей бычьей дивергенцией.